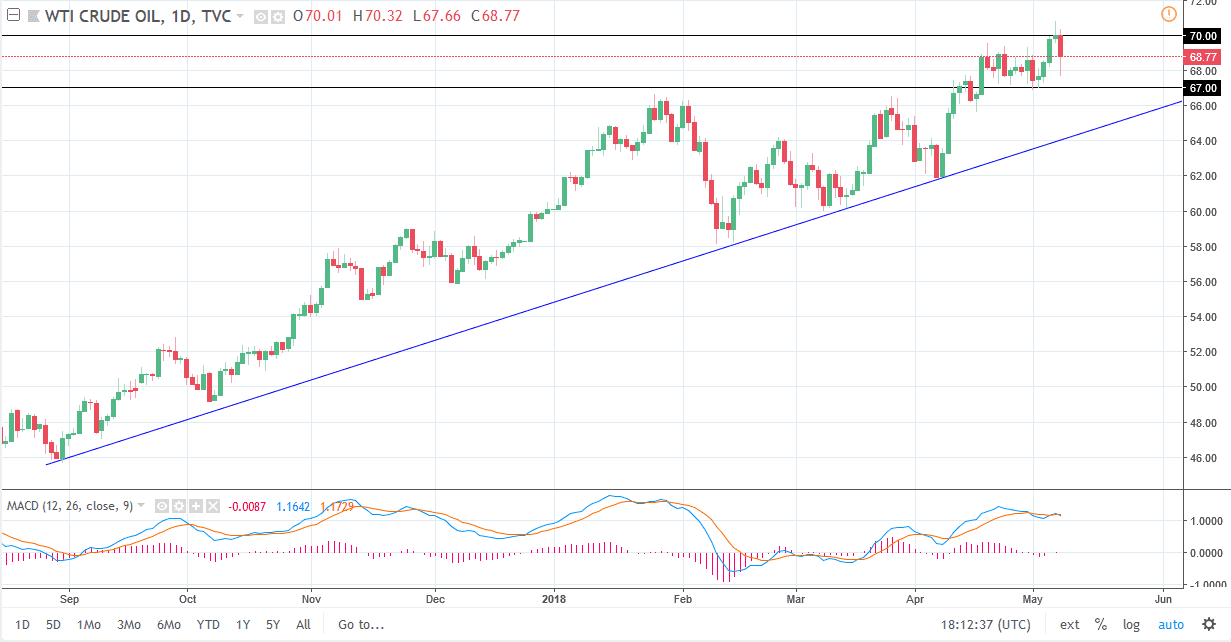

WTI Crude Oil

The WTI market was very volatile during the trading session on Tuesday, as the markets prepared for Donald Trump to leave the Iranian deal. Instead of breaking the deal apart completely, the United States has offered more sanctions, so in a sense it was probably the “least bad” scenario for crude oil. It’s obvious to me after looking at the charts that the algorithmic traders had no idea how to handle this information, as we broke down drastically. However, we turned around to show signs of strength again during the day, as there is nothing short of confusion in the market. I would stay out of this market, but I do think that longer-term we have more upward pressure than anything else. I see massive support below at the $67 level underneath and anticipate that in the next couple of days we will go much higher.

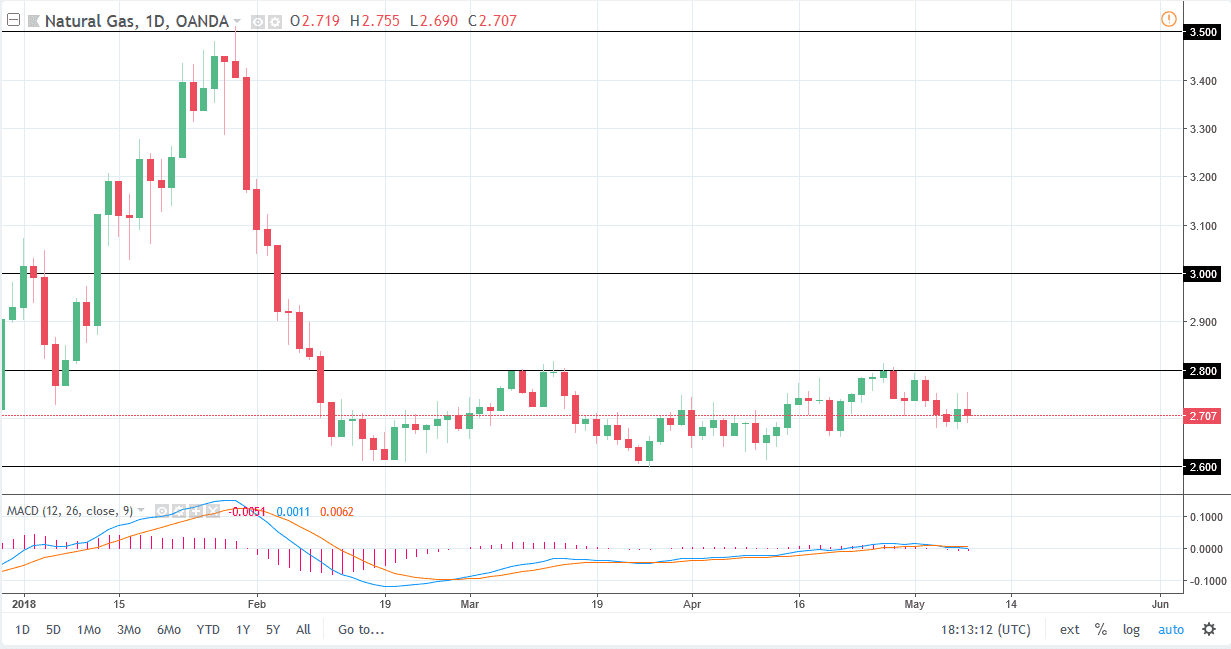

Natural Gas

Natural gas markets were noisy as well, but negative as per usual. It looks as if every time we rally, the sellers will come back and that’s been the way I have been trading this market for some time. I think that the market continues to bounce around between the $2.60 level on the bottom and the $2.80 level on the top. We are currently right in the middle, so we can go in either direction, but I prefer selling rallies as they occur, based upon short-term moves. Day traders will love this market, but people who are trying to aim for larger moves will probably be frustrated to say the least. If we did break above the $2.82 level, we could go higher based upon momentum, but beyond that I don’t see any buying opportunities.