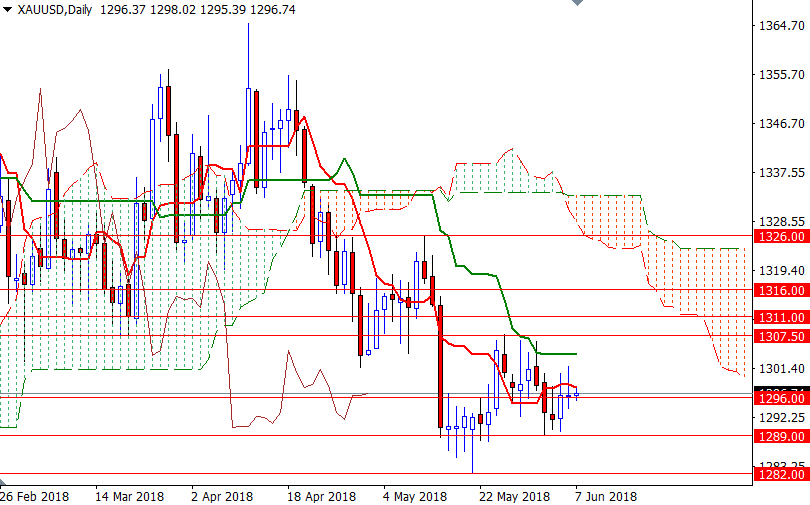

Gold prices ended Wednesday’s session nearly unchanged after shuffling between gains and losses. XAU/USD initially tested the resistance in the $1302-$1300 area but it was unable to pass through. As a result, prices returned to the $1296 level. The precious metal is getting a bit of support from a pullback in the U.S. dollar index, though upbeat risk appetite in the market place continues to limit the upside.

The key levels remain unchanged as XAU/USD is struggling to make it out of the 1307.50-1282 range. The shorter-term charts suggest that a test of 1307.50-1306 is likely if prices can climb above the resistance in the aforementioned 1302/0 zone. However, XAU/USD is inside the 4-hourly Ichimoku cloud, and the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are flat on both the daily and the 4-hourly charts, indicating that there is a lack of strong momentum. A sustained break above 1307.50 could bring new buyers into the gold market. In that case, the market will probably revisit 1311 and 1316.

On the other hand, keep in mind that downside risks remain as prices continue to trade below the Ichimoku clouds on the daily chart. If the support in the 1290/89 area is broken, then the 1286 level will be the next stop. The bears have to produce a daily close below the solid support in 1282/1 to challenge 1277/4.