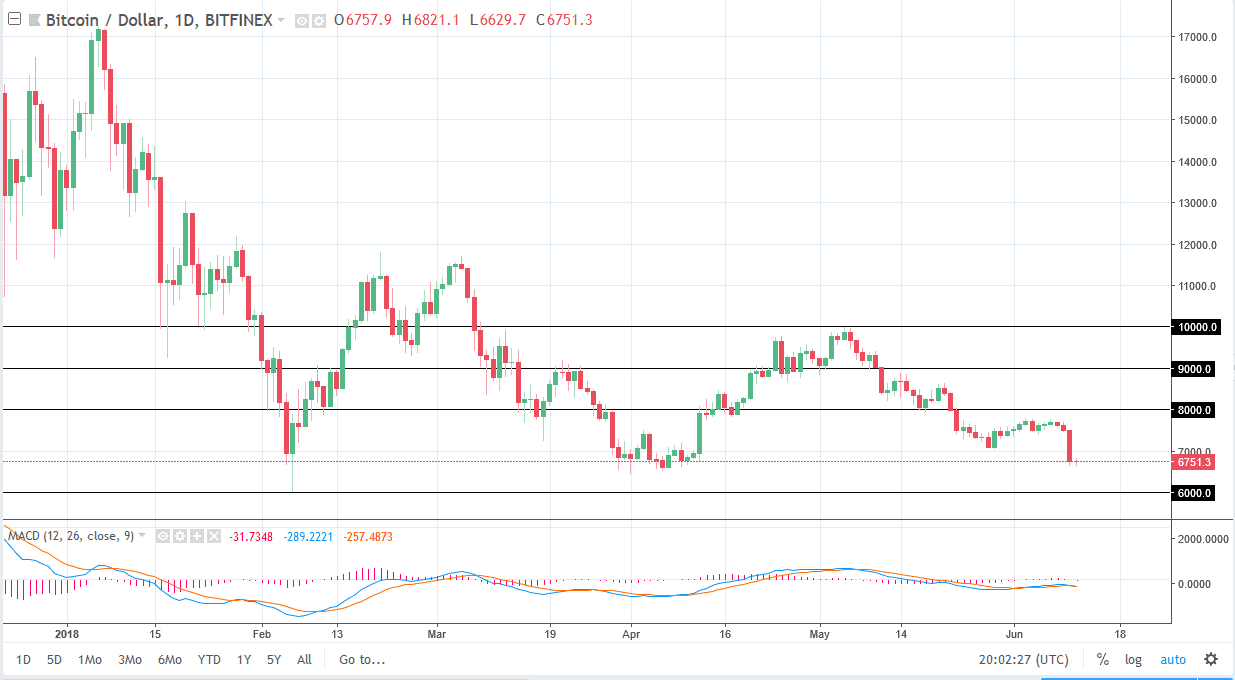

BTC/USD

Bitcoin has fallen apart during the last couple of days, while Monday was rather quiet. While this is somewhat encouraging, I think at this point it’s obvious that anytime this market rallies, you should be looking for an opportunity to short it. Highs continue to get lower, and I think it’s only a matter time before the $6000 level is revisited. In the short term, it appears that the $6500 level is offering a bit of support, as it is a “zone” that extends down to the previously mentioned $6000 level. In fact, it’s almost impossible to buy this market until we break above the $8000 level, something that would take a significant turnaround in attitude. Yet another hack has happened over the weekend, and that of course has a lot of people concerned.

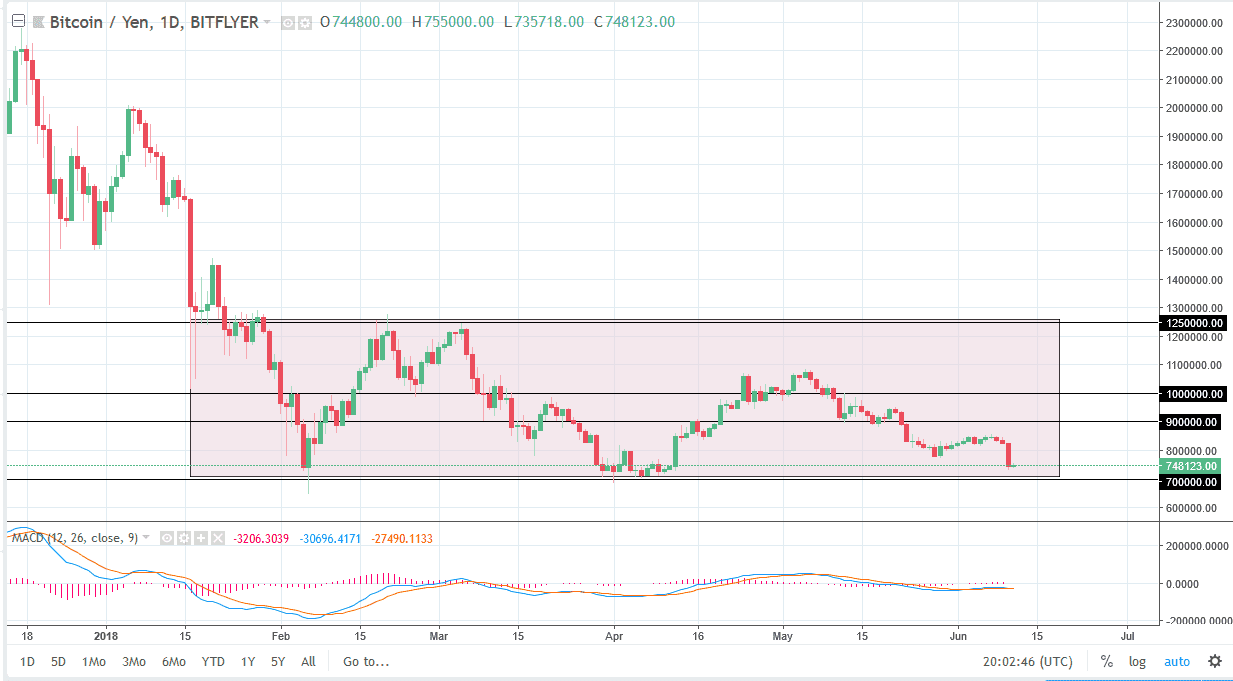

BTC/JPY

Bitcoin fell during the week against the Japanese yen as well, and just like against the US dollar, there seems to be a bit of support just below. There is a vital area in the form of the ¥700,000 level, so I think that the market breaking down below that level would be very negative indeed, more than likely opening up the door to the ¥600,000 level. If we do rally from here, I think it’s not until we break above the ¥900,000 level that we show any believable strength. Quite frankly, this is a “sell the rallies” market as well, and I think that bitcoin is in serious trouble at this point. While we have not broken through the structurally important ¥700,000 level, the one thing that’s almost impossible to ignore is that each successive high continues to get lower, which of course is in and of itself a very negative sign.