Gold prices are slightly higher in early Asia trading on a mild rebound following recent selling pressure that took prices to the lowest level since December 19. Yesterday, XAU/USD drifted lower towards the strategic support in the $1261-$1260 area as expected after prices dropped below $1265. The precious metal was able to recover some of its losses as the dollar weakened on softer-than-expected U.S. economic data. The Federal Reserve Bank of Philadelphia reported that the index measuring manufacturing activity in the region fell to 19.9 from 34.4 the prior month.

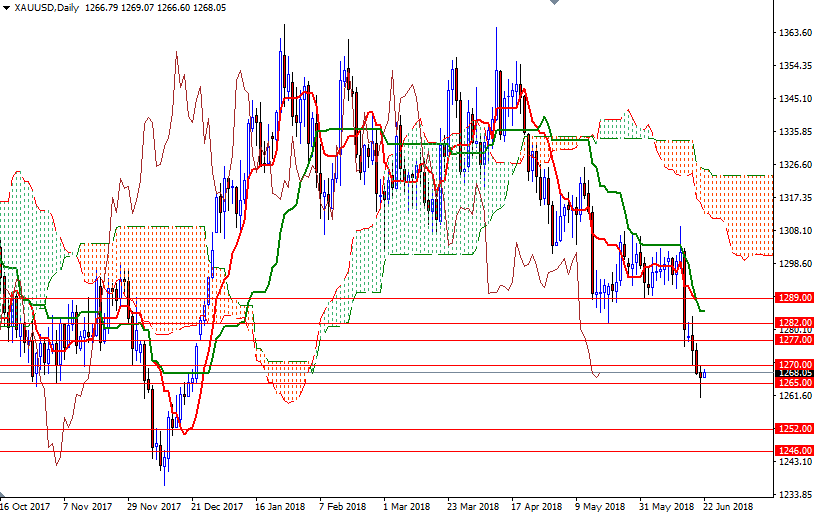

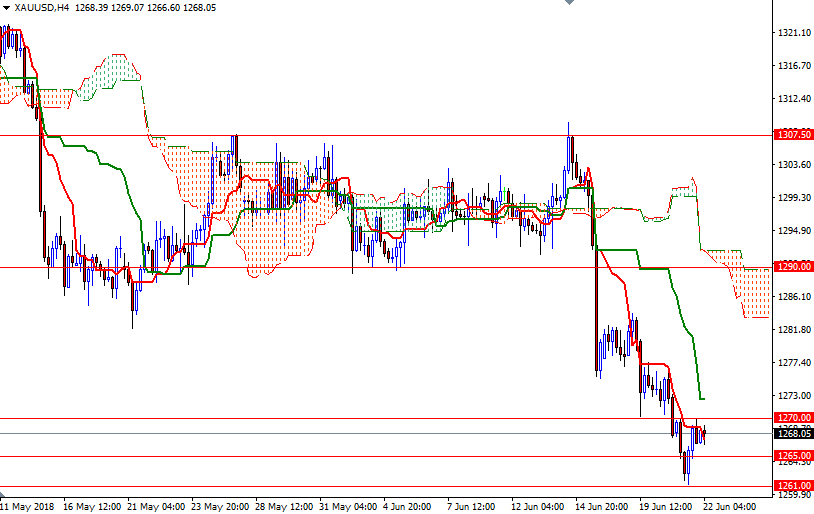

Prices remain below the daily and the 4-hourly Ichimoku clouds. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned on both charts. However, the long lower shadow of yesterday’s candle makes me think that we are seeing a bit of short-covering supporting the gold market into the weekend. As I mentioned earlier this week, there is a strategic support in the 1261/0 area, and the bears have to capture this camp if they intend to put extra pressure on the market.

If the bulls can defend their camp at around 1265 and successfully lift prices above the 1270 level, which happens to be the bottom of the hourly Ichimoku cloud, they may have a chance to test the next barrier in 1273.50-1272. The top of the hourly cloud sits at 1277. To the downside, the initial support is located at 1265, followed by 1261/0. A sustained break below 1260 could trigger further weakness and open up the risk of a drop to 1252/0. On its way down, support can be seen at 1257.