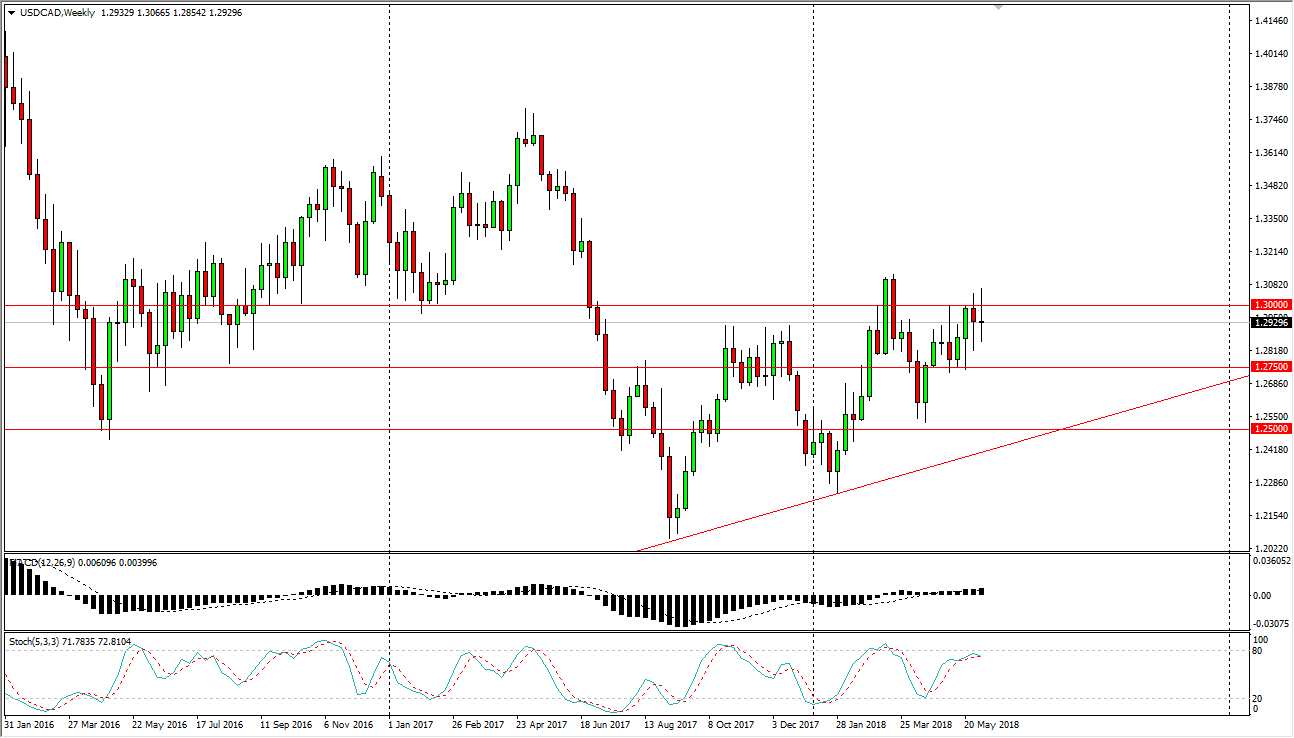

USD/CAD

The US dollar was very noisy against the Canadian dollar during the week as we pressed the vital 1.30 level. It was difficult to break above, which isn’t much of a surprise as it is such a large come around, psychologically significant number. The resulting candle was basically and unchanged week, and because of this I suspect that we are going to continue to see a lot of sideways action. Range bound short-term trading will probably continue to be how this pair behaves.

