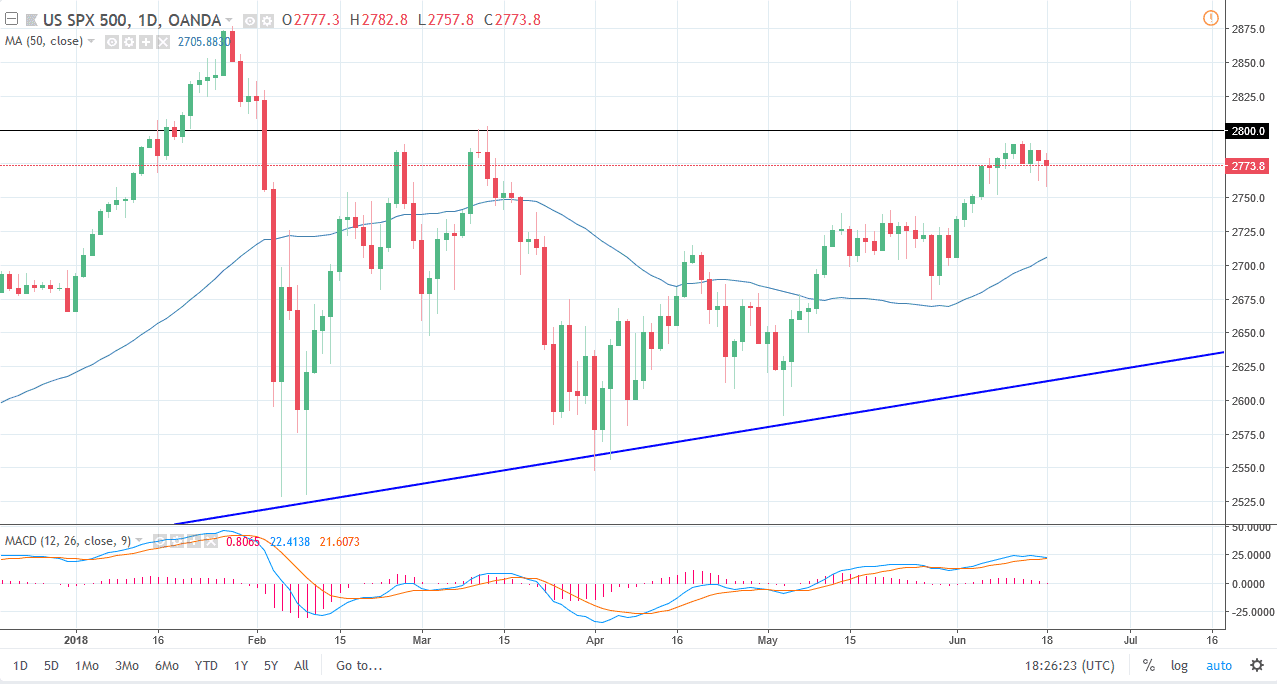

S&P 500

The S&P 500 has fallen during most of the session on Monday to start out the week but ended up finding enough support underneath the turn around and form a nice-looking hammer. The hammer of course is a positive sign, and it shows that there is still plenty of buyers for this market underneath, so it appears that the 2750 level is going to continue to offer a bit of a floor in the market. Obviously, we have problems with the 2800 level, so breaking above there would be a very bullish sign. I think at that point; the market could break out to go towards the 2850 level in the short term. A lot of this will be due to the situation arising between the United States and China. If things calm down, that should be reason enough for the S&P 500 to continue going higher.

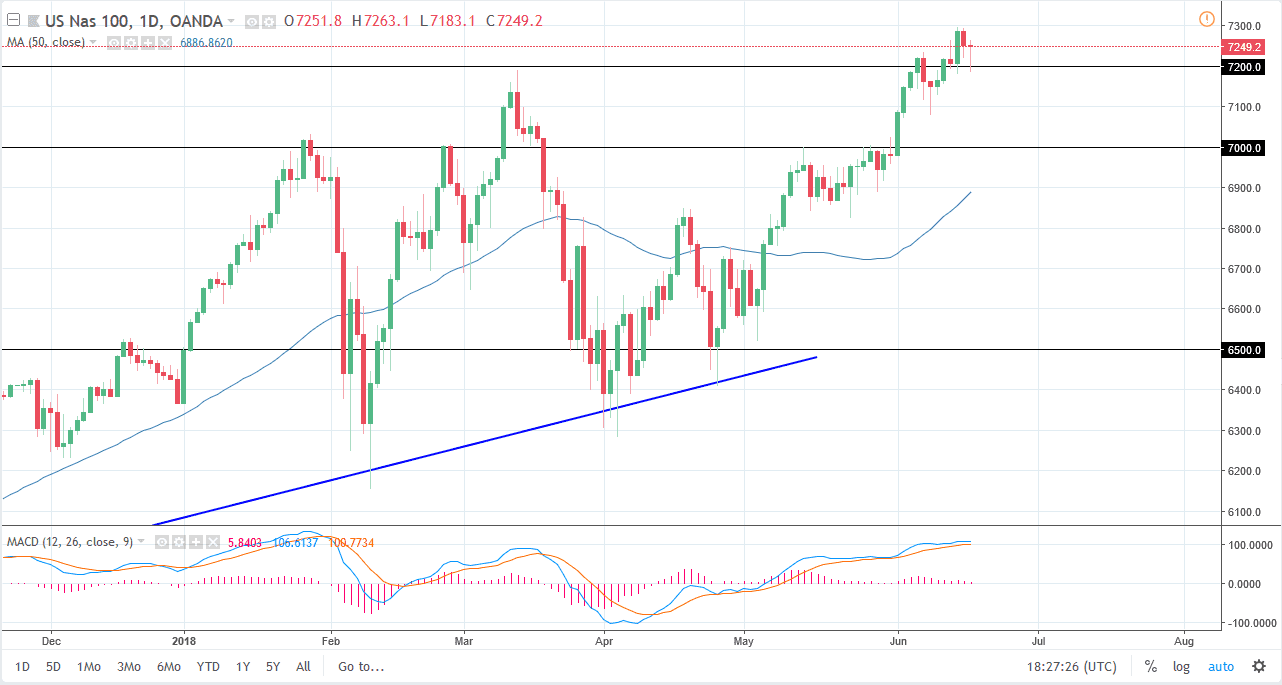

NASDAQ 100

The NASDAQ 100 initially pull back during the session as well but found plenty of support at the 7200 level to turn around of form a massive hammer. The hammer of course is a very bullish sign, and a break above the top of that candle could trigger more buying. The 7100 level underneath continues to be supportive as well, so I think at this point any pullback is probably going to be thought of as a value proposition that we can take advantage of. I believe that the overall attitude of this market remains bullish in general, so I’d be a buyer of those dips at the first signs of support. I certainly have no interest in shorting this market, it seems to be far too strong and of course the US stock markets continue to outperform many of the other ones that I follow.