Gold prices ended Wednesday’s session up $3.75 an ounce as the dollar’s rally in the wake of the Fed statement faded. The Federal Reserve’s Open Market Committee (FOMC) raised interest rates by 0.25%, to a range of 1.75% to 2.0%. Central bank officials indicated the stronger U.S. economy now warrants a total of four interest rate increases this year, up from a projection of three at their March meeting. U.S. stocks turned lower after the Fed signaled a more aggressive rate path in the coming years. The market’s focus will be on the European Central Bank meeting today.

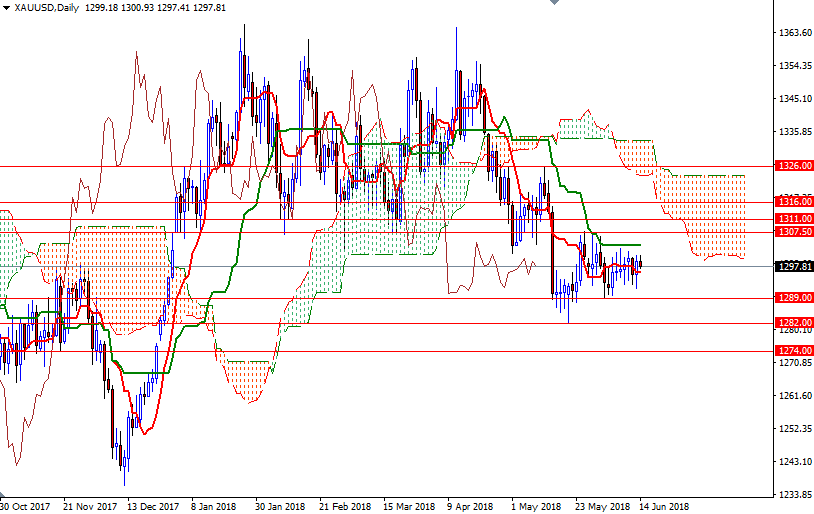

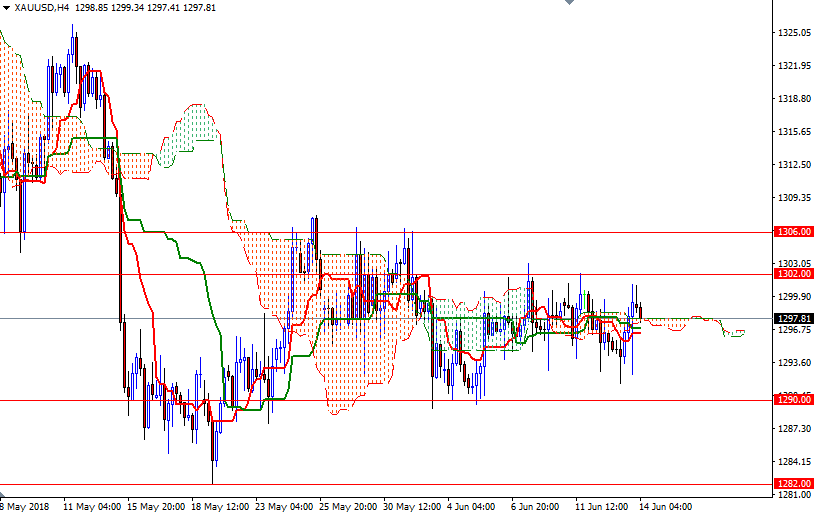

XAU/USD is trading above the Ichimoku clouds on the H1 and M30 charts. The market is in the process of testing the intra-day support in the 1297.44-1296 zone. If this support remains intact, it is likely that prices will grind higher towards 1302-1300. Beyond there, the 1307.50-1306 area stands out as a key technical resistance, and the bulls have to penetrate this barrier to gain momentum for 1311. Breaking above 1311 could foreshadow a move to 1318/6.

The 4-hourly and the hourly clouds overlap in the aforementioned 1297.44-1296 area so the bears will need to drag prices below there to test 1292.50 and 1290-1289. A sustained drop below 1289 suggests that the next target is 1286. If prices fall through, I think XAU/USD will revisit solid technical support in the 1282-1281 zone. Closing below 1281 on a daily basis would put us back on track with such a scenario eying subsequent targets at 1277/4 and 1270.