WTI Crude Oil

The WTI Crude Oil market has gone back and forth during the day on Tuesday, showing respect to the longer-term uptrend line and the 100-day simple moving average. I believe that the buyers are probably going to come into this market place and look for some type of value, as it has given up quite a bit of the gains that it had recently made. I like the idea of buying dips, and I believe it is only a matter of time before the rally continues. However, if we were to close below the $66 level on a daily chart, I think at that point we would probably unwind. There are rumblings a bounce production cuts being halted, and of course the US dollar has strengthened, both of which are bearish. However, there is still plenty of tension in the Middle East to lift this market as well.

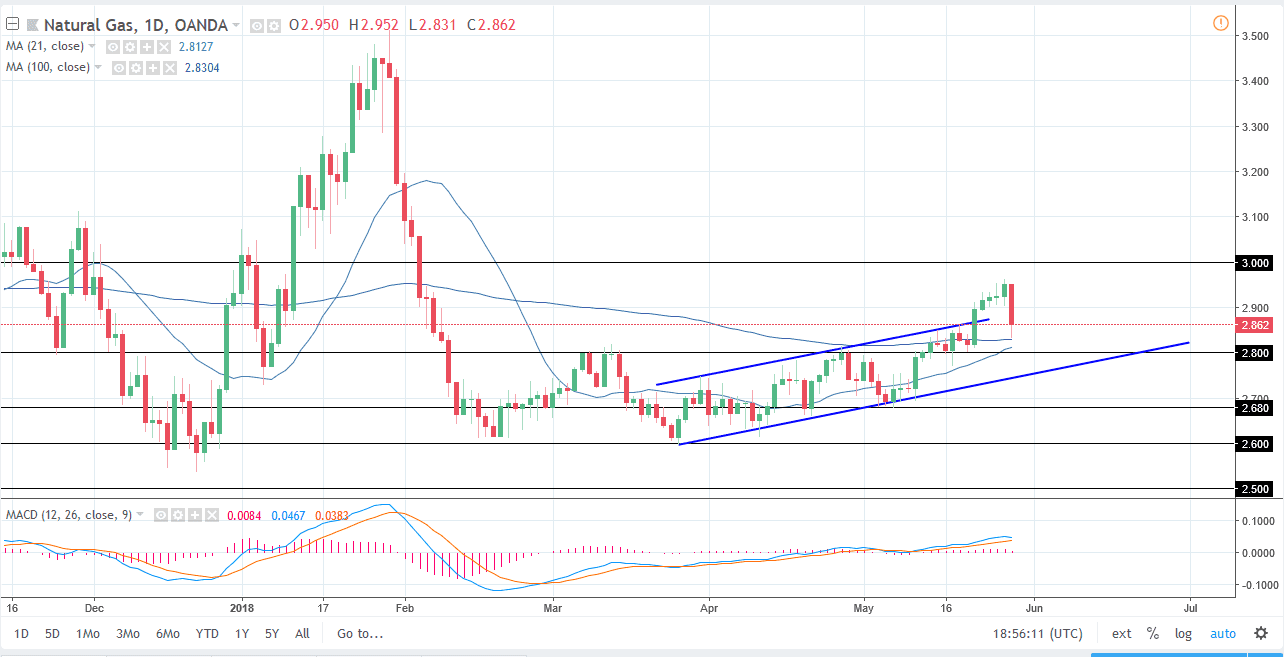

Natural Gas

Natural gas markets broke down significantly during the session on Tuesday, slicing through the $2.90 level like it wasn’t even there. By the end of the trading session in America, we had lost 3%. This was due to milder temperatures forecast for the next couple of weeks, and that of course drives down demand for natural gas to run air conditioning. There is a significant amount of support at the $2.80 level, so it makes sense that we bounced just a bit. I think that if we break down below $2.80 though, the market will probably unwind to the uptrend line you see on the chart, and perhaps even lower than that. I think at this point, we could get a bit of a bounce and a short-term rally so if you are short-term inclined, you may have a buying opportunity. However, as I have been saying for some time now I believe that it’s only a matter of time before we sell off. Quite frankly we didn’t get the exhaustive candle I was hoping to see so that we could start selling. We may have to drill down the shorter time frames to get that on this bounce.