Gold prices rose $2.77 an ounce on Thursday as worries about global trade offset pressure from a stronger dollar. The greenback rallied after the European Central Bank said “The Governing Council expects the key ECB interest rates to remain at their present levels at least through the summer of 2019 and in any case for as long as necessary to ensure that the evolution of inflation remains aligned with the current expectations of a sustained adjustment path.” U.S. retail sales jumped 0.8% in May, data from the Commerce Department showed yesterday. Media reports say President Donald Trump has approved a new batch of tariffs on Chinese goods, and an updated list of Chinese tariff targets will be released today. This matter is bullish for safe-haven gold, but safe-haven gains tend to be short-lived.

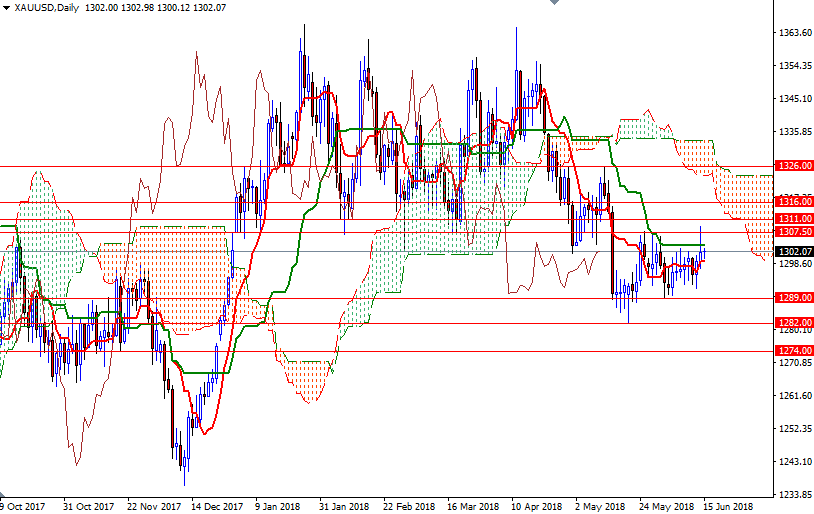

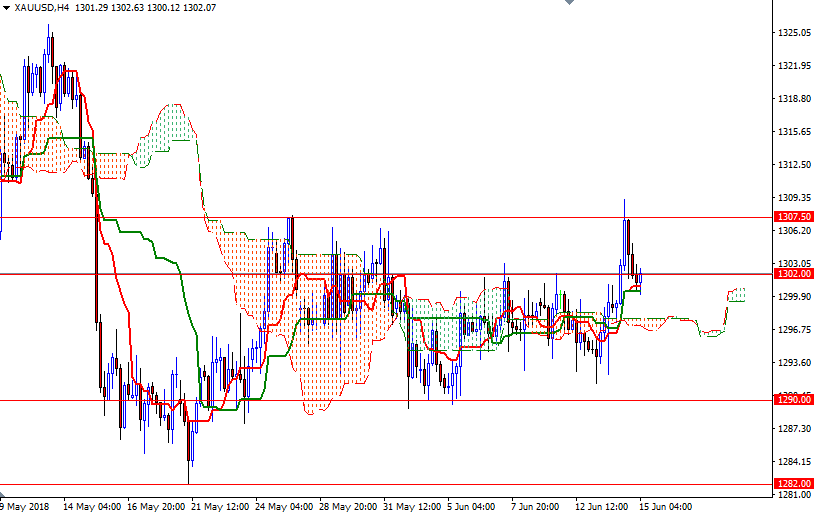

XAU/USD reached the 1307.50-1306 area as expected after prices passed through 1302-1300. However, it was unable to sustain gains above the 1307.50 level. The market is currently trying to find support in the 1302-1300 zone. If the bulls fail to defend this camp, the bears will have a chance to test a strategic technical support in 1297.44-1296. The 1297.44-1296 area is occupied by the 4-hourly and the hourly Ichimoku clouds. If prices fall through, the market will be targeting 1292.50 next.

To the upside, the initial resistance stands at 1304, the daily Kijun-Sen (twenty six-period moving average, green line). If prices get back above 1304, it is likely that the market will pay another visit to the resistance at around the 1307.50 level. The bulls have to produce a daily close above 1307.50 to challenge 1311.