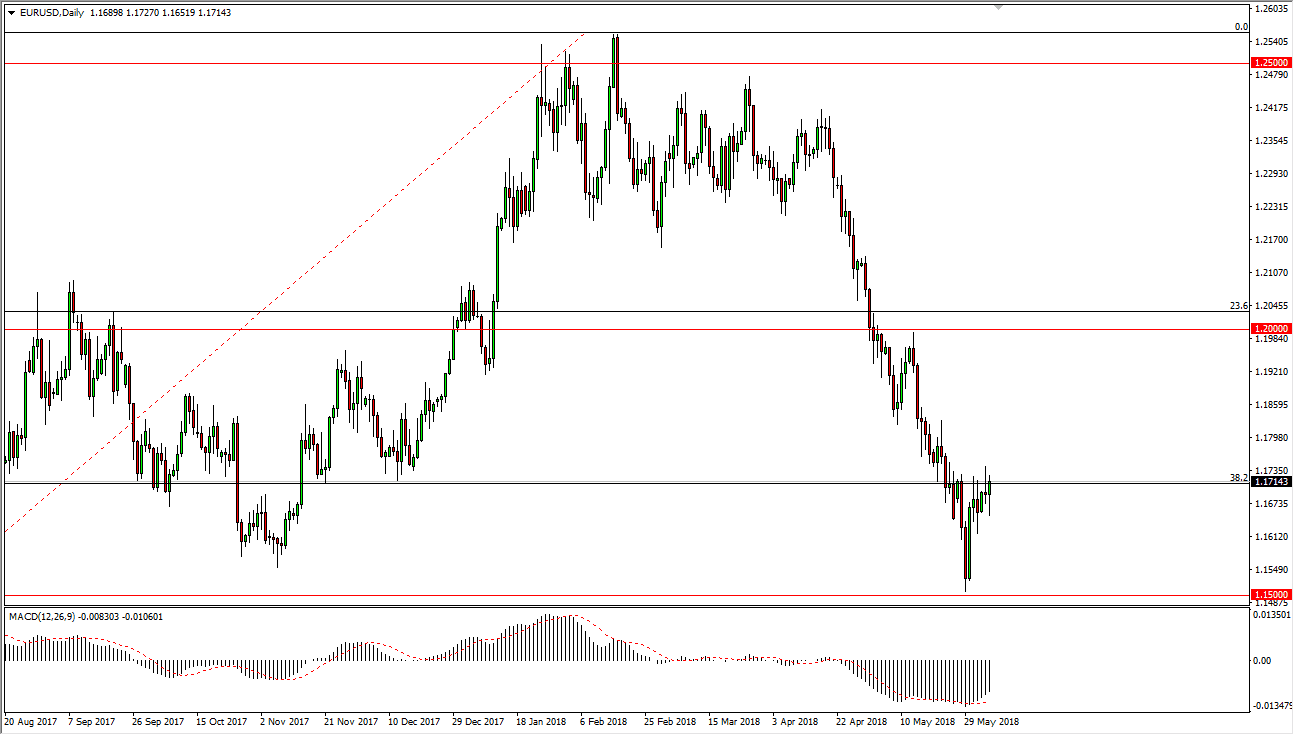

EUR/USD

The EUR/USD pair initially fell during trading on Tuesday but turned around and show signs of strength as it was rumored that the ECB will be looking at the June 14 meeting to discuss the possibility of exiting quantitative easing. If that’s the case, that should put a bit of a charge into the Euro but remember that we have a lot of moving pieces in the European Union right now. Quite frankly, I’ve been long of this market in the short term, simply because we were oversold, and we have tested major support at the 1.15 level. With that being the case, I think we continue to grind higher, but the keyword here is certainly going to be “grind.” I am not expecting an explosive move unless of course somebody of some official capacity confirms these rumors.

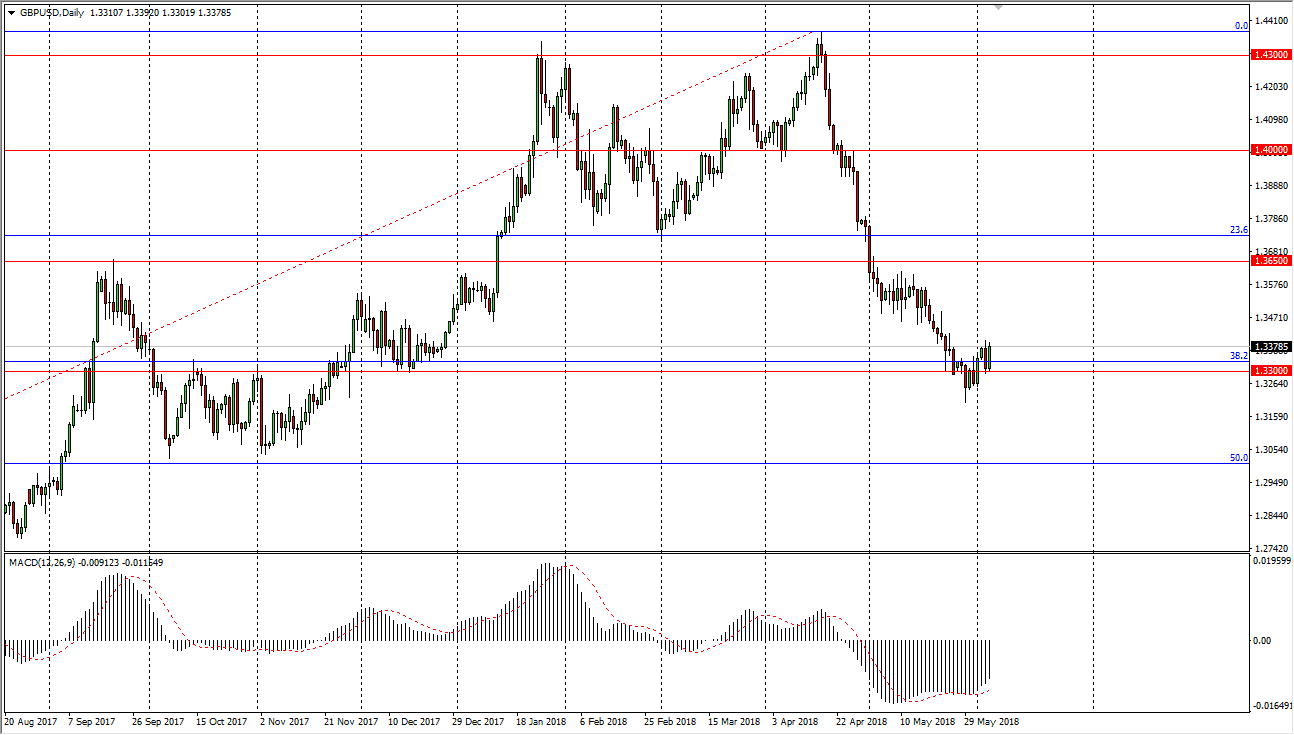

GBP/USD

The British pound also found buyers during the day as the 1.33 level has offered a bit of support. I think that the market will ultimately go looking towards 1.35 handle, and the 1.34 level is ready to give way. I think the 1.33 level will continue to offer support, but if we were to break down to make a fresh, new low, then I believe that the 1.30 level is the next target. I would anticipate a lot of resistance near the 1.3650 level, but a break above there would be a significant turnaround and fortune for the British pound. I believe that a lot of this is going to be driven by the US dollar more than anything else, so pay attention to those interest rates in America, especially the 10 year note. As they rise, so does the value of the greenback.