The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 3rd June 2018

In my previous piece last week, I forecasted that the best trades would be short EUR/USD, GBP/USD, and EUR/JPY. The results were mostly negative: EUR/USD rose by 0.08%, GBP/USD rose by 0.24%, and EUR/JPY fell by 0.05%. This gave a very small average loss of 0.09%.

Last week saw a rise in the relative value of the New Zealand Dollar, while the other major currencies remained relatively unchanged. The U.S. stock market advanced to end the week just below a test of a key zone of resistance between about 2730 and the psychologically important level of 2750. Crude Oil fell again.

The major event of last week was strong earnings and employment data from the U.S.A. which has the effect of boosting the U.S. stock market and the U.S. Dollar to a lesser extent. The Italian Euro crisis also seems to have temporarily abated.

Fundamental Analysis & Market Sentiment

Fundamental analysis tends to support the U.S. Dollar, as American economic fundamentals continue to look strong and this is reinforced by the latest positive data release. The weakest and most vulnerable currencies remain the Euro, which is prone to a re-eruption of the Italian crisis, as well as the Swedish Kroner which is heavily correlated with the Euro and is suffering from a relatively high negative rate of interest. The Mexican Peso and Turkish Lira also look vulnerable, although both need to be handled very carefully as the Mexican Peso is refusing to give up the psychologically important 20 level. The Turkish Lira can be subject to sudden emergency measures by the Turkish Central Bank which might improve its position in an instant, but it looks as if last week’s emergency measures may not be enough to stop a further rise. I would be interested in USD/MXN long above last week’s high price and in USD/TRY long above 4.71.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows a small, bearish near-pin bar / candlestick move was made over the week, with the Index now above its price levels from 3 months and 6 months ago, sitting in a long-term bullish trend. The candlestick might be said to be bearish, but, it is better described as very inconclusive. The bearish case is signified by the fact is may indicate the move up is running out of steam. So, the trend is bullish, but there may not be much momentum in the short-term.

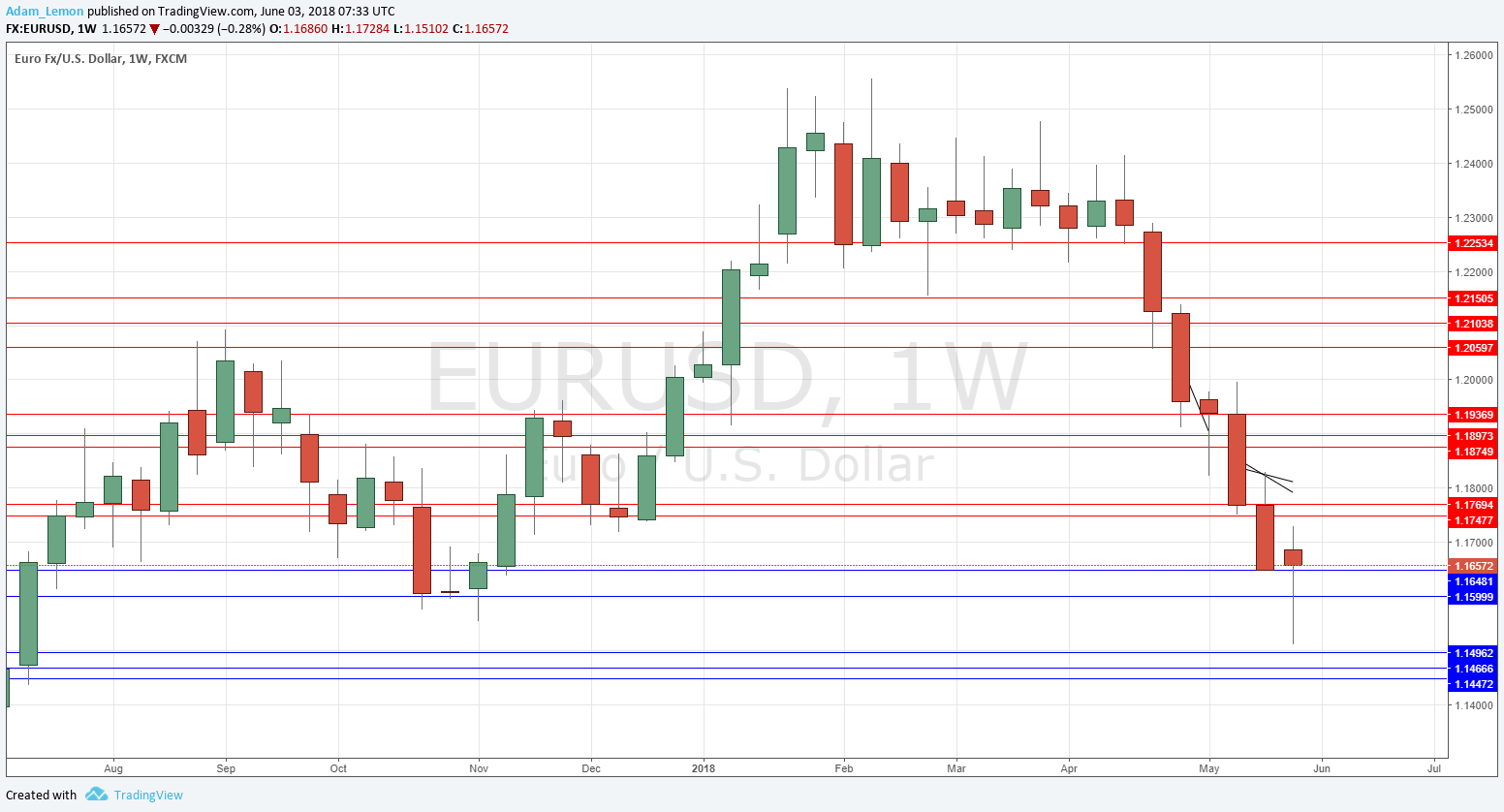

EUR/USD

The weekly chart below shows the price made a downwards movement, but the weekly candle is a bullish pin candlestick with a long lower wick. This should make us cautious about expecting a further fall next week, even though the price is clearly in a long-term bearish trend. The support is also at a formerly inflective supportive point, which gives weight to the bounce. The short-term price action became more bearish as the week closed, but I still would prefer to look to get long USD/SEK instead of short EUR/USD.

