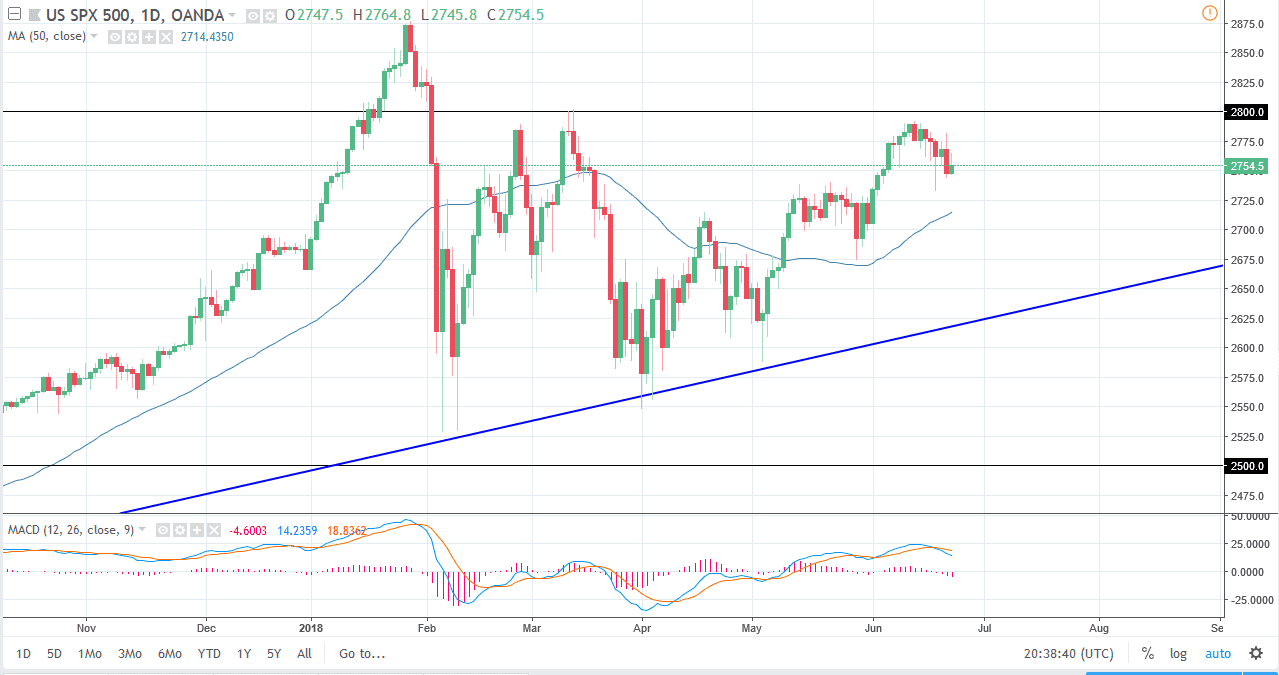

S&P 500

The S&P 500 rallied a bit during the trading session on Friday but gave back most of the gains as we could not keep up the move. It looks as if the market may go looking towards the 2750 level again, and then perhaps even lower than that. Otherwise, if we break above the top of the shooting star shaped candle from the Friday session, the market probably goes looking towards the 2800 level. If and when we break above that level, the market goes much higher. However, the meantime I think there are a lot of concerns when it comes to global trade as tariffs continue to be levied back and forth, and that of course has stock traders a bit concerned. As long as that’s the case, this will be a very choppy market to say the least.

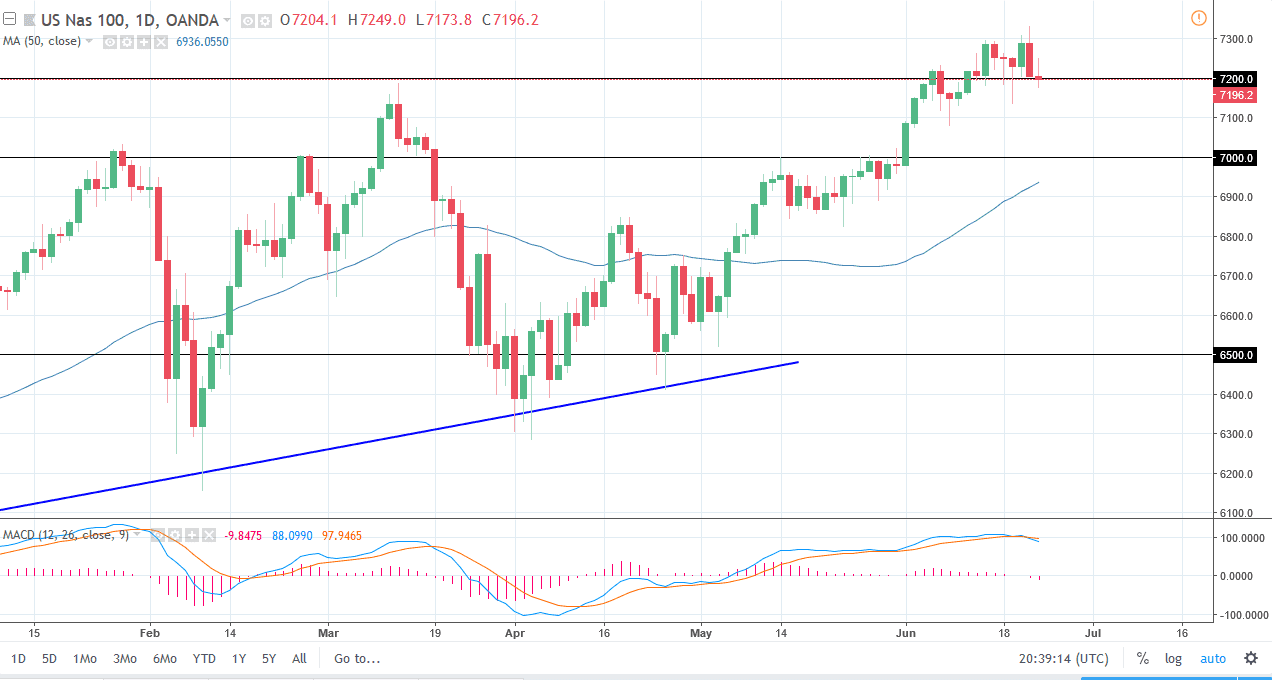

NASDAQ 100

The NASDAQ 100 also initially tried to rally during the day but gave back the gains to form a shooting star shaped candle. We are sitting on top of significant support at the 7200 level, and I think that support runs down to at least the 7100 level. Beyond that, 7000 should also offer a certain amount of psychological support as well, so I think if we do fall from here, it’s a buying opportunity on this pullback. I think that the market will continue to go higher over the longer-term, but we need to get past these trade spats, and as a result I think it’s likely that we will very noisy in the short term. I would look for signs of support underneath, but in the meantime I think you may want to step out of the way of what is probably going to be a move to the downside.