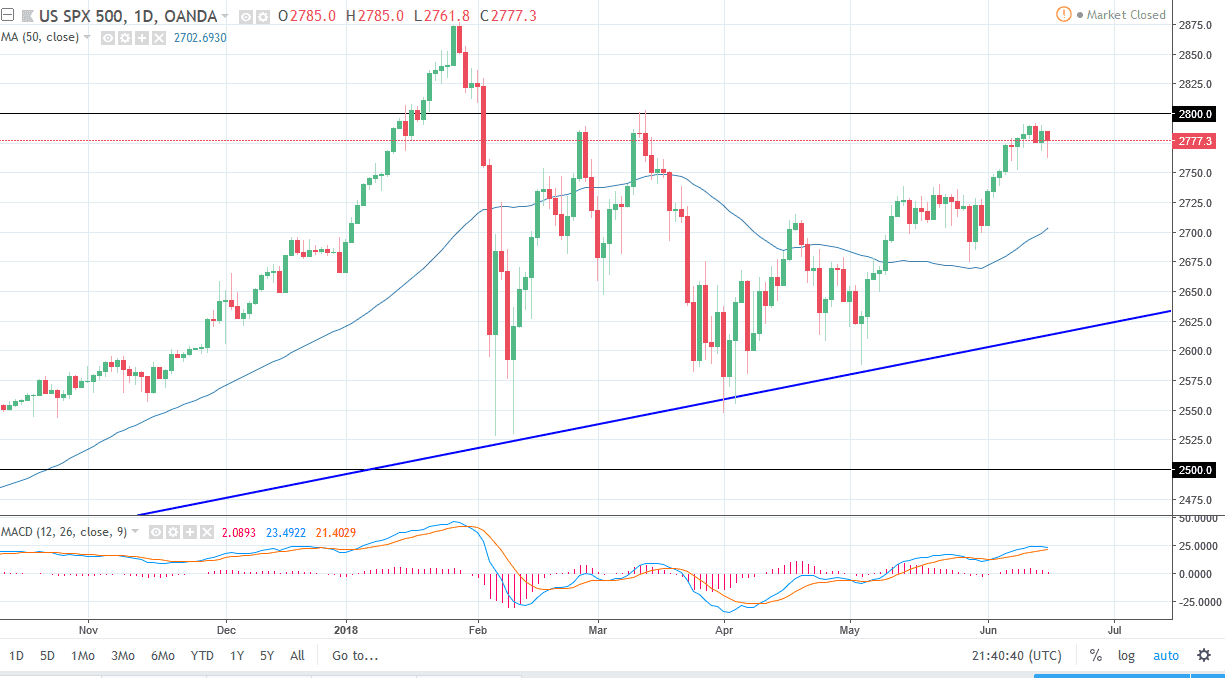

S&P 500

The S&P 500 fell significantly during the trading session on Friday but did find enough momentum to turn things around and form a hammer. The hammer of course is a bullish sign, but I see a significant amount of resistance above at the 2800 level. If we can break above that level, obviously that is a very good sign. There are a lot of fears when it comes to global trade right now, so it makes sense that we did get a bit of a dip as the Americans slap tariffs on the Chinese, and the Chinese turn things back around and slap tariffs on America. Donald Trump has also stated that if the Chinese retaliate, so will the Americans. I think it’s only a matter time before that happens. Because of this, I would expect more volatility but there is a clear barrier at 2800 that if we overcome, but it’s a buying opportunity.

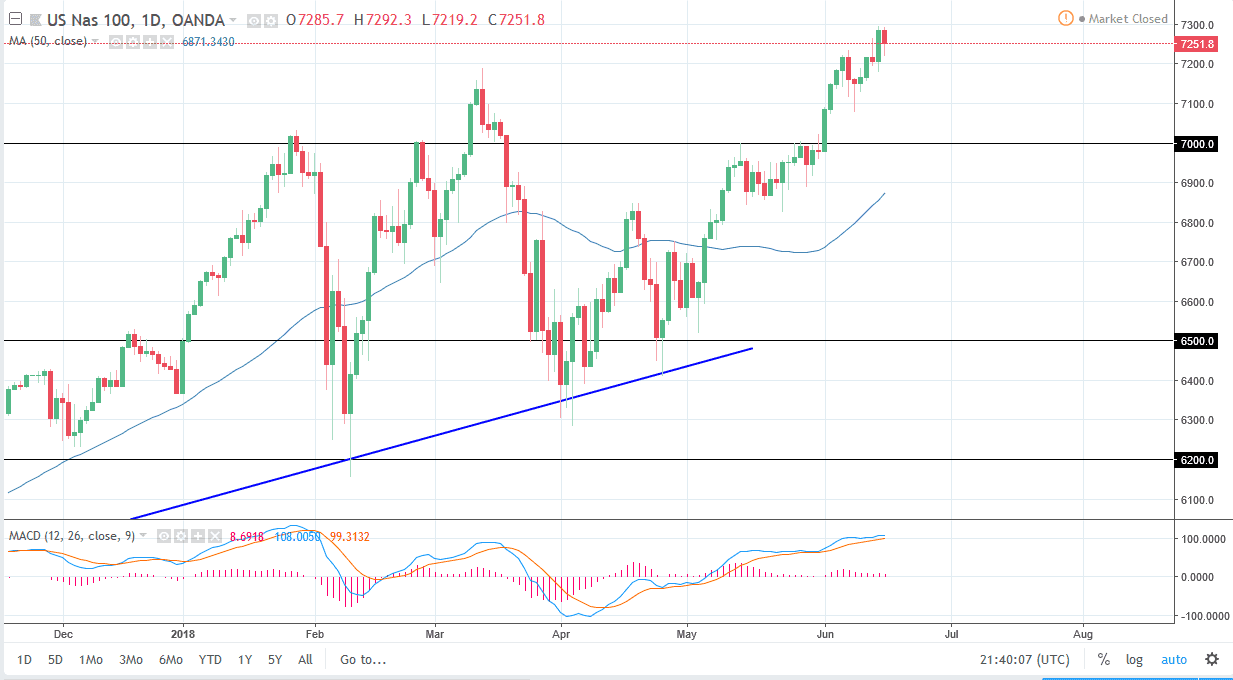

NASDAQ 100

The NASDAQ 100 fell as well but did find buyers just above the 7200 level. We bounced from there to gain 50 point again, and it looks likely that we are going to continue to go higher over the longer-term, but I would anticipate a lot of noise. I also believe that the markets are going to be susceptible to tariffs being slapped around the way they have been. I think that the 7000 level underneath is the “floor” in the uptrend, and I think that the market will continue to attract a lot of value hunters down near that level. However, I still maintain that we are going to the 7500 level, but it appears that most money is flowing into the United States, so it makes sense that these stock indices will outperform many of the other ones.