Gold prices were largely unchanged on Monday as investors awaited policy meetings from two of the world’s major central banks. The Federal Reserve is expected to announce the second increase in rates this year. The European Central Bank, meanwhile, will debate whether to rein in its massive monetary stimulus program. The key U.S. economic highlight of the day will be consumer price index.

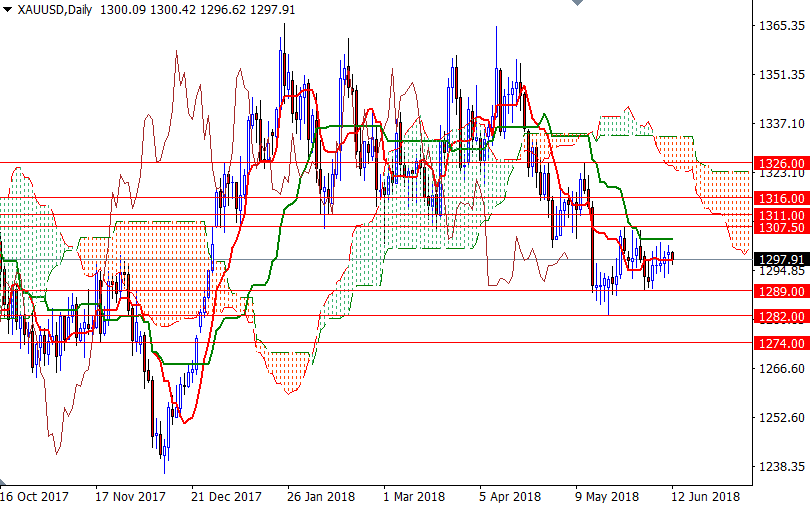

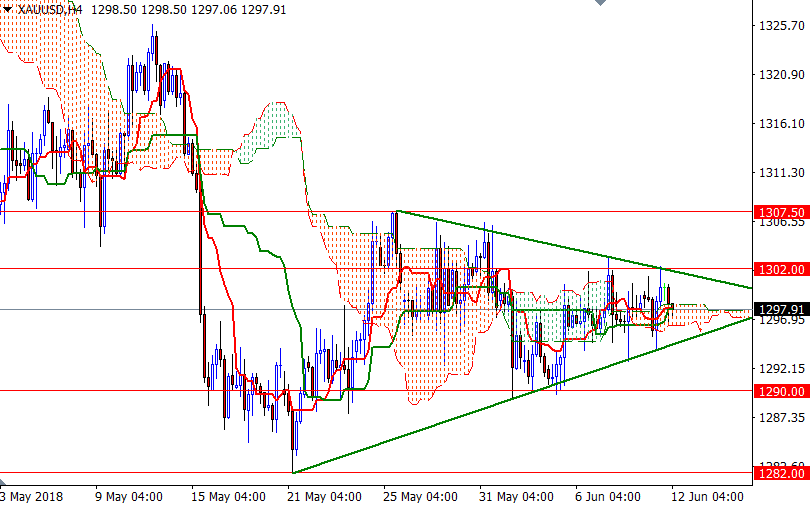

The market remains in consolidation mode, but of course this consolidation period will eventually come to an end. Meanwhile, we are coming closer and closer to the corner of a narrowing triangle. To the upside, the initial resistance is located in the 1303.91-1302 area. If XAU/USD convincingly gets back above 1303.91, where the daily Kijun-Sen (twenty six-period moving average, green line) resides, I think the 1307.50-1306 area will be the next port of call. Penetrating this barrier would suggest an extension to 1311.

The bears, on the other hand, have to capture the intra-day support in the 1294-1292.85 zone to make an assault on 1290-1289. If this support is broken, the market will be targeting 1286. Below there, the 1281-1281 area stands out a key technical support.