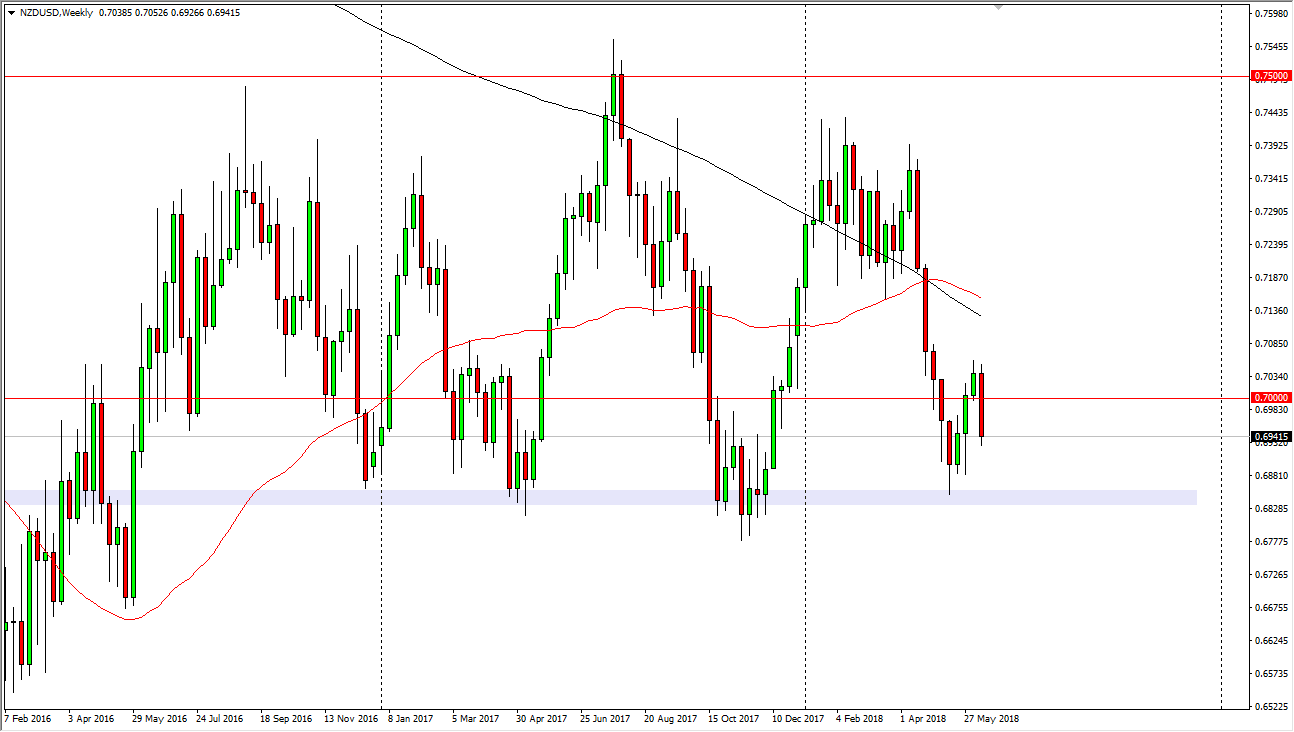

NZD/USD

The New Zealand dollar took a bashing this past week and has certainly turned a bit bearish. Because of this I think that we will more than likely go towards the 0.68 level again, an area that has been important more than once. I believe that this market may go looking towards the 0.68 level underneath, which is the scene of a major support based upon longer-term charts. If we can break down below there, the market should continue to go lower. Overall, I believe that it’s not until we break above the 0.7050 level that we could be comfortable buying again.

