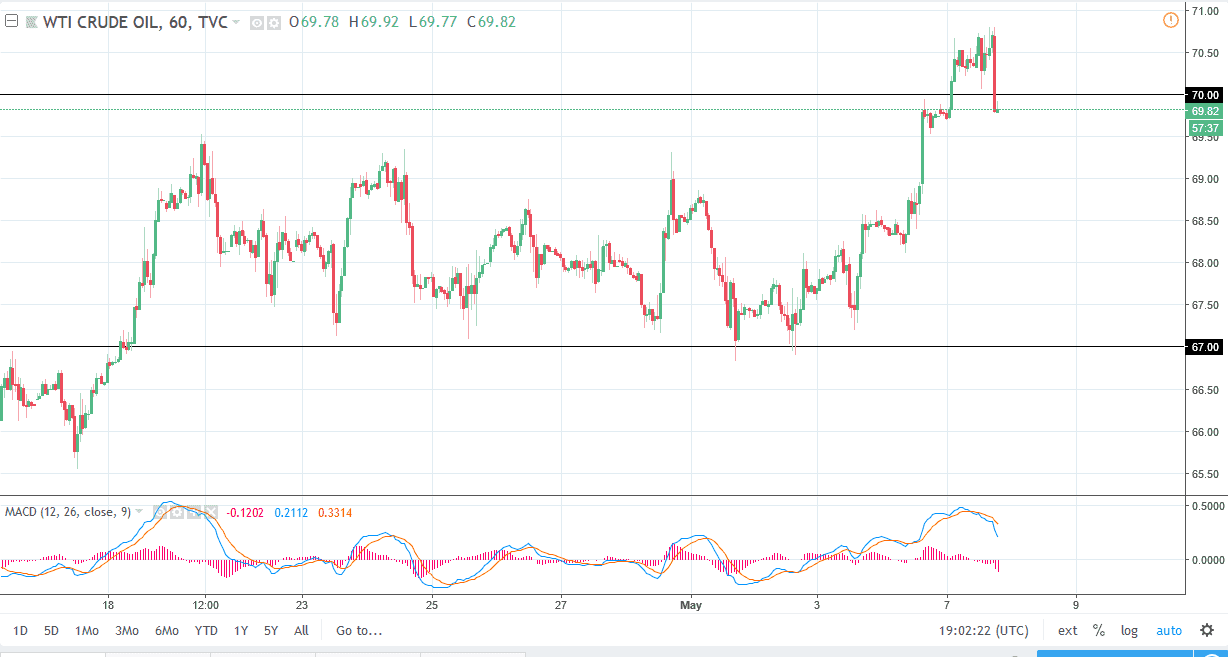

WTI Crude Oil

The WTI Crude Oil market was initially a bit positive during the day on Monday, but then broke down rather significantly to sliced through the $70 handle. By doing so, that shows an extreme reversal of attitude during the day, but I think that the support will run down to the $69 level. This not until we break down below there that I would be willing to sell, perhaps down to the $67 level. Otherwise, I anticipate a bounce rather soon, perhaps sending the market towards the $71 level, perhaps even the $72.50 level in the short term. Ultimately, this is a market that is reacting to headlines involving the Iranian nuclear deal, the US dollar, and many other external factors. Overall, the market continues to show positivity, so I think that we will see a general return to buying on the dips.

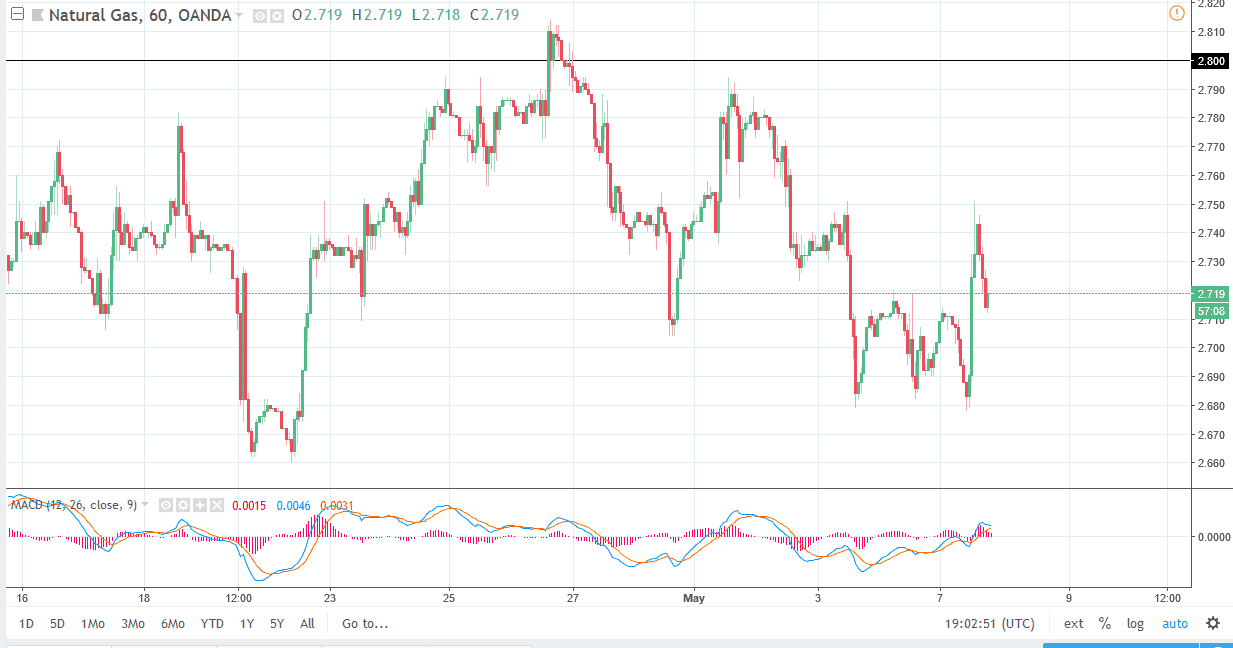

Natural Gas

Natural gas markets initially exploded to the upside during the day on Monday but found enough resistance at the $2.75 level to turn around and fall significantly. We are starting to see a bit of support at the $2.70 level, an area that was previous resistance. If we rally from here again, I will be looking to sell again at either to dollars $.75 on signs of exhaustion, or perhaps even the $2.80 level. Otherwise, we could continue to go lower, perhaps reaching down to the $2.68 level. Breaking down below the $2.68 level should send this market down to the $2.65 level, and then massive support at the $2.60 level. In general, I like selling this market on rallies, just as we have seen happen late in the day on Monday. Short-term traders continue to look to this market for nice selling opportunities.