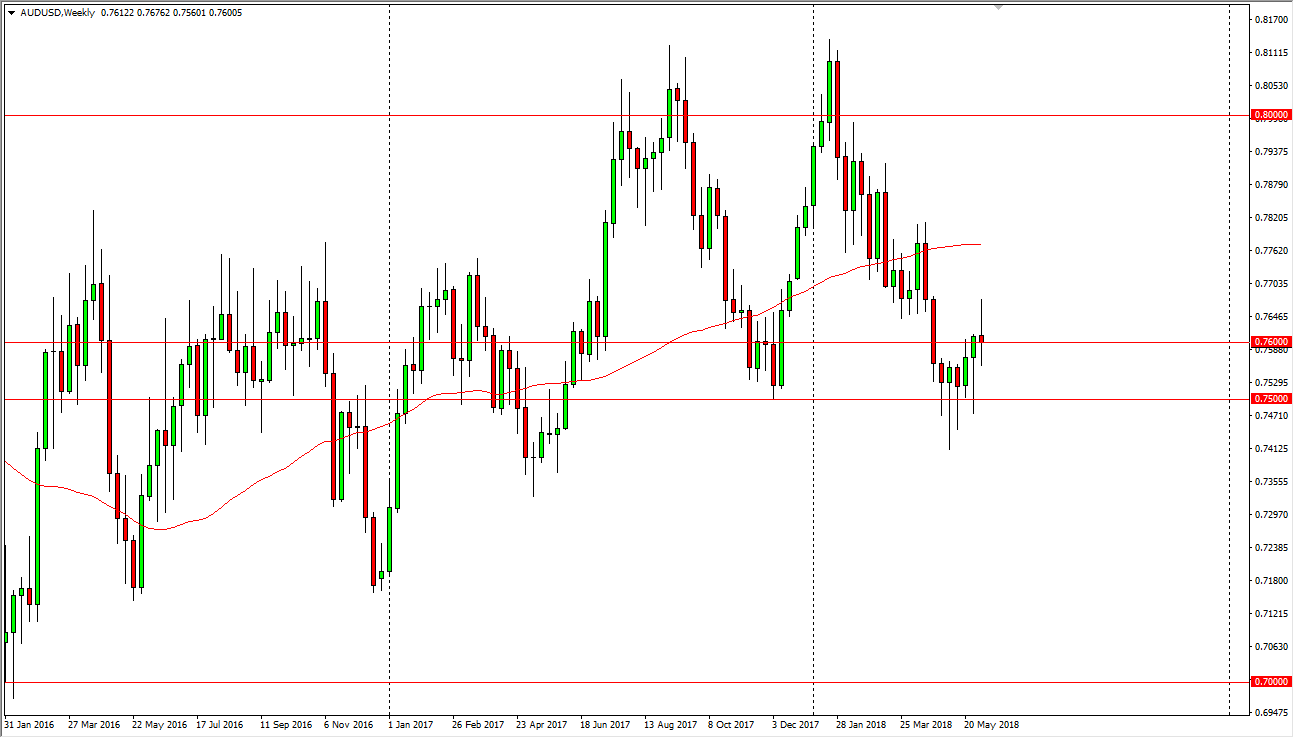

AUD/USD

The Australian dollar was volatile as well and ended up forming a bit of a shooting star to close out the week. It is preceded by several hammers though, so I think it’s likely that a pullback will be looked at as a buying opportunity for value hunters, but it might be a bit sideways in the short term with a slightly upward proclivity. The 0.75 level seem to attract a lot of attention.

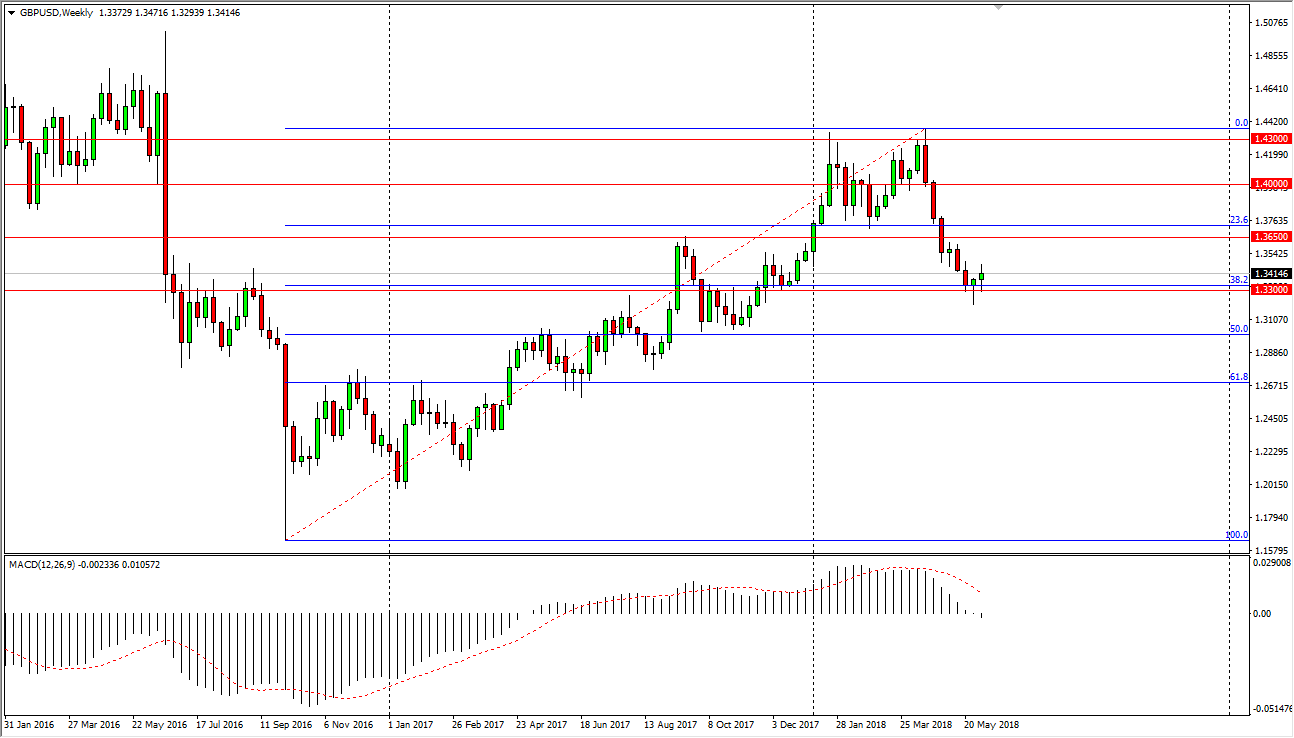

GBP/USD

The British pound has been very noisy during the week, testing the 1.33 level underneath before bouncing rather significantly. The market ended up forming a neutral candle, but the fact that we had formed such a perfect hammer the week before and at a perfect spot tells me that there is a lot of buying pressure underneath. I look at short-term pullbacks as buying opportunities and what will probably be more of a grind higher. However, if we break down below the bottom of the weekly candle from the previous week, that would be very negative indeed and send this market looking towards 1.30 level below.

EUR/USD

The EUR/USD pair rallied during most of the week but did get back quite a bit of the gains. Much like the British pound, we did end up forming a hammer at the perfect spot, and I think we are going to go higher, especially if the ECB says on the 14th that they are looking to get away from quantitative easing. Short-term dips should offer value.