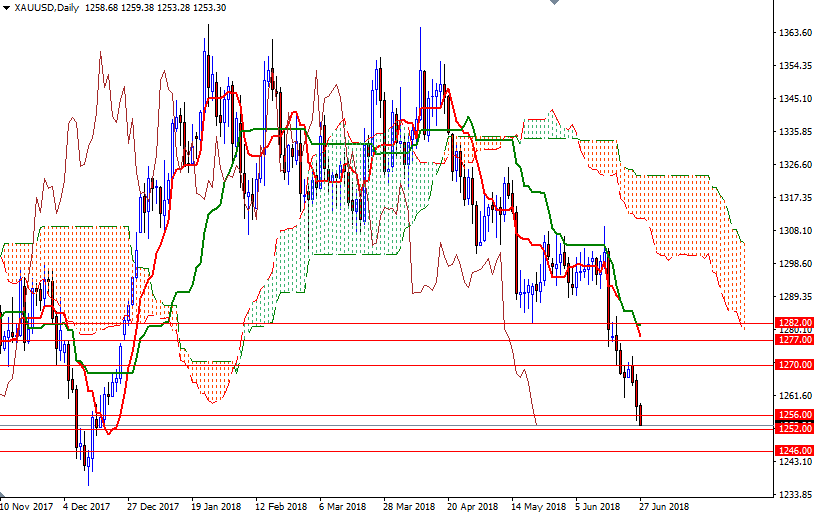

Gold prices fell $7.19 an ounce on Tuesday to settle at their lowest level since mid-December as a strengthening dollar fueled downside momentum. Technical selling was also behind the market’s 0.57% decline yesterday. A breach of a key support in the $1261-$1260 area generated more pressure on the market. XAU/USD is currently trading at $1253.30, lower than the opening price of $1258.68.

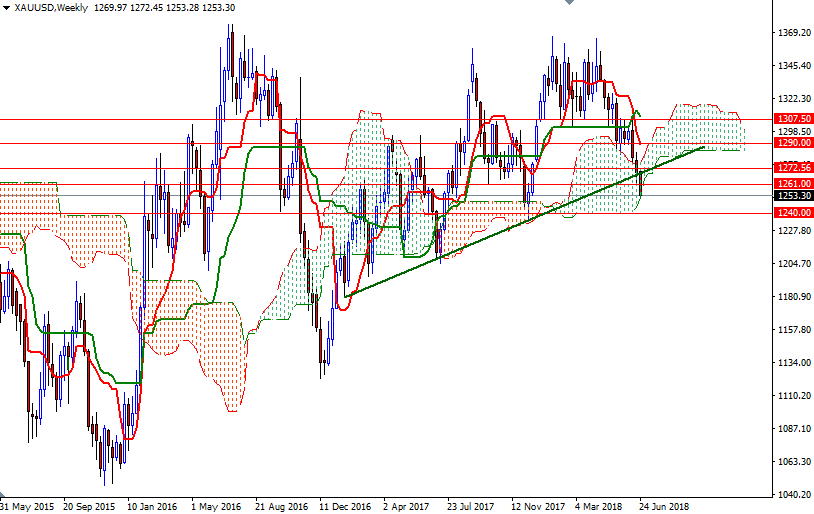

The market is trading below the Ichimoku Clouds on the daily and the 4-hourly charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned, and the Chikou-span (closing price plotted 26 periods behind, brown line) is also below prices. These suggest that the bears will remain in control over the medium-term. It looks like we are heading down to 1252/0 which is likely to act as support. If XAU/USD dives below 1250, then we will probably test 1246/4. The bears have to capture that strategic camp to make an assault on 1240/36.

However, if the support in the 1252/0 remains intact, the market may make a trip back up to 1263/1. Beyond there, the bears will be waiting in the 1268/7 zone. The bulls have to penetrate this barrier to tackle 1272.56-1270.