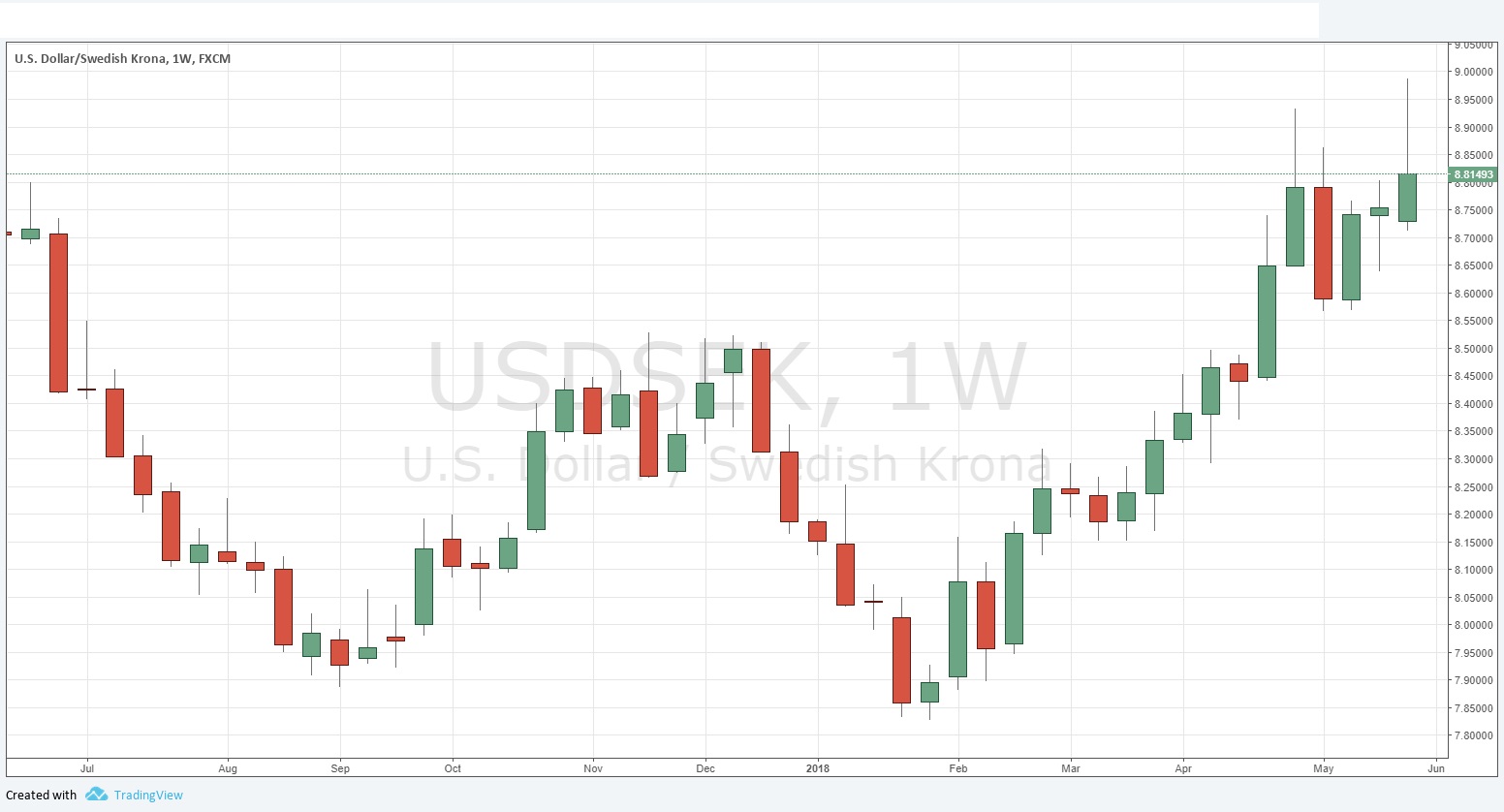

USD/SEK

The weekly chart below shows a seemingly inverse picture to the EUR/USD, but the close here is relatively healthier and the candlestick less pin-like. Here, we have the highest weekly close in many months, a healthy long-term bullish trend, and the promise of an attempt over the coming week at still higher prices. I would want to see a heathy rise after the week opens before going long here, however.

USD/MXN

The Dollar has advanced from 18 to 20 Mexican Pesos over the past 7 weeks and has been testing the psychologically important 20 level. The Mexican Peso is likely to be hit over new U.S. tariffs as well as a general weakness plaguing emerging markets currently. I would be interested in longs after a meaningful breakout above the 20 level.

USD/TRY

The Turkish Lira fell dramatically last week to all-time low prices, until the Turkish central bank effected a rate hike of 3% as well as a signal that it would be able to continue to operate relatively independently. This gave the currency more credibility, but it began to fall again towards the end of the week and would look bullish above 4.71 if it can advance a little further after the weekly open.

Conclusion

Bullish on USD/SEK, USD/MXN above last week’s high, and on USD/TRY above 4.71.