WTI Crude Oil

WTI Crude Oil markets initially fell during the trading session on Wednesday, but then exploded to the upside as value hunters came back into the marketplace, based upon the uptrend line that has been so supportive in the past. The market looks like it is ready to continue going higher, and I think that we will eventually go to the $70 level, and perhaps the $72 level after that. If we were to break down below the uptrend line, that would be very negative, but ultimately I think that the buyers will come in on short-term pullbacks, driving this market much higher. If we did break down below the uptrend line, the market would probably unwind to roughly $65 initially, and then perhaps even lower than that. The uptrend has held, so that no reason to think anything has changed, despite the massive pullback that we just witnessed.

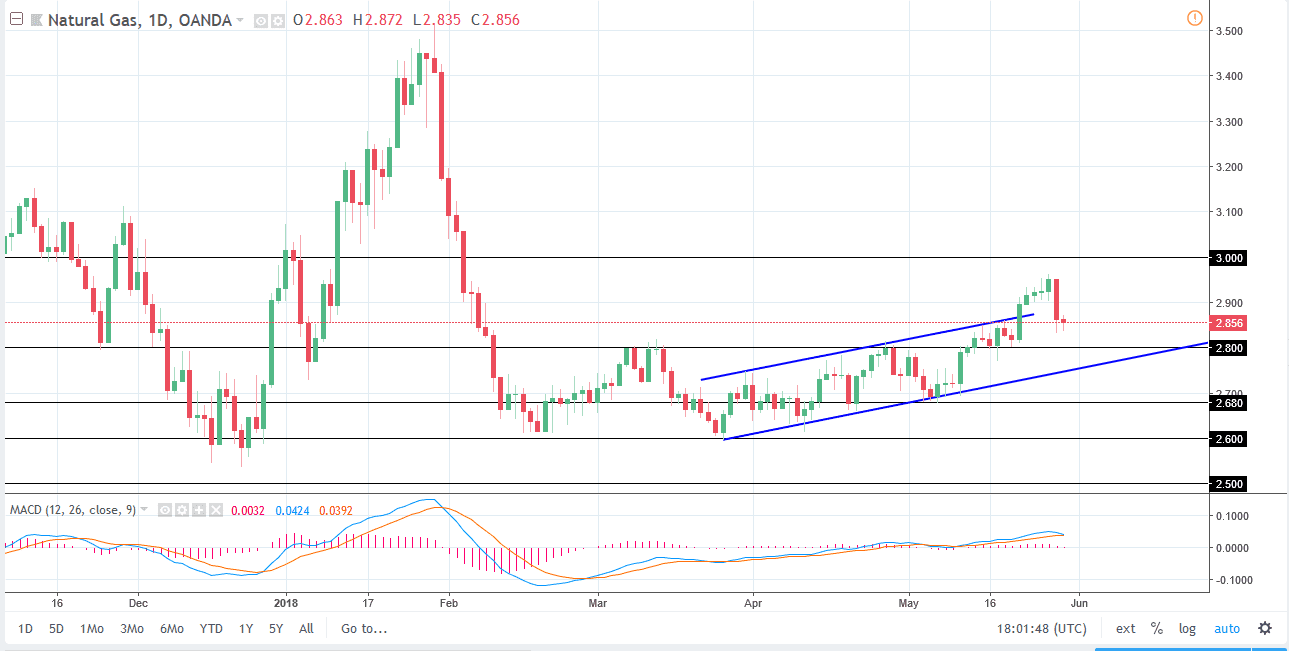

Natural Gas

Natural gas markets have gone back and forth during the trading session on Wednesday, showing signs of interest around the $2.85 level. I believe that if we do break down from here and is very likely after that extraordinarily bearish Tuesday session, we could probably go down to the $2.80 level next. A break down below there as the market testing the previous uptrend line, and I think that rallies are to be sold at this point as milder temperatures in the United States are to be expected. I wanted to wait until we got to the $3.00 level to start selling, but unfortunately we never got there. In general, the market should continue to be very noisy, but I believe that after the Tuesday session, it’s difficult to hang onto any long positions.