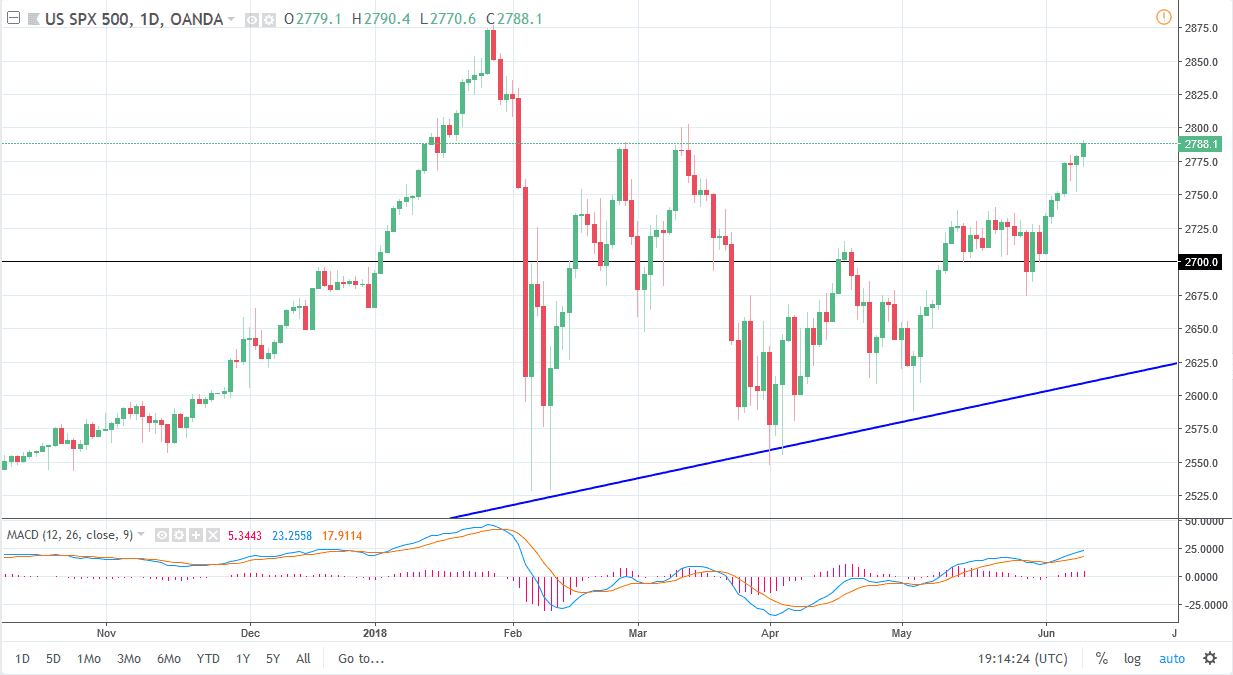

S&P 500

The S&P 500 initially pulled back slightly at the open on Monday but turned around the show signs of strength again, gaining 0.33% in positive, yet slow trading. This is because the market was awaiting the results of the meeting between the United States and the North Koreans, which of course can have a massive effect as to what risk appetite looks like going forward. The 2800 level offers a bit of psychological and structural resistance, but I think we can break above there if the meeting in Singapore goes fairly well. At that point, I would anticipate that the market would go to the 2850 handle after that. In the meantime, I believe there is a major support at the 2750 handle, and then a bit of a “floor” in the market at the 2700 level.

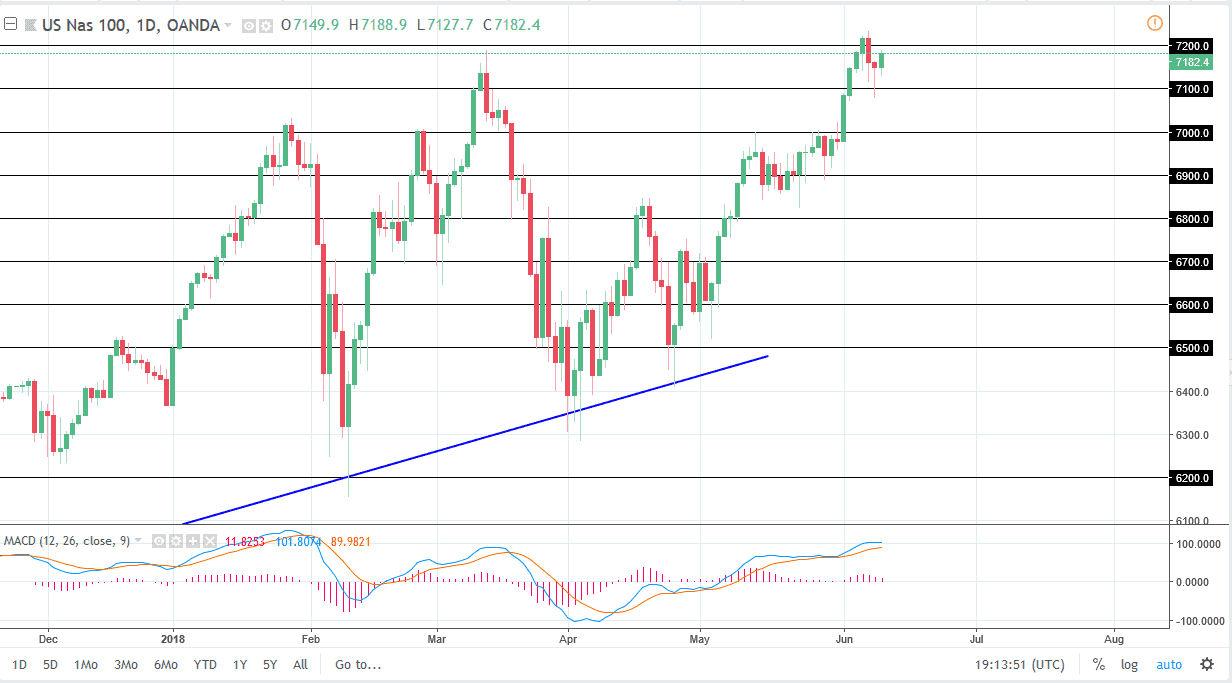

NASDAQ 100

The NASDAQ 100 initially pulled back as well but turned around to show signs of strength again. The market is reaching towards the 7200 level, an area that is previous resistance, and I think it we can break above that level, the market is ready to go much higher. I believe that the 7100 level is supportive, just as the 7000 level is as well. I believe that the market should continue to go higher, and I think that the short-term pullbacks offer bits of value that we can take advantage of, as stock markets are going to react quite positively to any good news coming out of that meeting in Singapore today. Overall, I believe that shorting is going to be very difficult to do, and therefore I think that the market will eventually go to fresh, new highs based upon the action that we have seen over the last several days.