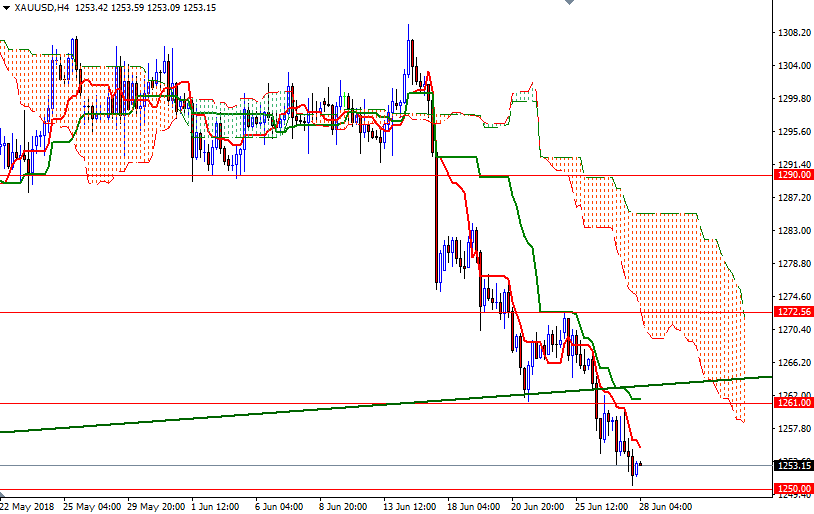

Gold prices fell for a third straight session on Wednesday, hitting a fresh six-month low, as investors focused on expectations the Federal Reserve will continue to raise interest rates. XAU/USD tried to move higher but found resistance just below the $1261 level. Consequently, the market retreated to test the support in the $1252-$1250 zone.

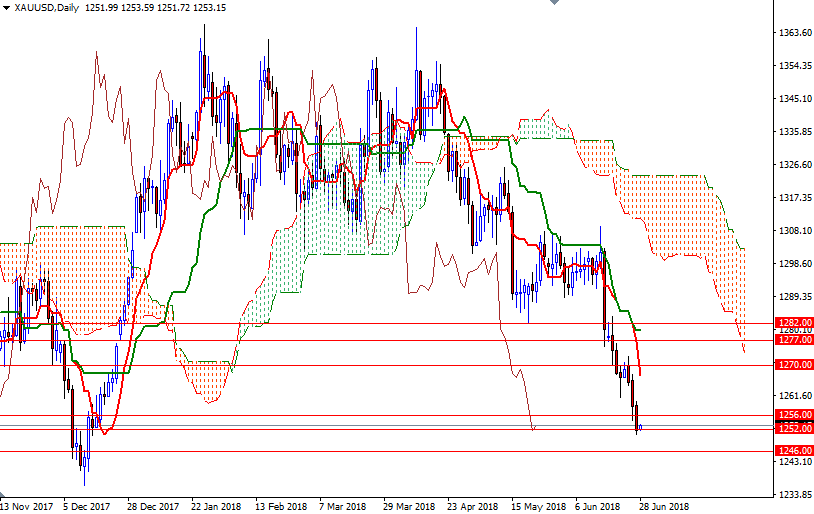

From a chart perspective, the bears have the overall near-term technical advantage. Prices are in a 2.5-month-old downtrend-month-old downtrend on the daily chart. Although the bears have the downside momentum on their side, keep an on the aforementioned support in the 1252/0 area. The bears will need to drag prices below 1250 to challenge 1246/4. A break below 1244 paves the way for a test of 1240/36.

At this point, another thing to pay attention is the RSI on the hourly chart which shows a bullish divergence. The bulls have to lift prices back above 1256 to gain momentum for 1263/1. A break through indicates that the market will make a move towards the 4-hourly Ichimoku cloud. In that case, the 1272.56-1270 area will be the next stop.