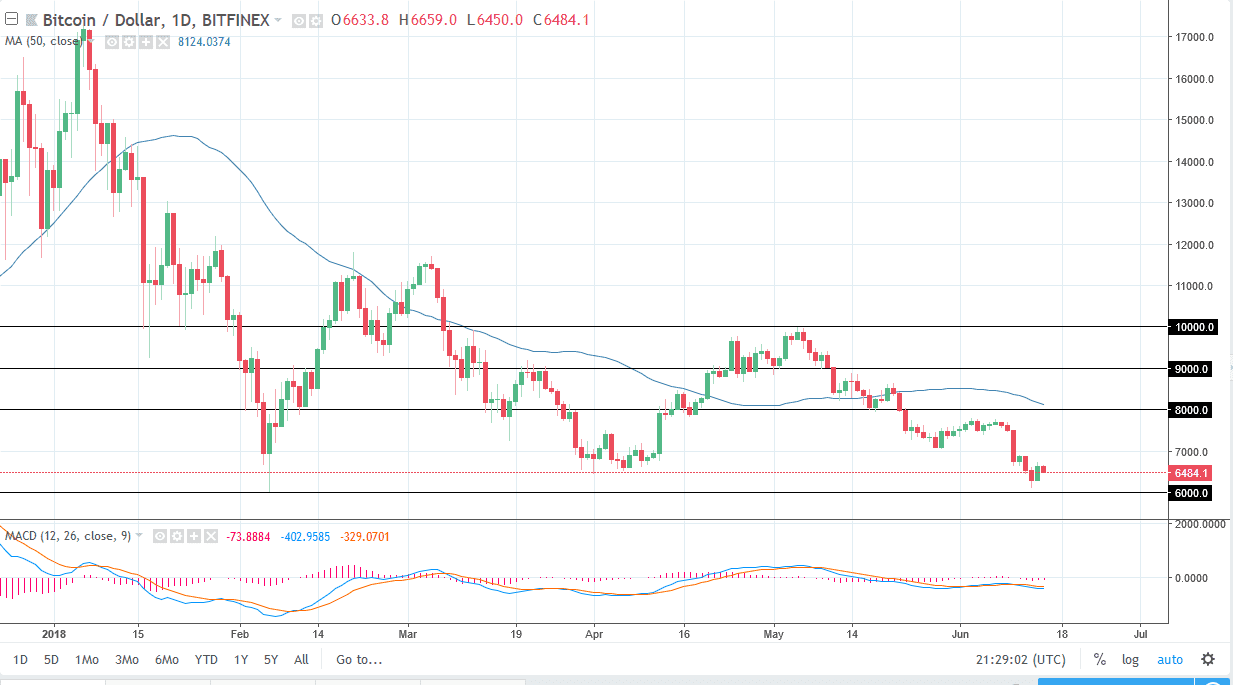

BTC/USD

Bitcoin markets fell a bit during the session on Friday, as we continue to see a bearish pressure. The market is below the $6500 level again, and I think that we are probably going to revisit the $6000 region. The $6000 region has been a major support level more than once, so I think that we will probably attract a lot of attention then. If we break down below the $6000 level, the market could go down to the $5000 level after that. Rallies at this point are to be sold as we continue to see a lot of bearish pressure and of course concern around the globe when it comes to trading tariffs. This has a lot of large trading desks selling assets that are underperforming, much like the Bitcoin market has been.

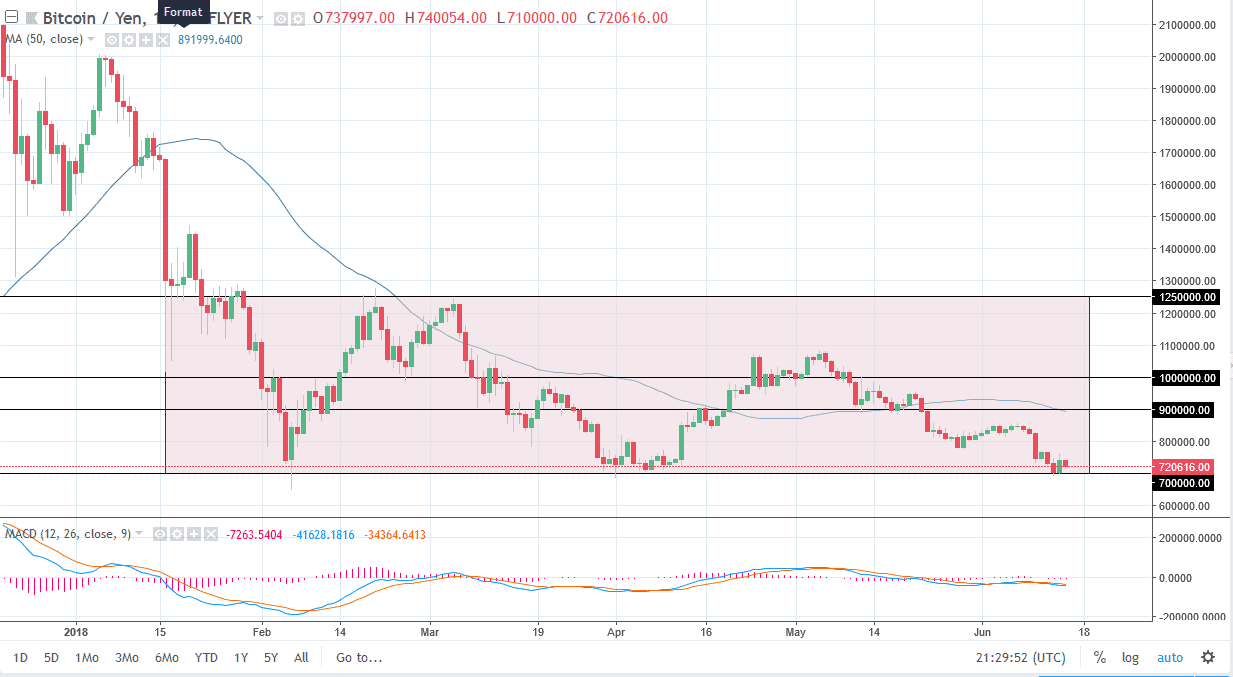

BTC/JPY

Bitcoin fell during the session as well, as it looks likely to test the ¥700,000 level again. The ¥700,000 level underneath is support that we have seen come into play more than once, and a break down below that level would of course be very negative. The fact that we couldn’t sustain gains for two consecutive days from that important level tells me that we will more than likely try to break through it. That doesn’t mean that it will happen, but it certainly looks likely at this point. I also recognize that rallies are to be sold, as the ¥800,000 level begins the next wave of selling pressure even if we do rally to that level. This market continues to foretell lower bitcoin pricing, not only hear against the Japanese yen, but against other currencies around the world.