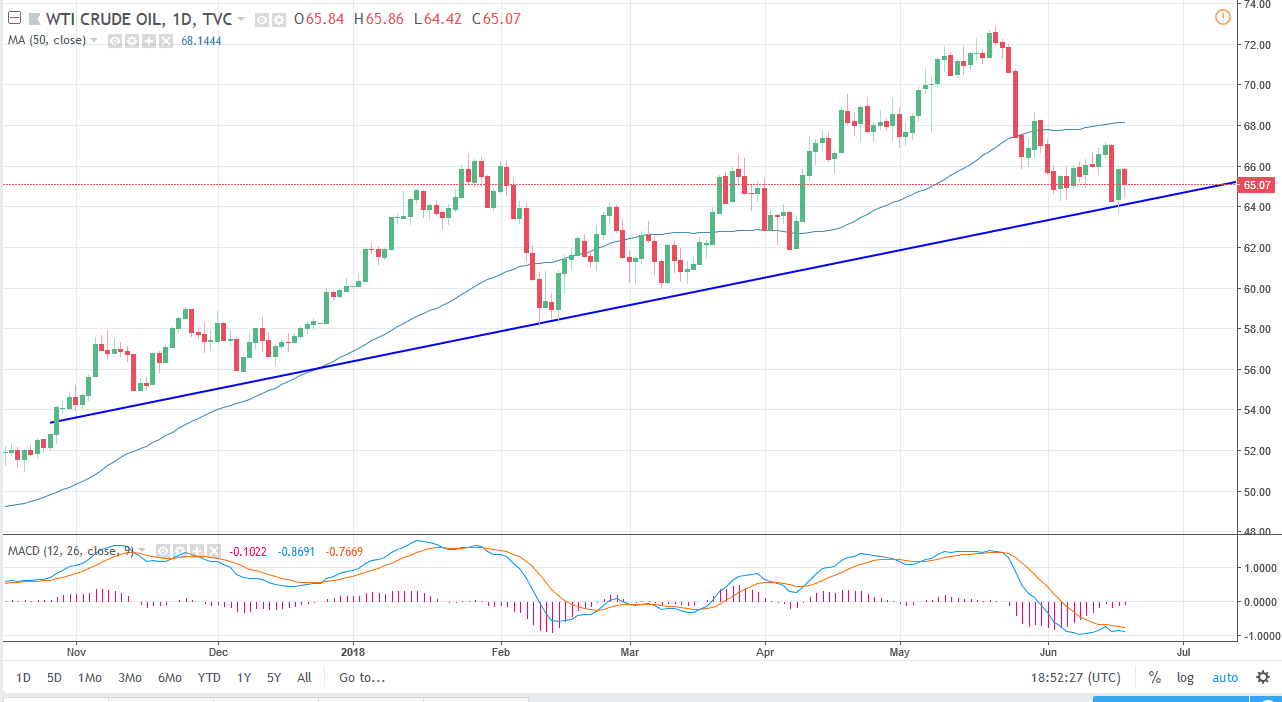

WTI Crude Oil

The WTI Crude Oil markets have been noisy during the trading session again on Tuesday, as we have tried to wipe out the gains from the Monday session. We are currently consolidating and walking along the uptrend line, and I think that should continue to be the case as we await the results of the OPEC meetings at the end of the week. It becomes obvious when looking at this chart through the prism of the daily timeframe that the $64 level is where we see a lot of support. If we were to clear that area, the market probably unwinds down to the $62 level. However, I suspect that over the next couple of days what we are going to be looking at is a lot of back and forth choppiness and scalping in both directions as we await an announcement as to whether OPEC will continue the production cuts.

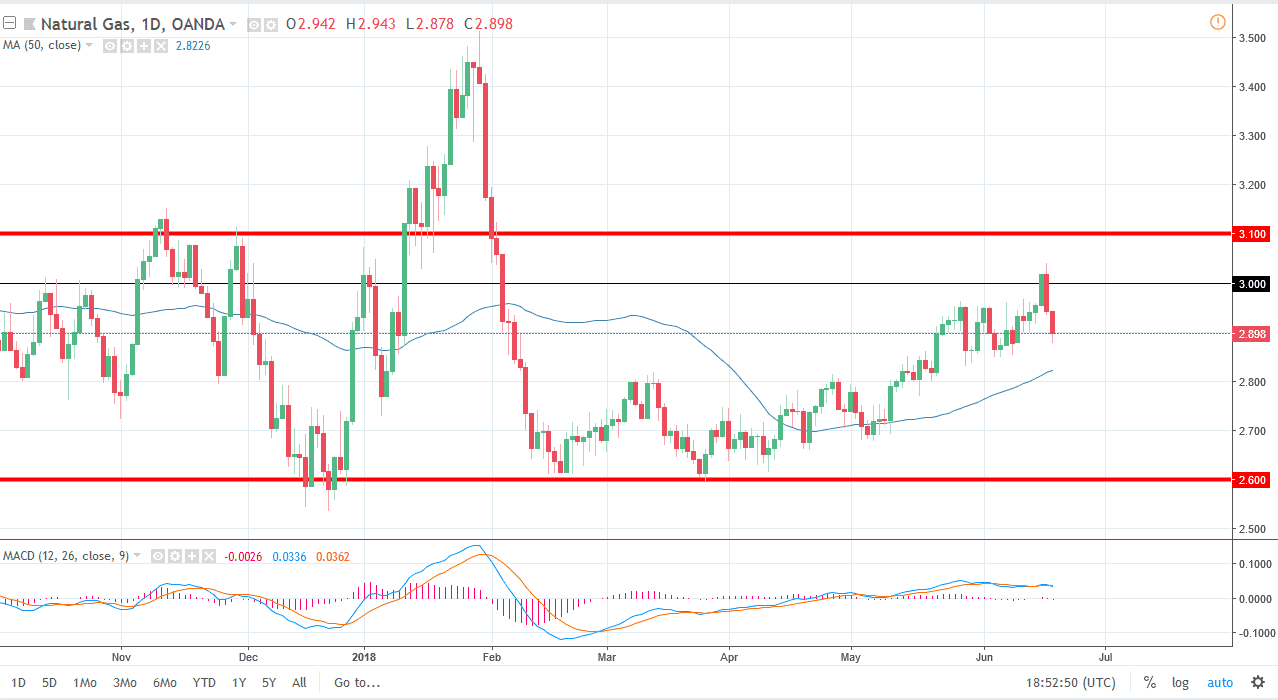

Natural Gas

Natural gas markets fell rather hard during the day on Tuesday, breaking below the $2.90 level. We did bounce from below there though, so it’s likely that the market will continue to be very noisy, but the last couple of days have shown just how resistive the $3.00 level is. As you can see on the chart, I have a thick redline above there at the $3.10 level, and for me it looks as if that’s a significant resistance region. I believe that signs of exhaustion on rallies will be sold now, and if we can break down below the $2.85 level, the market will more than likely go down to the $2.80 level next.

As temperatures have cooled off a bit in the United States, that drives down a bit of the demand for the commodity. Remember, this market tends to focus on short-term events more than anything else, and because of this I think we will see the sellers return on short-term bounces.