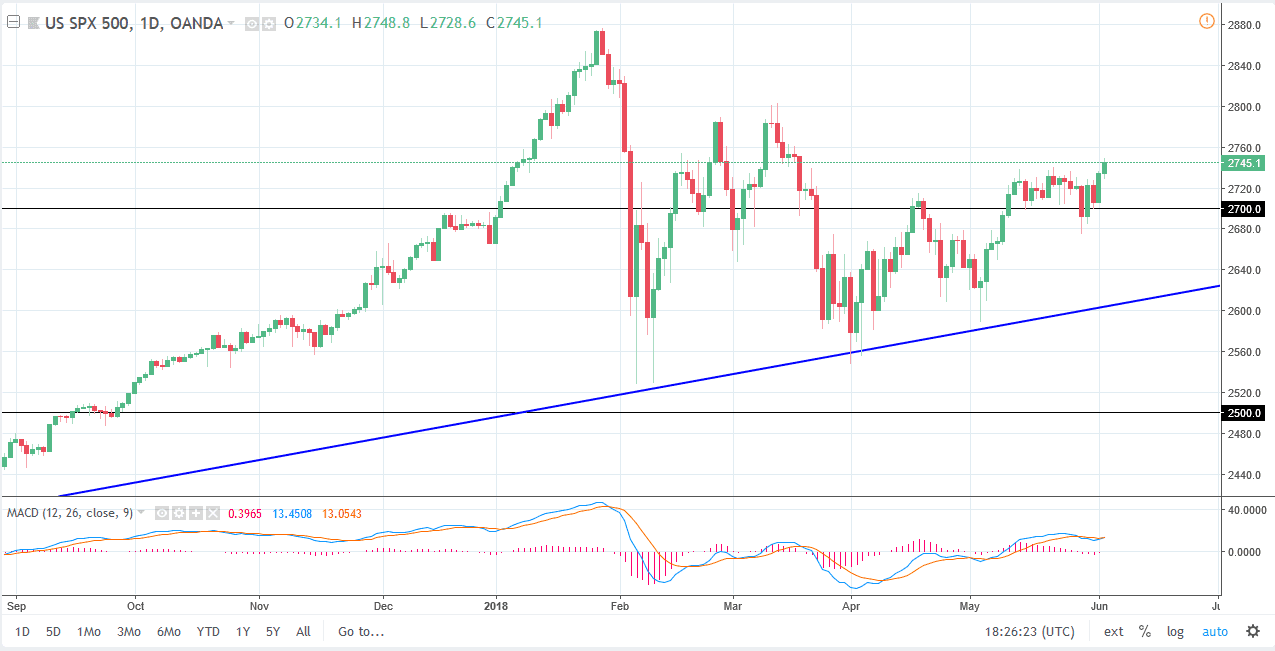

S&P 500

The S&P 500 rallied a bit during the trading session on Monday, breaking above the 2740 handle. This is a market that should continue to go higher based upon breaking out of this consolidation area, and I think that the market could go to the 2800 level. The 2800 level has been resistance in the past, so it makes sense that we will probably continue to test that area. The uptrend line underneath should continue to offer support, and I think that it’s only a matter of time before the buyers take control again. Ultimately, I do think that this market could go to the 3000 level but it’s going to take quite a while before that happens. This is likely going to be one of those markets that you should continue to find buyers on dips as we have seen so much in the way of tenacity.

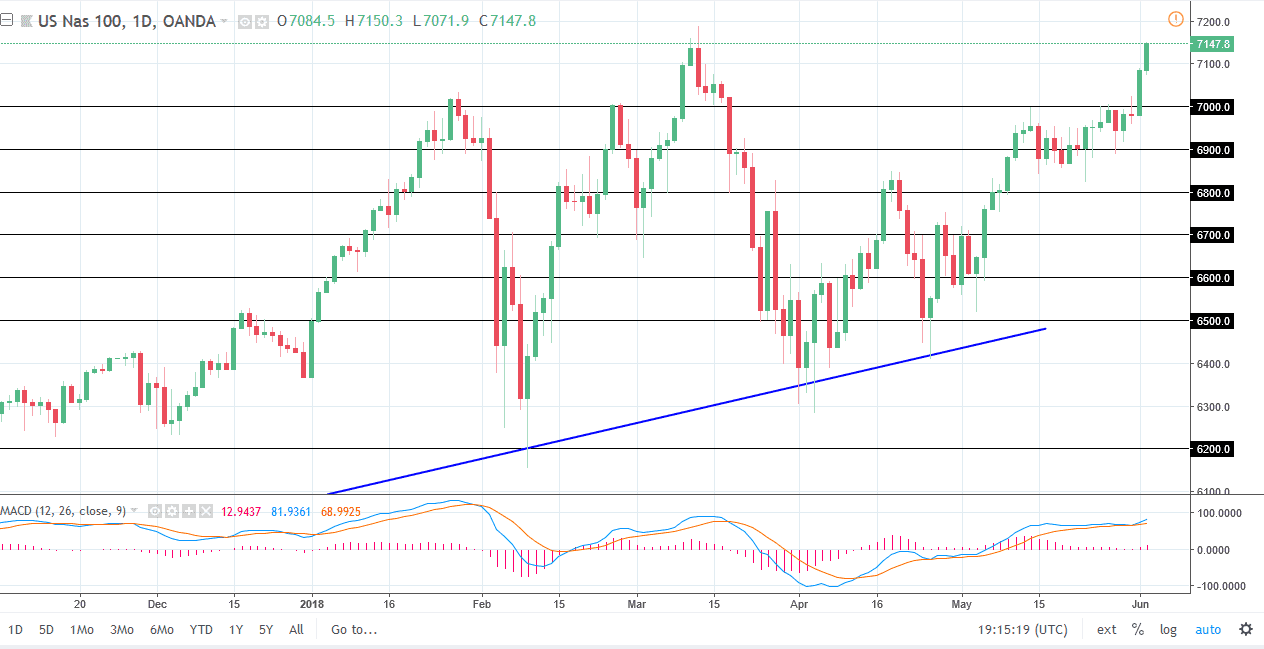

NASDAQ 100

The NASDAQ 100 has broken out to the upside again, clearing the 7100 level now. It looks as if it’s only a matter time before we break above the 7200 level, and then continue to go even further. I believe that short-term pullbacks should continue to offer plenty of buying opportunities and I think that the 7000 level underneath will be the “floor” in the market. I think that if we can stay out of trade wars, and that there isn’t an escalation of rhetoric, I believe that this market should continue to find plenty of reason to go to the upside. If the US dollar softens a bit, that also helps stock markets in general. I think that the NASDAQ 100 should continue to go much higher, perhaps dragging other indices higher as it seems to be a bit of a leader.