USD/CAD

The US dollar has rallied significantly during the week against the Canadian dollar but gave back much of the gains on Friday as oil rallied. When I look at this chart, I recognize that there is a certain amount of bullish pressure, but I think that if we get a pullback, that would not be a surprise either. I anticipate that somewhere near the 1.32 level buyers would return to this market.

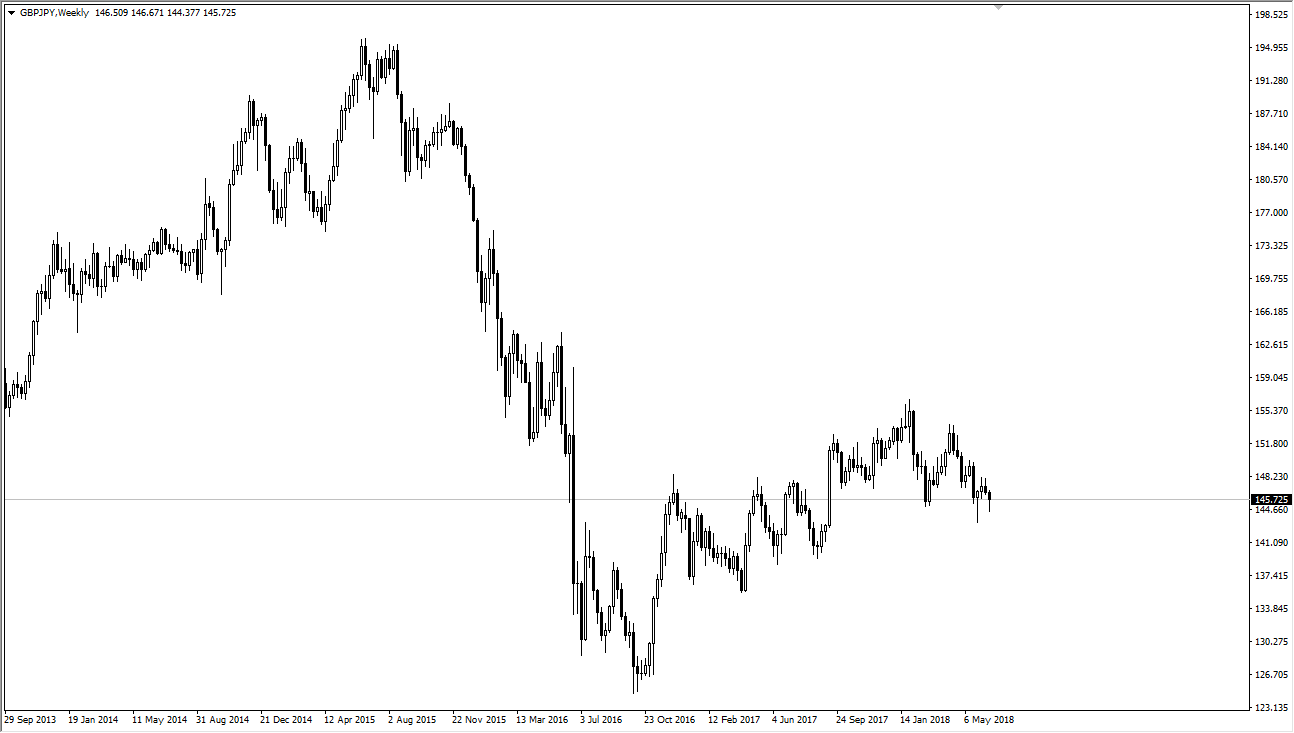

GBP/JPY

The British pound fell during most of the week against the Japanese yen but did find buyers near the ¥145 level. As we have formed a hammer on the weekly chart, and it is also an area that has previously formed hammers. I think that given enough time, the market probably rallies from here and goes looking towards the ¥150 level above. If we were to break down below the range for the week, that would be very negative, and could send this market looking towards ¥140 level. Keep in mind that this pair is very sensitive to risk, so if we have a sudden move and risk appetite, that will drive where we go next.

