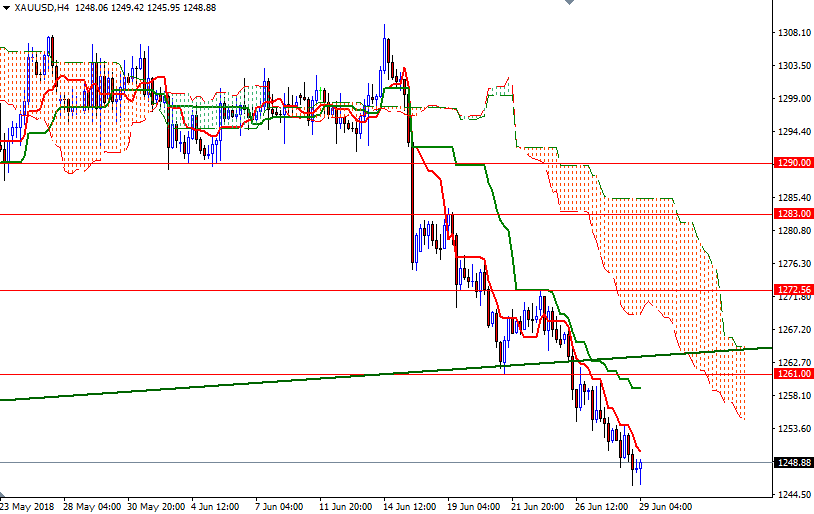

Gold prices are slightly higher in Asia trade, trading up 0.1% at $1248.88 an ounce, as the dollar softened after European Union leaders reached an agreement on migration. Yesterday, XAU/USD tested the support in $1246-$1244 as expected after prices broke down below the $1250 level. In economic news on Thursday, the Commerce Department reported that gross domestic product increased at a 2% annual rate in the first quarter.

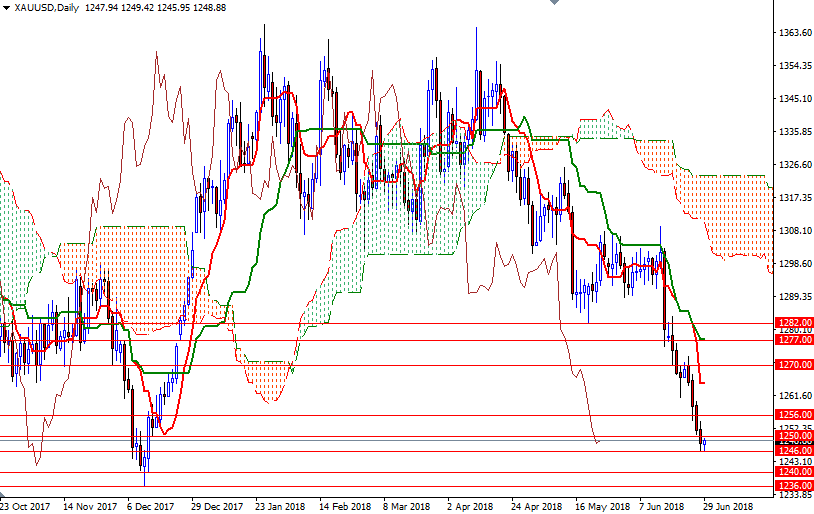

Technically, the bears have the near-term technical advantage, with prices remain below the daily and the 4-hourly Ichimoku clouds. However, the area at around 1246 provided support twice so far, and it seems like we are going to see some short-covering ahead of the weekend. If that is the case, the market will visit the 1252/0 zone, which is occupied by the Ichimoku cloud on the M30 time frame. A break above 1252 suggests that the market is heading towards the hourly Ichimoku cloud. On its way up, resistance can be found at 1256 and 1259.40.

To the downside, keep an eye on the 1246/4 area. If the market dives below 1244, then prices will probably fall to the 1240 level. Below there, the 1236 level stands out as a key technical support.