Gold prices ended Tuesday’s session down $4.01 an ounce as investors continued to focus on the recent strong rally in the U.S. dollar index. The euro weakened further after European Central Bank President Mario Draghi signaled the central bank could delay plans to end its bond-buying program. Adding to downside pressure on the yellow metal yesterday was a general sell-off commodities. Commodity markets have been hit by fears of a major world trade war developing.

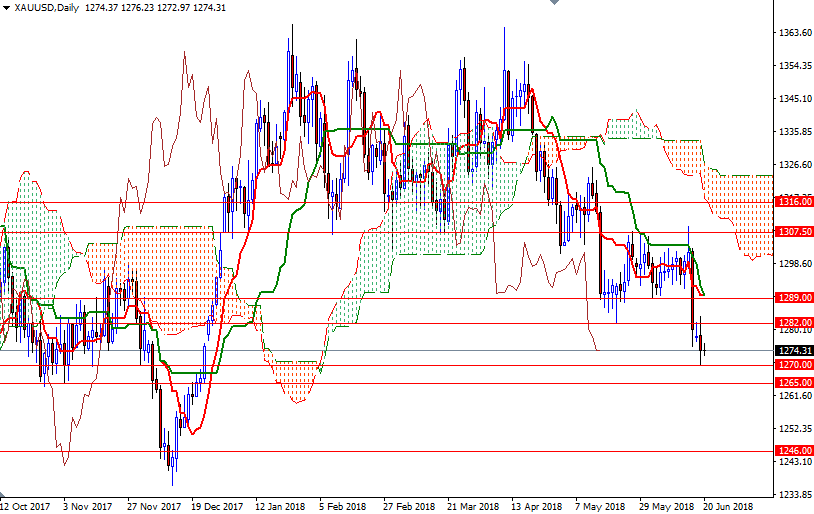

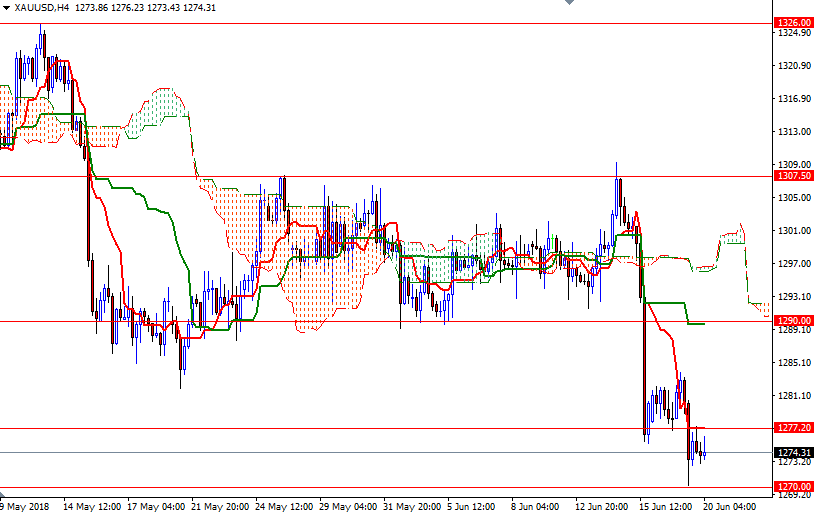

Trading below the Ichimoku clouds, along with the negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line), suggests that the bears still have the near-term technical advantage. The Chikou-span (closing price plotted 26 periods behind, brown line), which is below prices, also supports this view. Not surprisingly, XAU/USD reached the 1270 level after prices fell through 1277/4. The market has been in a downtrend since prices dropped below the daily cloud. However, at this point, I wouldn’t be surprised to see some short-side profit taking as we come closer to strategic supports such as 1270 and 1265. The bears will have to produce a daily close below the 1261/0 area to march towards the bottom of the weekly Ichimoku cloud.

To the upside, the initial resistance stands in 1282/0, followed by 1286. If the bulls can push prices back above 1286, they may have a chance to test the next barrier in the 1292.50-1289 area, where the daily Tenkan-sen and Kijun-sen converge. Closing above 1292.50 on a daily basis paves the way for a test of 1296.