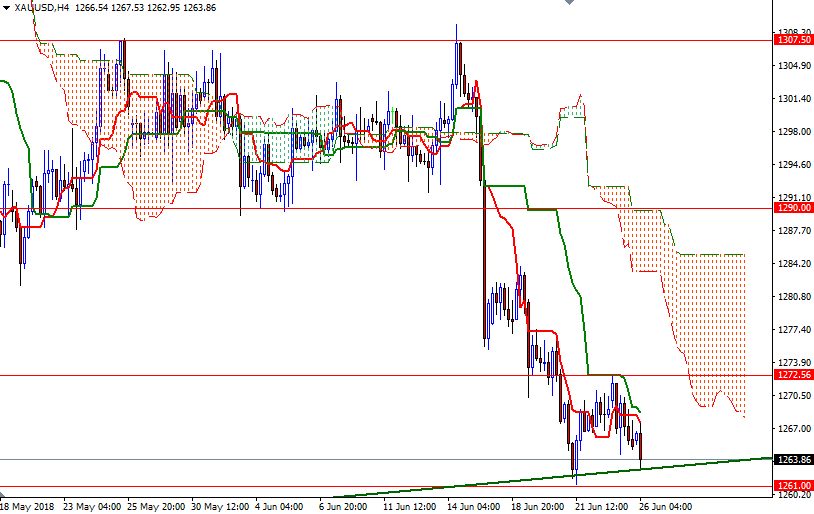

Gold prices dropped $4.79 an ounce on Monday as a general sell-off in the raw commodity sector weighed on the market. XAU/USD initially headed higher and tested the resistance in the $1270-$1272.56 area as expected, but it was unable to break through. An escalating trade dispute between the U.S. and China continues to pressure world stock and commodity markets. Worries about rising interest rates have been a bearish element for gold and silver markets over the past couple of weeks. U.S. economic data due for release Tuesday includes the consumer confidence index and the Richmond Fed’s business survey.

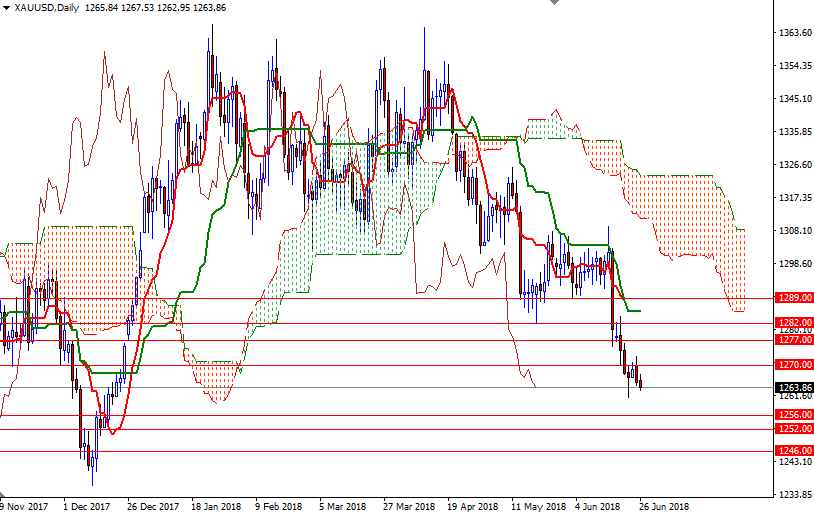

The bears still have the overall technical advantage, with the market trading below the daily and the 4-hourly Ichimoku clouds. The failure to break through 1272.56 is dragging prices towards a strategic technical support at around 1261 - note that a medium-term trend line also coincide with this area. If this support is broken, the market will be targeting 1256 next. A break below 1256 would encourage sellers and open a path to 1252/0.

To the upside, the initial resistance sits at 1268, followed by 1272.56. If the bulls successfully defend their ground and push prices above 1272.56, it is likely that the market will revisit 1277. The bulls will have to overcome this barrier to set sail for 1283/2.