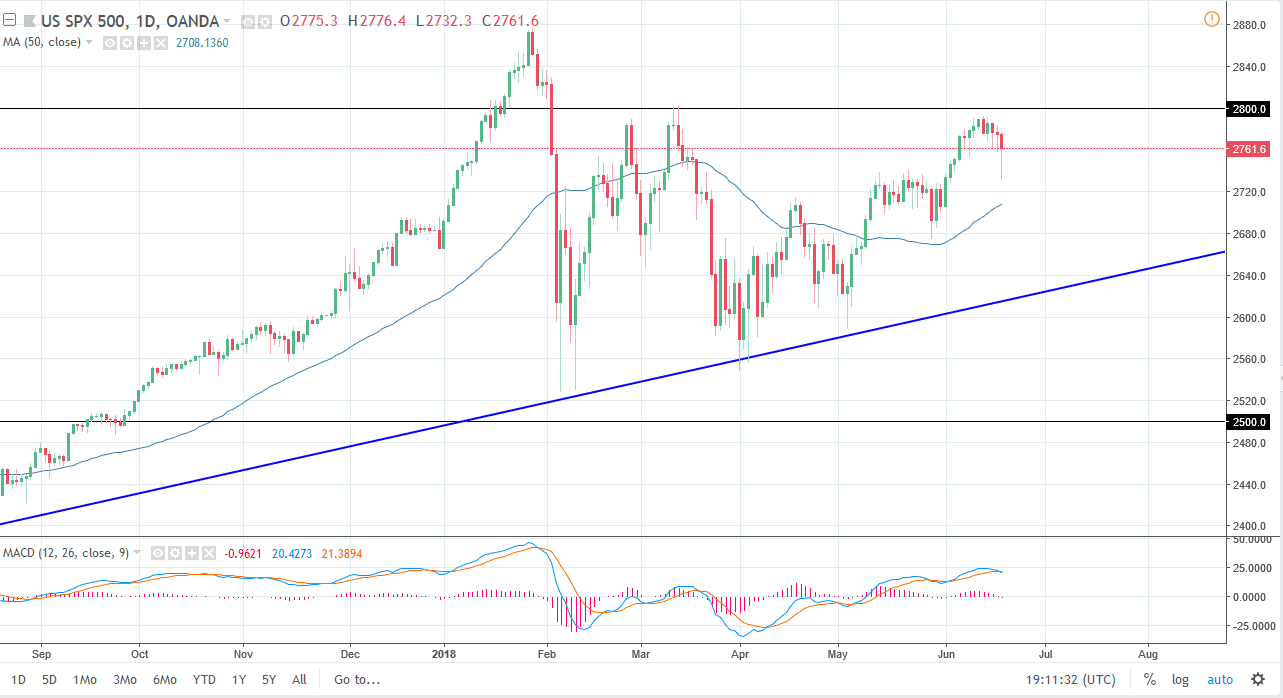

S&P 500

The S&P 500 has initially fallen during the trading session due to the Chinese tariffs, and the knee-jerk reaction of course continues to be something that people are concerned about. I think that the escalation of trade tariffs continues to have people nervous, but as you can see we have formed a massive hammer and that hammer of course is a very bullish sign and means that we will probably continue to try to break through the 2800 level. Once we do, that could be a very strong sign as it would bring in more confidence.

It now looks as if the 2725 level is offering support, and the 2700 level already has as well. The 50 day moving average is offering bullish pressure below as well, so I do think that it’s only a matter of time before we make a significant move. I look at short-term dips as value that we can take advantage of, and I think that most of the market does as well.

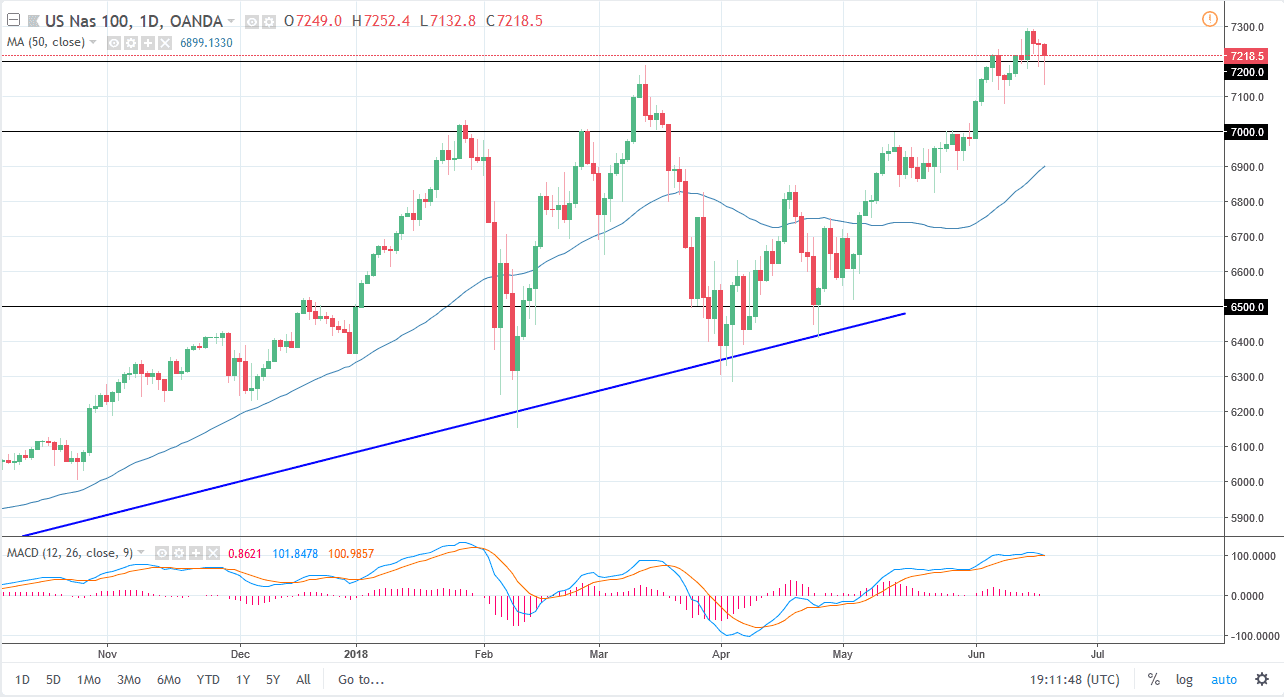

NASDAQ 100

The NASDAQ 100 broke down rather significantly during trading on Tuesday, just as the S&P 500 did. The knee-jerk reaction was very negative, but as you can see we continue to find value hunters coming into the market and picking up these little bits and pieces on these moves. It’s likely that the 7200 level will continue to be one that is important, in the beginning of significant support down to at least the 7100 level, as shown during the day. By forming a hammer the way we have, it shows just how resilient this market is, and I think we will continue to try to find reasons to go higher. At this point, I anticipate that the 7000 level underneath is essentially the “short-term floor.”