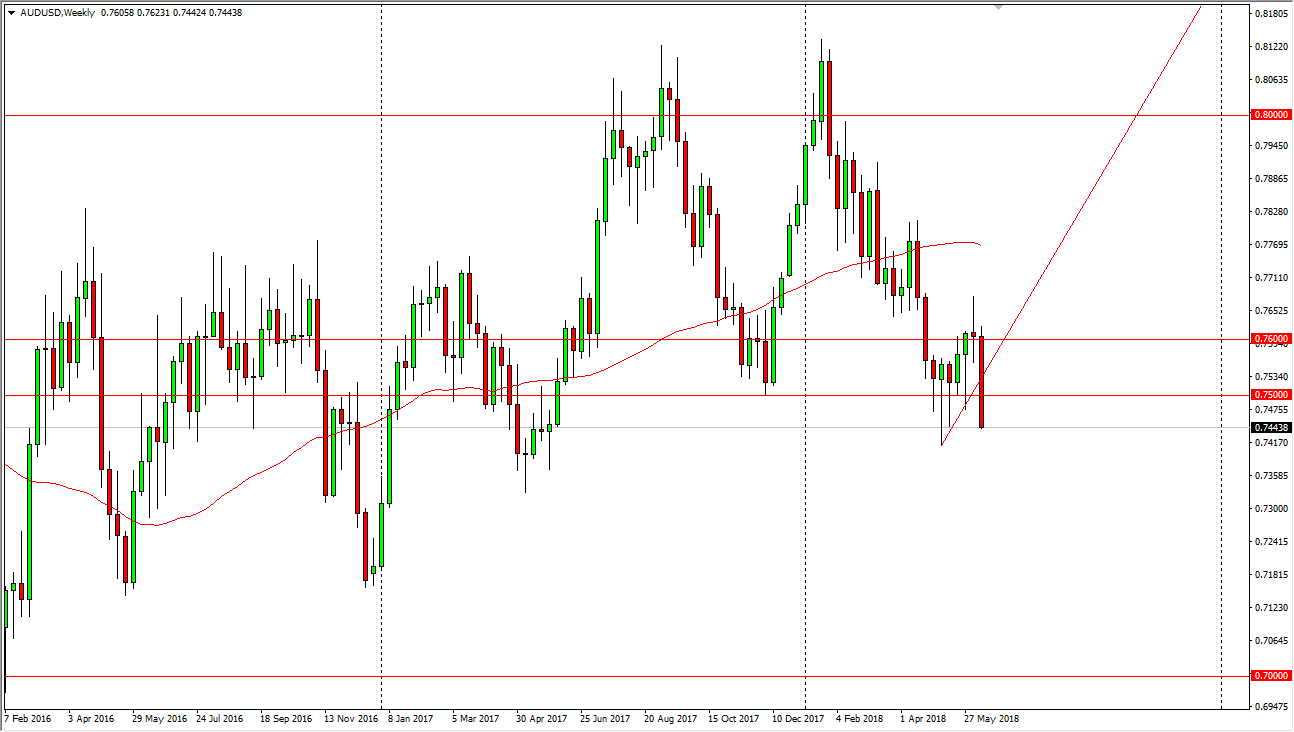

AUD/USD

The Australian dollar has broken down rather drastically during the week, slicing through the 0.75 level and closing at the bottom of the range. It looks like the market is ready to continue to go towards the 0.74 level, and then possibly the 0.7350 level again. I think at this point, rallies in this market should be looked at with suspicion, and I think it’s only a matter of time before the sellers will return on the first signs of exhaustion.

