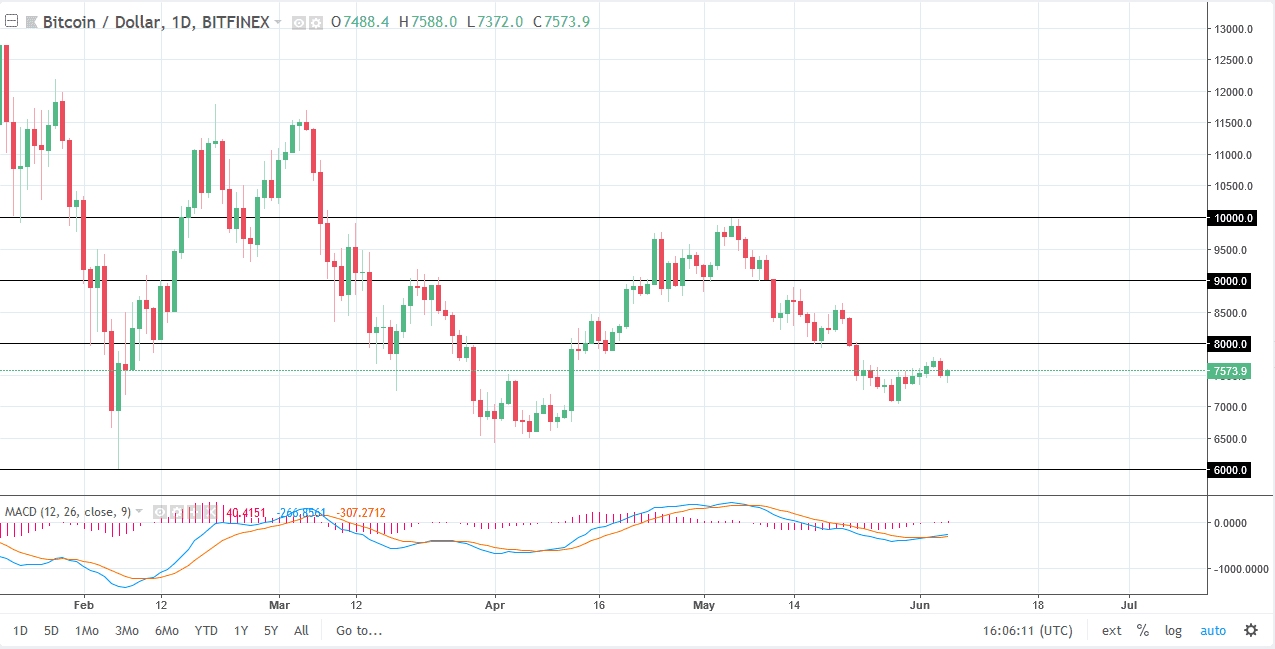

BTC/USD

The bitcoin market fell initially against the US dollar on Tuesday but turned around to form a bit of a hammer. This was in reaction to what was going on in the currency markets, as the EUR/USD pair rallied. With the softness in the US dollar, it makes sense that bitcoin would be able to gain from this move. However, I think there is significant resistance above at the $8000 level that you should be paying attention to, and I think that it will be difficult to break above that level. I suspect that any short-term bounce will be short-lived to say the least. I think that $7000 will be tested again rather soon. If we did break above the $8000 level, we could go looking towards the $8500 level next. I have no interest in trying to buy this market currently, it has shown far too much in the way of weakness over the last several months.

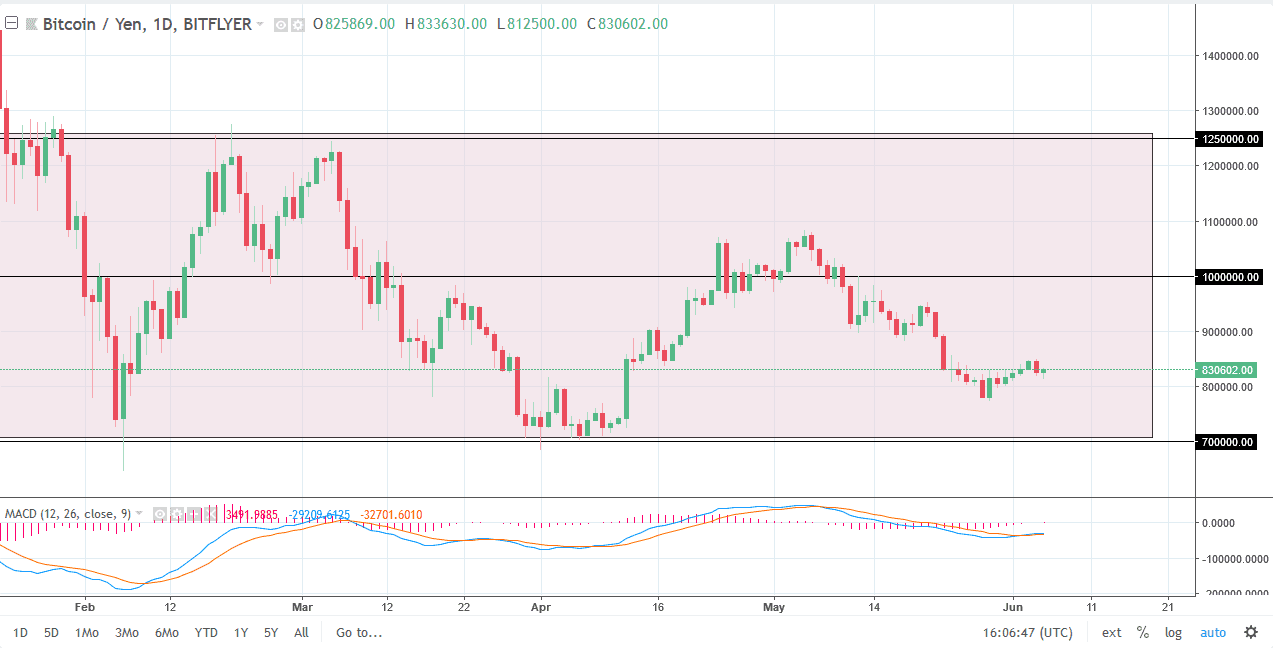

BTC/JPY

Bitcoin also fell against the Japanese yen initially during the trading session on Tuesday but found enough buyers to turn around of form a bit of a hammer as I record this. I think that ultimately this market will probably continue to find a lot of volatility, and most certainly downward pressure. I think that we are going to revisit the ¥700,000 level eventually, and it’s only a matter of time before we get there. I look at rallies as opportunities to sell, as this market has not been able to sustain gains for any significant amount of time. I anticipate that the ¥1 million level will continue to act as a “ceiling” in the pair and breaking above that is going to be very difficult.