Gold prices rose $4.17 an ounce on Tuesday, supported by a weaker U.S. dollar. Concerns about Italy’s debt also helped provide a lift to gold. XAU/USD traded as high as $1300.42 an ounce after the market found strong support just above the $1290 level. U.S. economic data due for release Wednesday is light and includes the trade balance numbers.

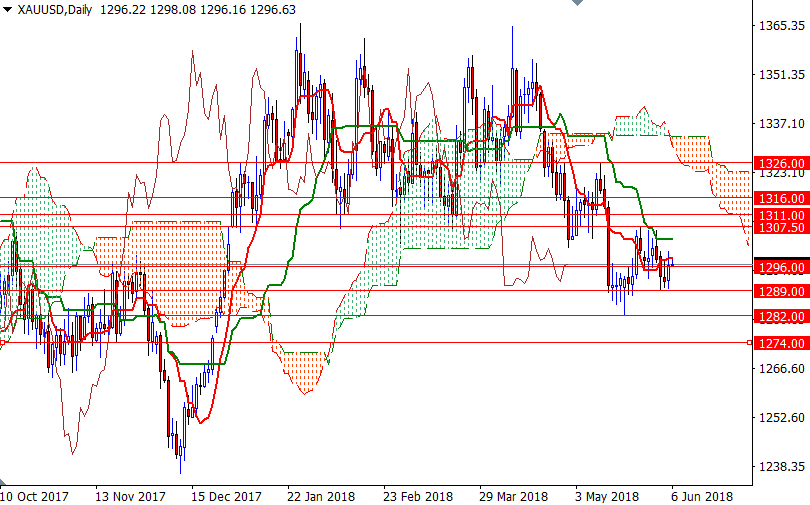

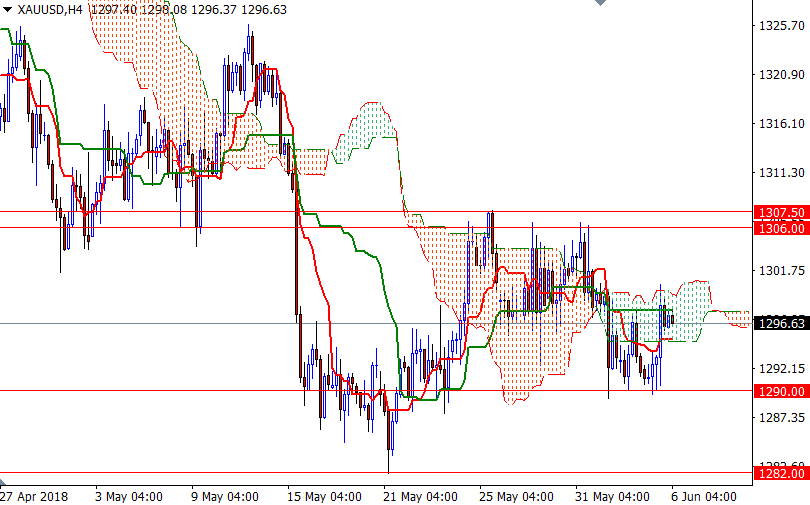

The market is trading above the Ichimoku clouds on the H1 and the M30 time frames, suggesting that the bulls have the short-term technical advantage. However, XAU/USD is still below the daily cloud, and we have negatively aligned Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) on the daily and the 4-hourly charts. With these in mind, I expect market to move higher and revisit the top of the Ichimoku cloud on the H4 chart. If the market anchors somewhere above the 1302/0 area, the bulls will be targeting a key technical resistance in 1307.50-1306. A break through there brings in 1311.

To the downside, the initial support sits at 1296, followed by 1290/89. The bulls have to drag prices back below 1289 to gain momentum for a test of 1286. Below there, the 1282/1 zone stands out as a solid technical support. If this support gives way, then look for further downside with 1277/4 and 1270 as targets.