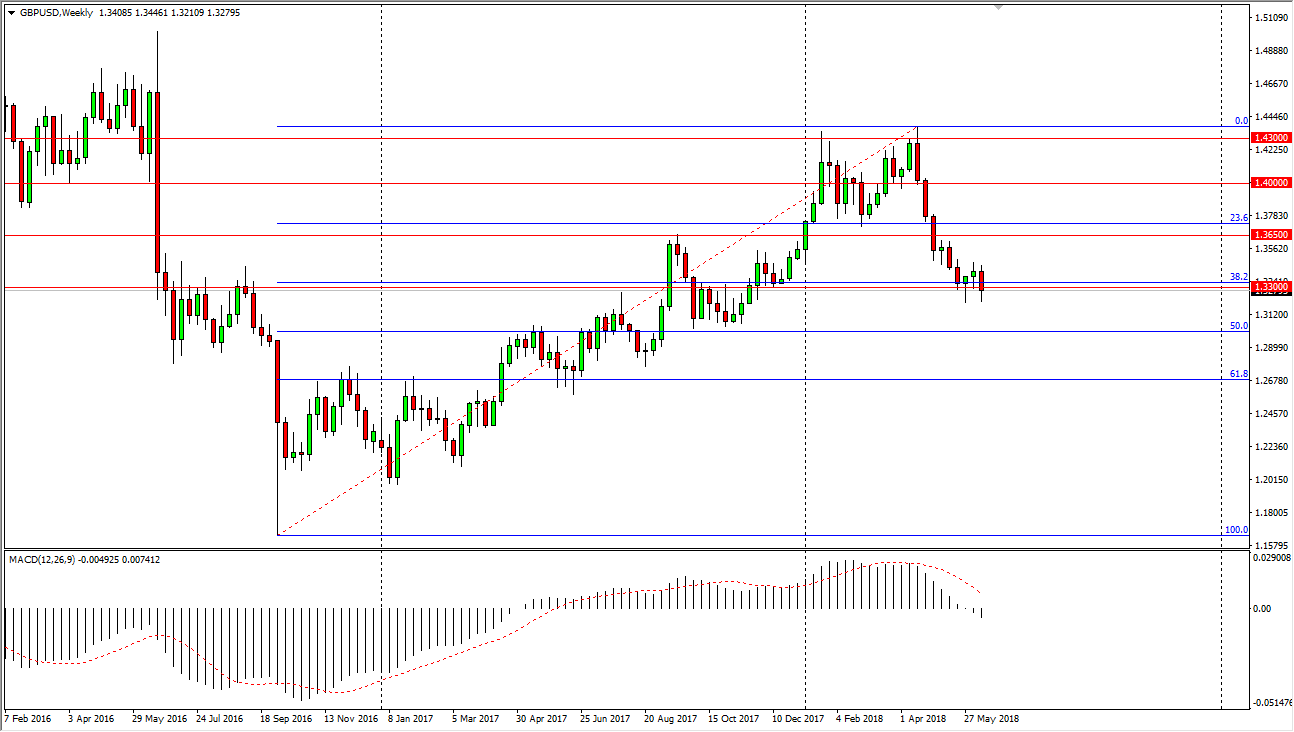

GBP/USD

The British pound has been very noisy during the week as well, initially trying to rally but then broke down significantly. I think that the market continues to go lower, and a break down below the hammer from a couple of weeks ago frees the market to go down to the 1.30 level. Otherwise, if we can break above the top of the range for the week, then I believe the buyers are going to try to push this market towards 1.35 handle.

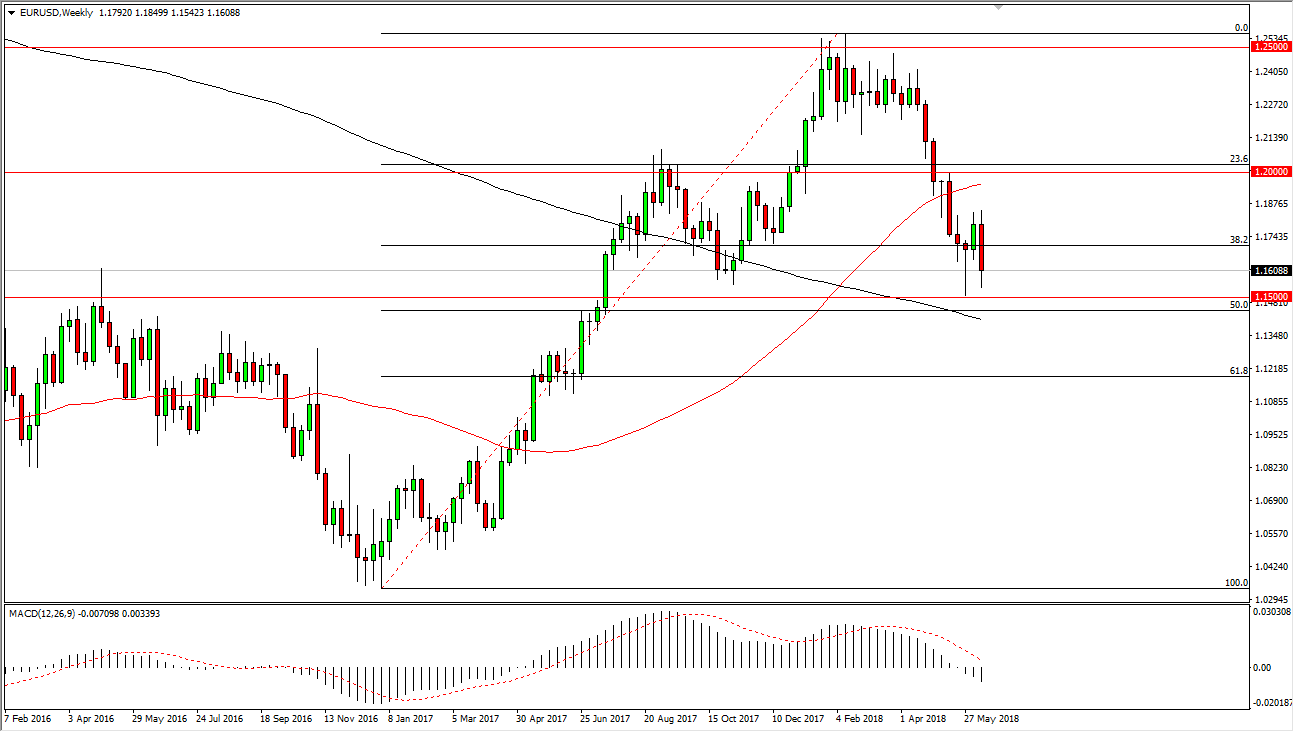

EUR/USD

The EUR/USD pair initially tried to rally during the week but then broke down significantly as the ECB pushed back the idea of interest rate hikes until the middle of 2019, so I think that the market will continue to favor the US dollar overall, at least in the short term. I believe that the 1.15 level will continue to be massive support, and if it gives way that would be a very negative turn of events.