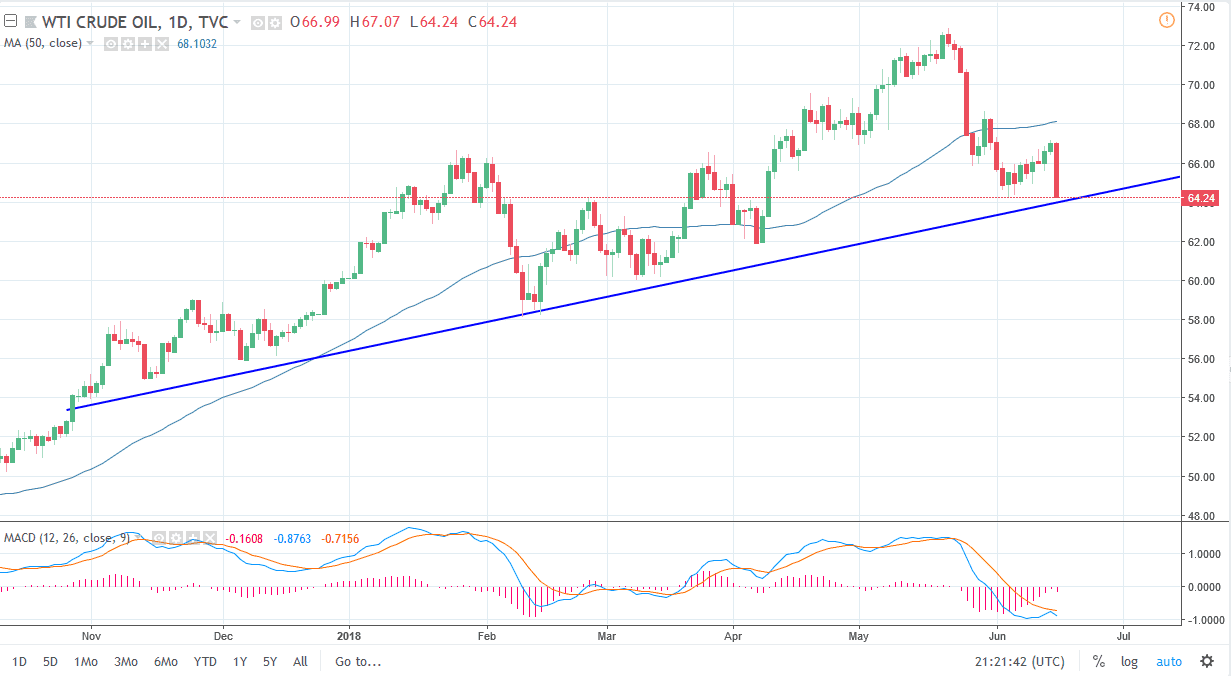

WTI Crude Oil

The WTI Crude Oil market fell apart during the day on Friday, losing over 4% in closing that the absolute lows. This is a horrific looking candle that is sitting on top of a major trendline. The fact that we closed at the very bottom of the range for the day tells me that the market is very likely going to continue. It appears that OPEC could increase production, and if they do that will bring a lot more supply onto the marketplace. The simple law of supply and demand should continue to drive this market down, and if we continue the bearish pressure, breaking below the uptrend line at essentially the $64 level, the market will unwind to the $62 level, and then the $60 level. I rally at this point would be very suspicious and difficult to put a lot of faith in.

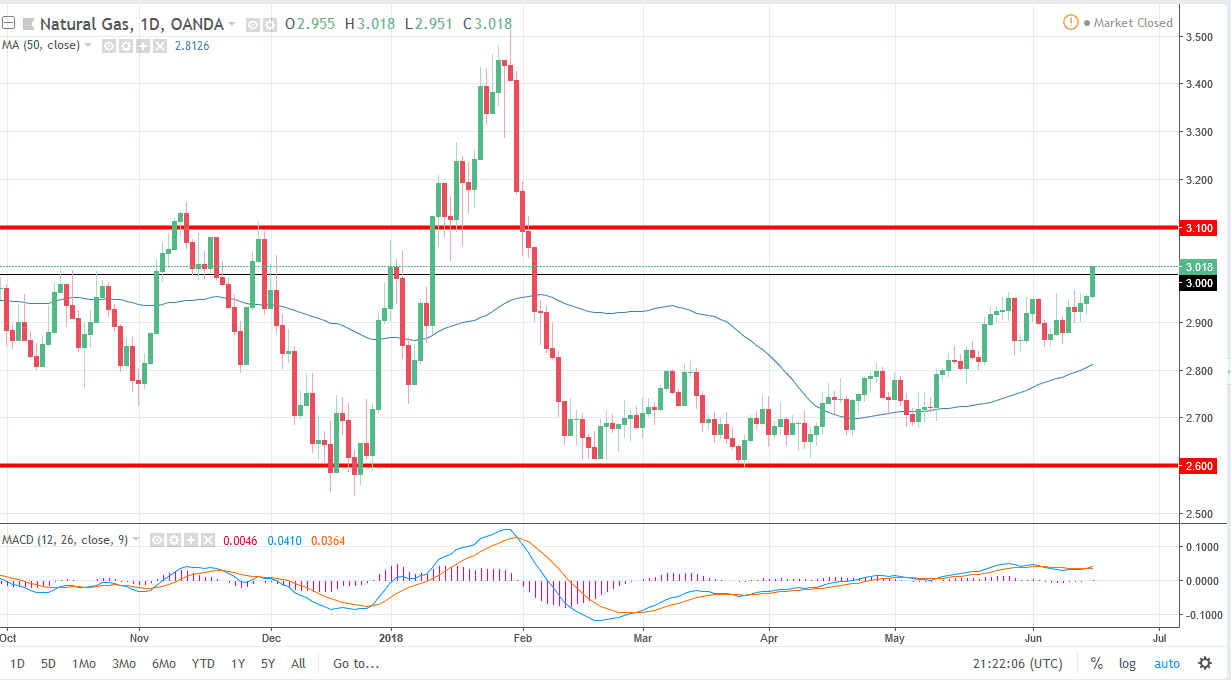

Natural Gas

Natural gas markets rallied significantly during the trading session, breaking above the $3.00 level. The fact that we have broken above there is a very bullish sign and it looks like we could go towards the top of the larger consolidation region, going to the $3.10 level. I think that an exhaustive candle on the daily chart should be a nice selling opportunity, but if we were to break above the $3.10 level, that would be extraordinarily bullish and could send this market as high as the $3.40 level. If we fall from here, I suspect that the $2.96 level will continue to offer support based upon the previous resistance, but I do think eventually the sellers come back as we have an oversupply of natural gas longer-term in places like the United States and Canada.