Gold prices settled at $1298.51 an ounce on Friday, rising nearly 0.44% over the course of the week, as safe-haven demand rose on geopolitical tensions. The dollar came under pressure after the euro climbed on expectations that the European Central Bank will discuss whether to end bond purchases later this year at its June 14 policy meeting. World stock markets were mixed last week. European stock markets were mostly lower amid the uncertainty caused by the political situation in Italy. U.S. stocks posted weekly gains on better-than-expected economic data.

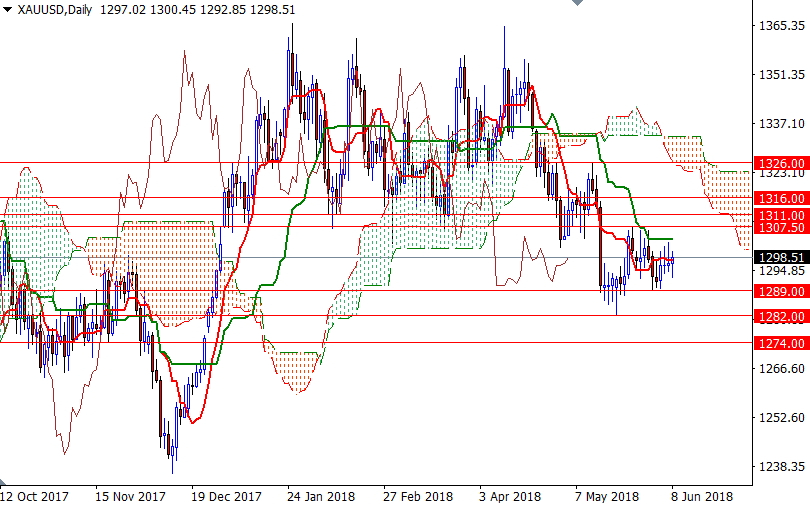

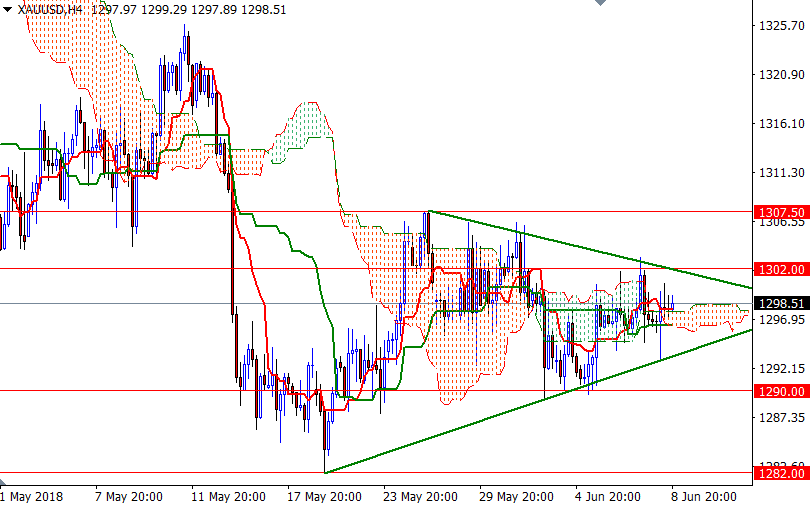

The prospect that the Trump administration could be moving toward an even greater protectionist trade policy is likely to be supportive for gold at the beginning of the week. However, safe-haven gains may be limited in the current environment, with the U.S. Federal Reserve set to hike interest rates this week. The gold bears still have the slight overall near-term technical advantage but are fading and need to show fresh power soon to maintain control. Another thing to pay attention is the weekly and the daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) that are completely flat.

If the market sees a bullish upside breakout from a sideways trading range and manages to hold above 1307.50 on the daily chart, gold should be able to test 1311 and 1318/6. A successful break above 1318 implies that bulls are getting ready to challenge the key resistance at 1326. The bulls have to produce a daily close above 1326 to tackle the next barrier in the 1333/1 zone. To the downside, the initial support sits in 1290/89, followed by 1286. A break down below 1286 opens up the risk of a drop to 1282/1. If this strategic support is broken, the market will be targeting 1277/4. The bears will need to push prices below 1274 to make an assault on 1270.