Last Thursday’s signals produced a losing long trade from the bullish price action at 0.9810.

Today’s USD/CHF Signals

Risk 0.75%.

Trades must be entered between 8am and 5pm London time today, over the next 24-hour period only.

Short Trades

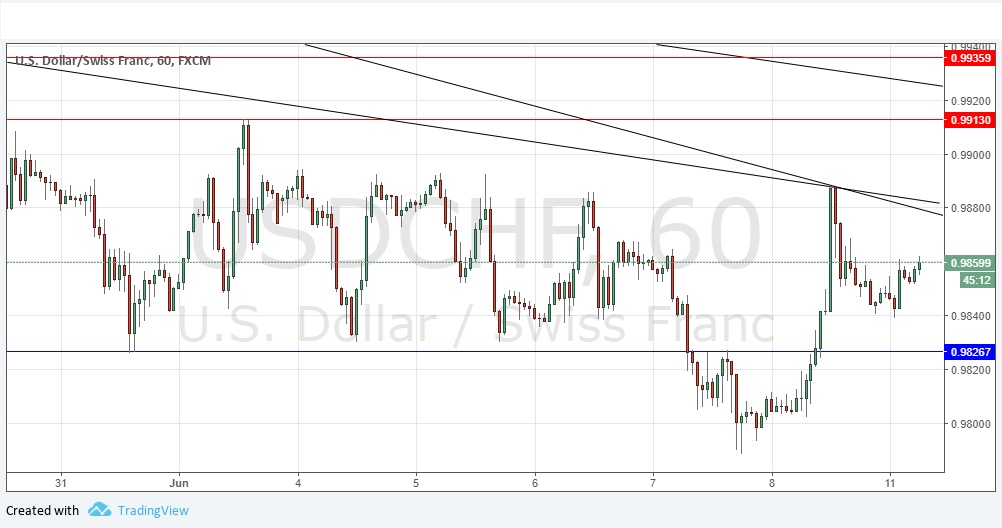

Short entry following a bearish price action reversal upon the next touch of 0.9913 or 0.9936.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.9827.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/CHF Analysis

I wrote last Thursday that retracements to the areas of resistance starting at about 0.9880 will remain the best trade opportunities in this pair. This has turned out to be correct. The price action has retained a generally bearish pattern with the price being slowly pushed down by the resistance levels and trend lines which form a zone of confluent resistances between 0.9900 and the parity level at 1.000. It is a very slow-moving downwards trend. There has also been a new development with some more strongly bullish price action printing new support at 0.9827, and it looks like the start of a bullish pattern. This means that I am now very doubtful about the gentle bearish bias I had and would step aside from trading this pair for a while until the picture becomes clearer.

There is nothing due today concerning either the CHF or the USD.