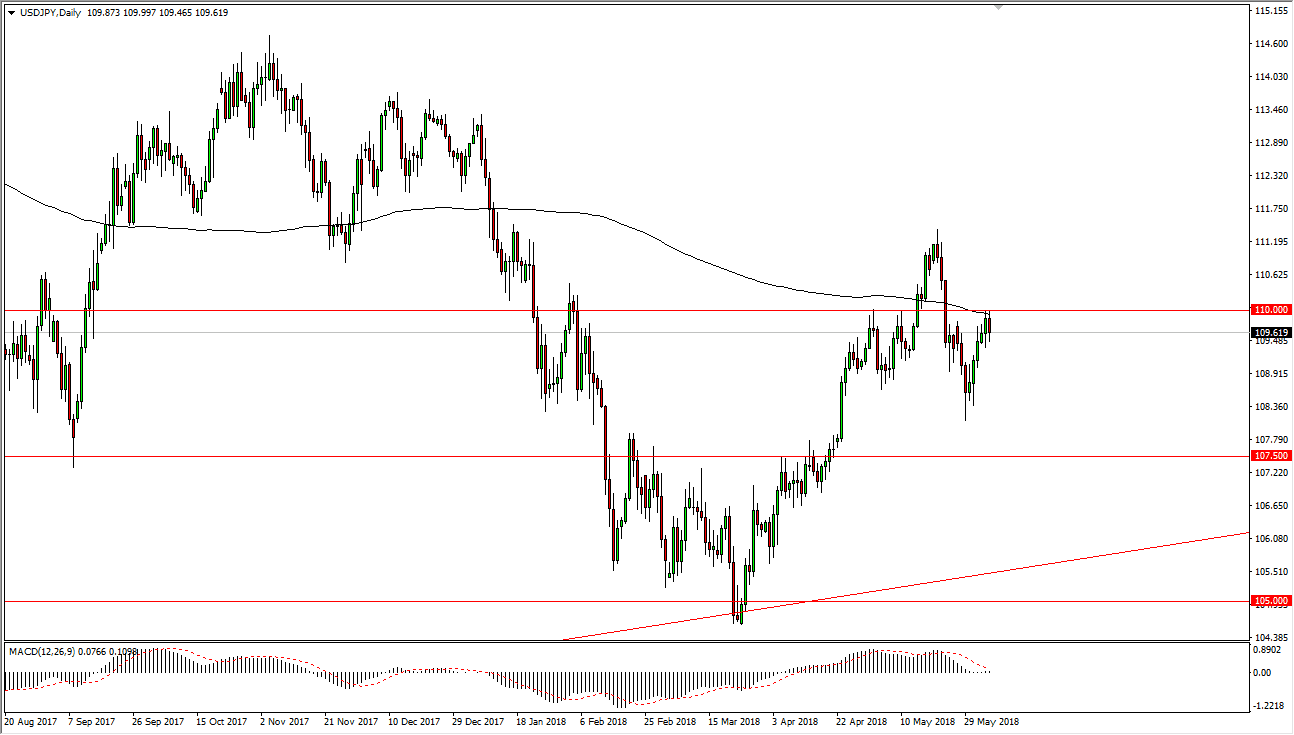

USD/JPY

The US dollar has fallen a bit during the trading session on Tuesday, as the 200 day estimate came into play. Beyond that, we also have the ¥110 level offer and resistance, so I think it’s only a matter time before you break out above there. Assuming we do, the market is likely to rally quite a bit, but I think it could I think a lot of momentum to get it going. I think in the short term, you can look at this market is one that is likely to be very range bound, and I think that short-term pullbacks could be buying opportunities for value hunters. Eventually, I think we go looking towards the ¥114 level, but that could take some time. Currently, I look at the ¥107.50 level as the “floor” in the market.

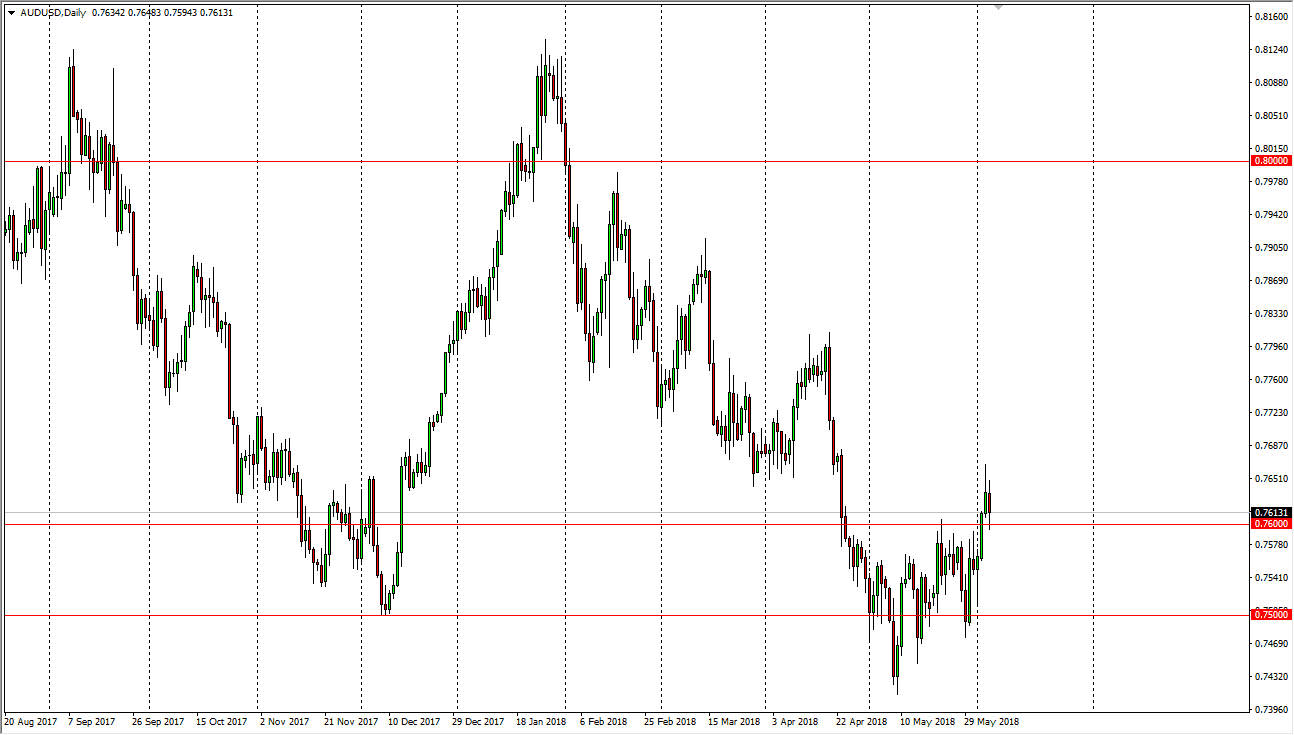

AUD/USD

The Australian dollar has initially tried to rally during the session, but then turned around to test the 0.76 level for support. I think that the market will ultimately find reasons to buy this market, mainly because we have seen so many hammers on the weekly chart, suggesting that the 0.75 level is in fact going to be a major support level. I think that it’s only a matter time before we go looking towards the 0.78 level, but it is probably going to be very choppy along the way. If you are cautious and patient enough, you should be able to take advantage of this move, assuming that we continue to get more of a “risk on” attitude. Otherwise, we could revisit the 0.75 level where there is an extraordinarily large amount of buying pressure. If we were to break down to a fresh, new low I think this market would unravel.