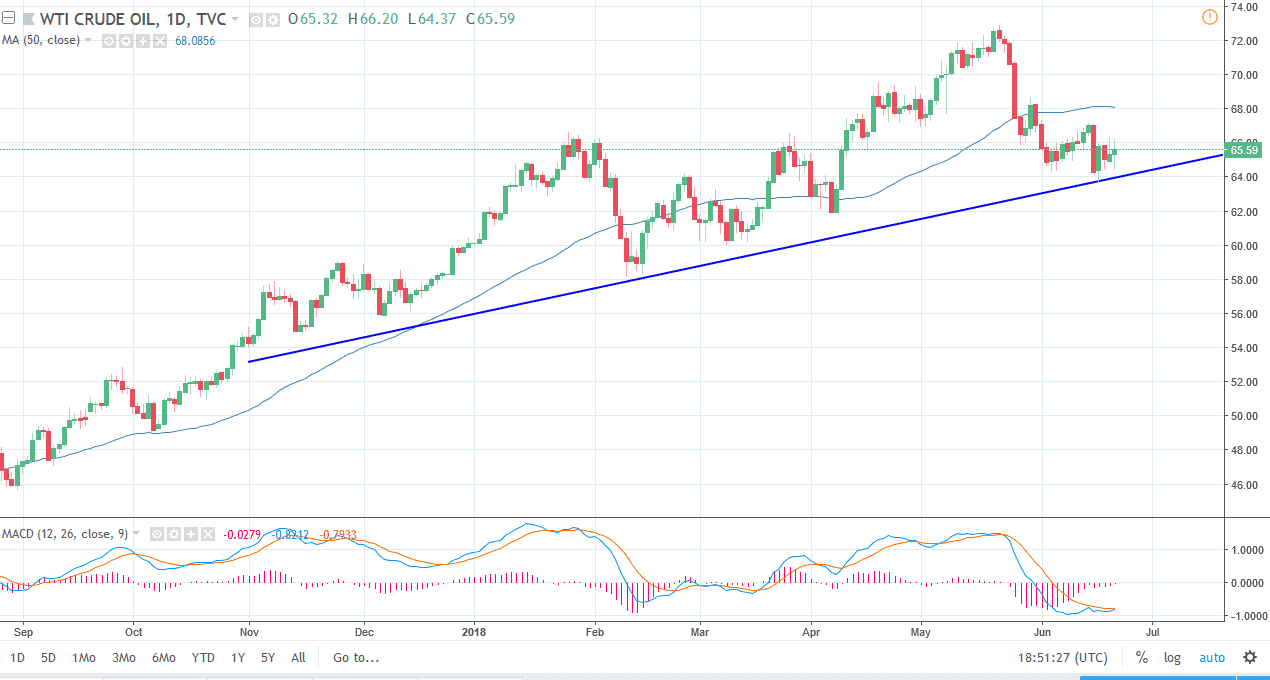

WTI Crude Oil

The WTI Crude Oil market has been very noisy during the trading session on Thursday, as we continue to see the uptrend line offer support. OPEC is meeting, and it is mulling over the idea of increasing output. That should put a bit of bearish pressure on the marketplace, but at this point it’s very unlikely that the we will make a move until we get a certain amount of clarity from OPEC. If we break down below the $64 level, the uptrend line, it’s likely that we could go lower, perhaps the $62 level, followed very quickly by the $60 level. Ultimately, if we turn around and break above the $67 level, the market could continue to go higher, perhaps reaching towards the $68 level and then eventually the $70 level.

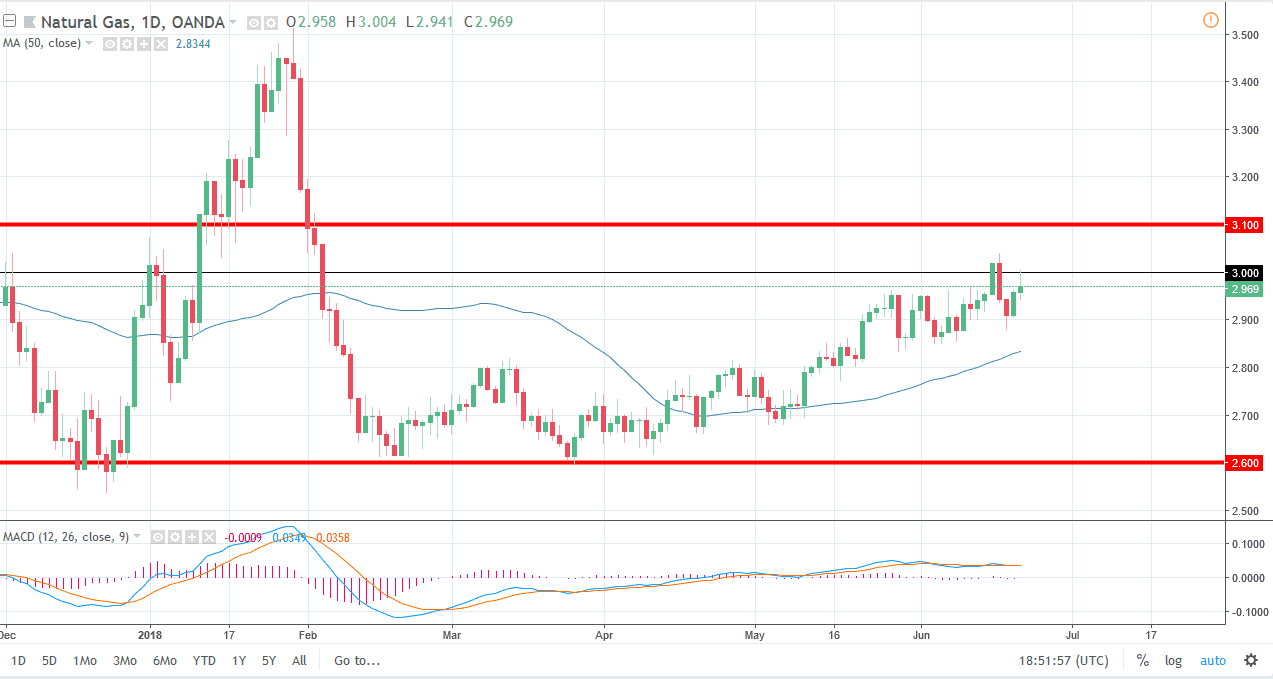

Natural Gas

Natural gas markets have been very noisy as of late, and had a strong move happened during the day on Thursday. However, the $3.00 level has offered enough resistance to turn things around of form a shooting star. The shooting star of course is a very negative candle stick, and it’s a technical selling signal if we break down below the bottom of it. At that point, the market could very well drive down towards the $2.85 level. However, if we break out above the $3.00 level, then we could continue to go higher, and perhaps test the $3.10 level after that. There is a lot of noise between here and there, so I think it’s very unlikely that it will be an easy move. Ultimately, this is a market that I do think is getting close to the top of the overall consolidation area, it’s likely that eventually the sellers will return.