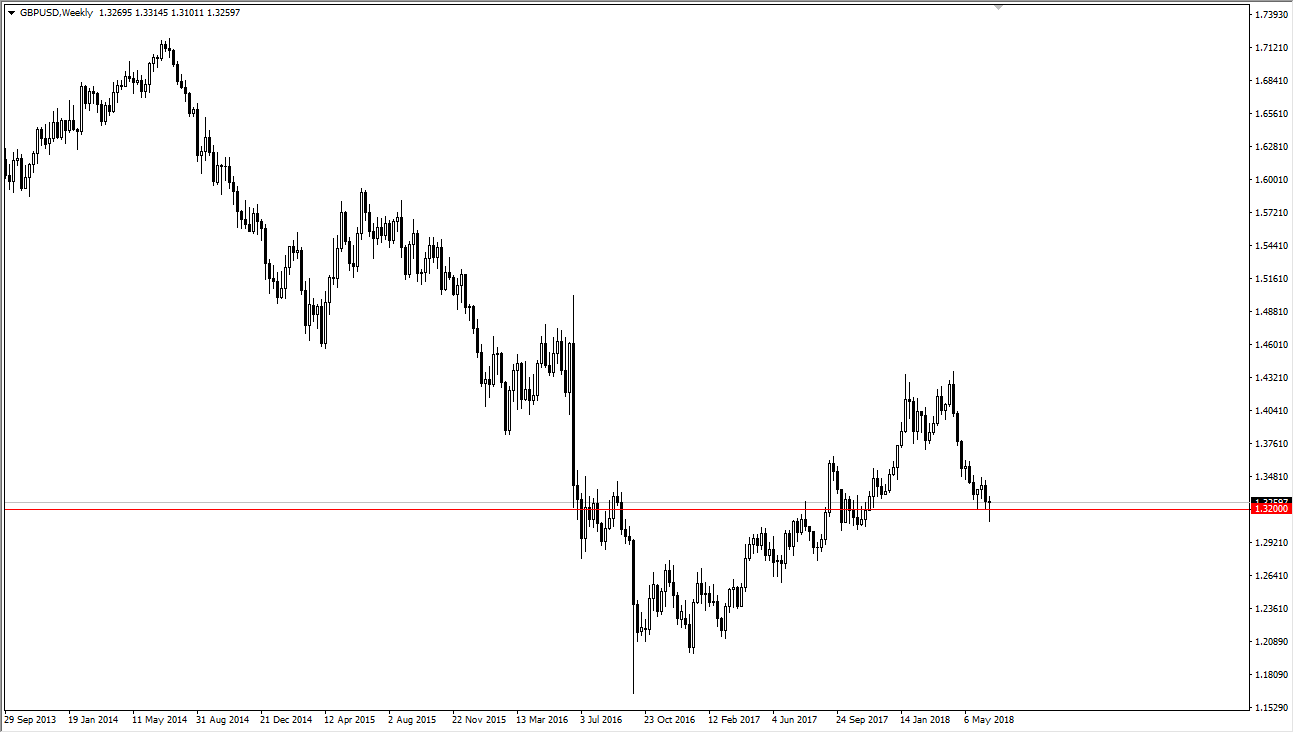

GBP/USD

The British pound fell during the week against the US dollar as well but found plenty of support underneath the 1.32 level as the Bank of England was a bit more hawkish than expected in its statement. Because of this, I think that we are going to see buyers jump into this market, and a break above the 1.33 level will probably send buyers in the markets with fresh money. If we break down below the bottom of the hammer for the week, that would be very negative and could send the market looking towards the 1.30 level.

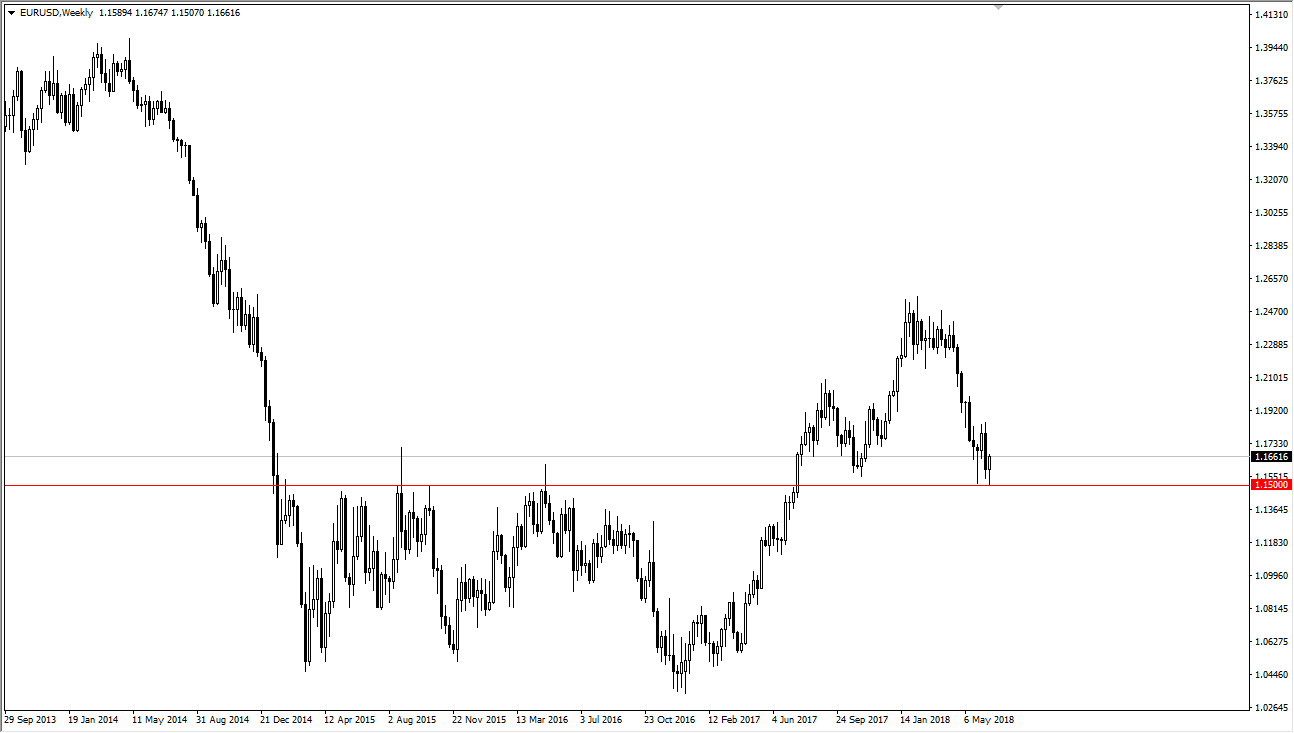

EUR/USD

The Euro fell during most of the week as well but found enough support near the 1.15 level to turn around of form a bit of a hammer. I think that we could bounce from here and continue to go higher, as tensions have calm down a bit in the trade front. The 1.15 level is massive support, so it's very likely buyers will continue to look for value in that area.