Gold prices fell $3.54 on Thursday as the dollar strengthened on the back of upbeat U.S. economic data. The Commerce Department reported that the personal-consumption expenditures price index rose a seasonally adjusted 0.2% in April from March. A separate report from the Labor Department showed the number of people filing new claims for unemployment benefits dropped by 13K to 221K. The key U.S. economic highlights of the day will be the monthly employment report and ISM manufacturing PMI.

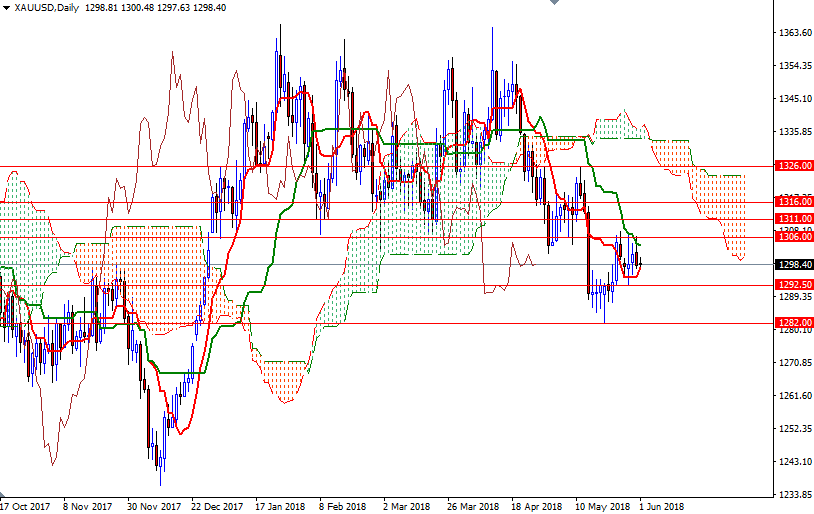

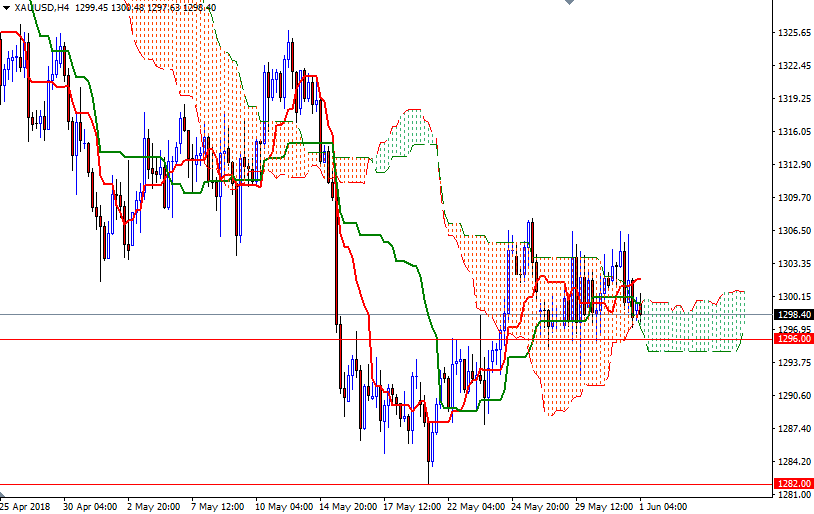

XAU/USD made another attempt to penetrate the resistance in the 1307.50-1306 area but was unable to break through. Consequently, the market pulled back to the support in 1297/6. Prices have been trapped in a relatively narrow range of around $15. The 4-hourly Ichimoku cloud has been supportive, but we have seen sellers increasing pressure every time prices get close to the 1307.50-1306 zone.

At this point, XAU/USD will have to either climb above 1307.50 and tackle the next barrier at 1311 or drop below the 1292.50-1290 area and test 1287.40-1286. While a sustained drop below 1286 would open up the risk of a fall to 1282/1, clearing the resistance at 1311 would make me think that the bulls are ready to challenge 1318/6.