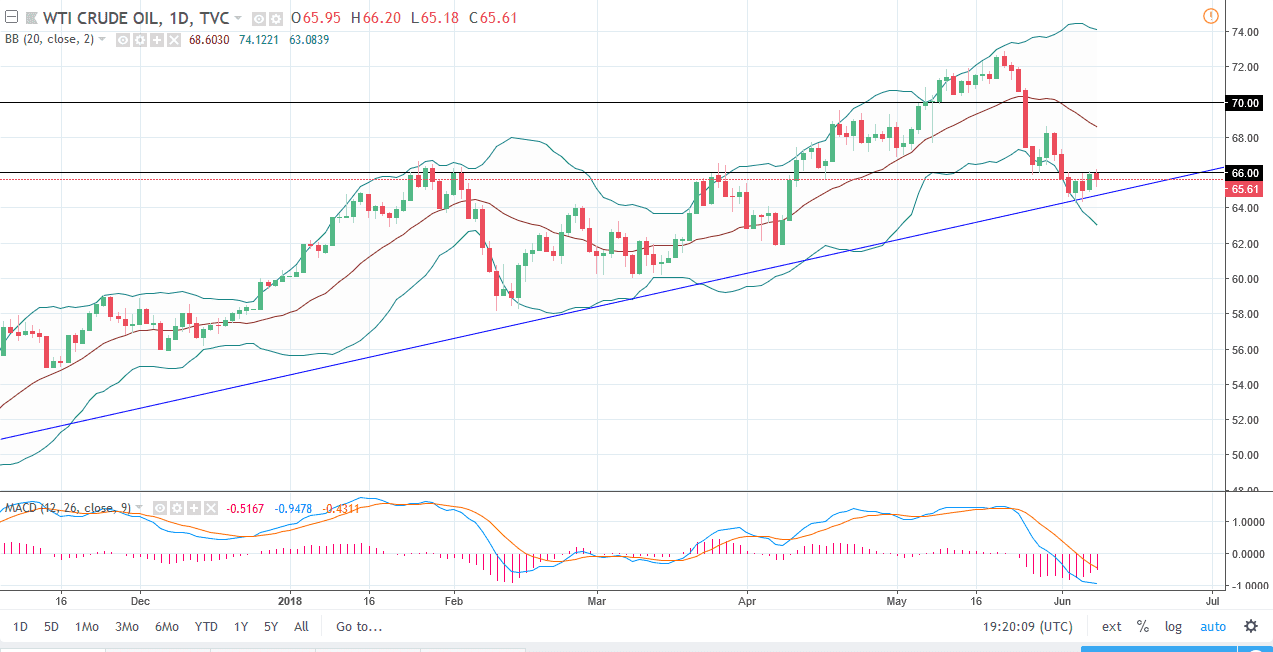

WTI Crude Oil

The WTI Crude Oil market lost 0.4% during the trading session on Friday but remained supportive just below by an uptrend line. At the end of the day, we had formed a hammer, which of course is interesting considering that we are pressing up against the major area. I think the $66 level is crucial, but if we can break above the top of the range for the Friday session, the market could very well find itself going to the $60 level next. Of course, the alternate scenario is that we break down below the lows of the week on Wednesday and continue to go towards $60. For what it’s worth, the weekly candle stick was a hammer, which of course is very bullish. With this in mind, it looks as if we could get a bit of a bounce.

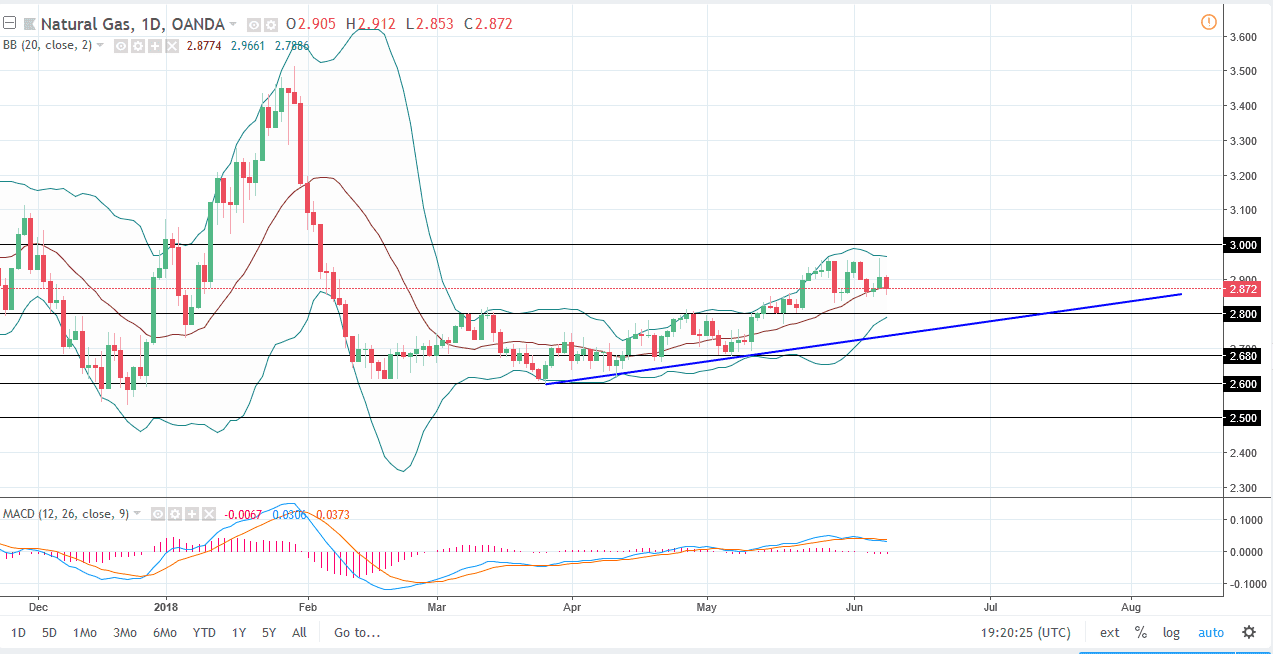

Natural Gas

Natural gas markets fell during the Friday session after forming a shooting star on Thursday. It’s obvious to me that we have a significant amount of resistance between the $2.95 and the $3.00 level, so I think that rallies will continue to sell off. We are currently consolidating in general after a nice move higher, but I think eventually we will break down and look towards the $2.80 level. There is an uptrend line to contend with, but when you zoom out look at the longer-term charts we are still very much in consolidation, and that consolidation goes back much further than the uptrend. With this in mind, we are towards the top of the consolidation, so I think that rallies continue to be looked at with suspicion. Exhaustion in the market looks likely to bring in more sellers.