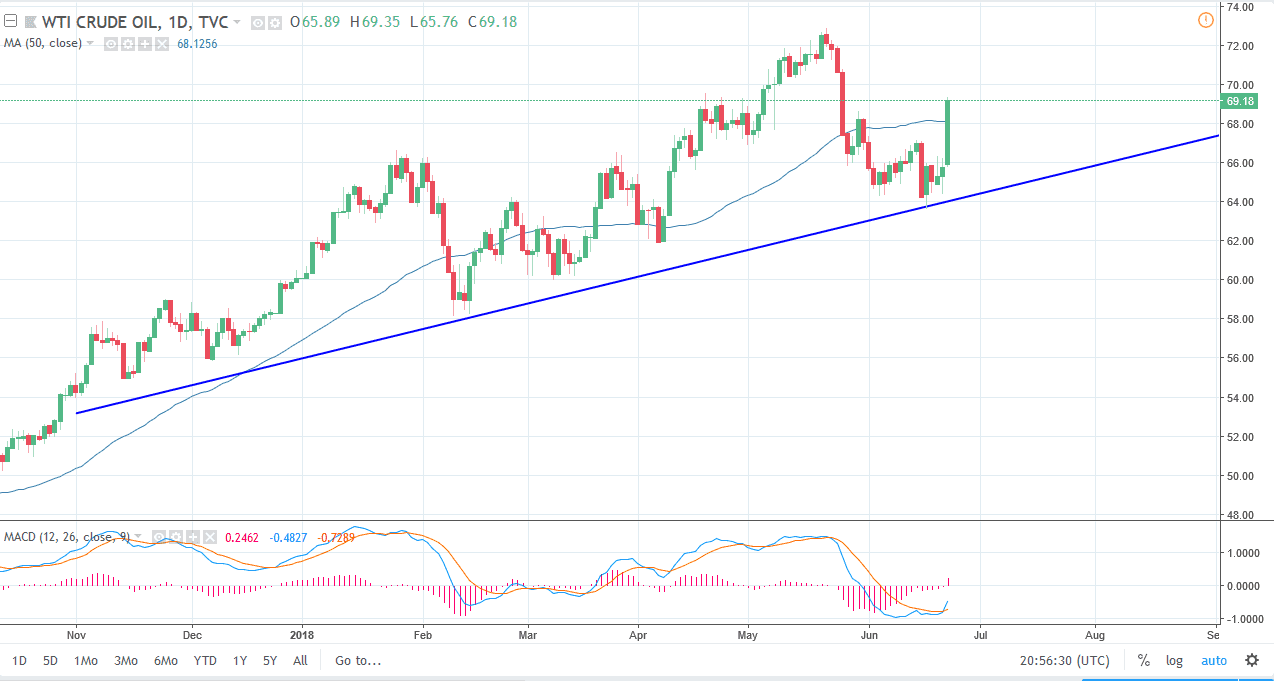

WTI Crude Oil

The WTI Crude Oil market shot straight up in the air during the trading session on Friday after the OPEC announcement. OPEC has agreed to increase production by roughly 700,000 barrels, which is less than the 1 million barrels anticipated. Because of this, the market gained over 5% and we have broken through the 50 day moving average again. We also broke above the $60 level which is resistance, but now I think at this point if you are not long of this market yet, you need to wait for some type of pullback to pick up value. At this point in time, I believe that we will probably find a bit of trouble at $70, but if we can clear that level, then we will go to the $72 level after that. This is an extraordinarily bullish candle, and bullish scandals like this normally have follow-through over the longer-term. However, do not buy at the highs, wait for value.

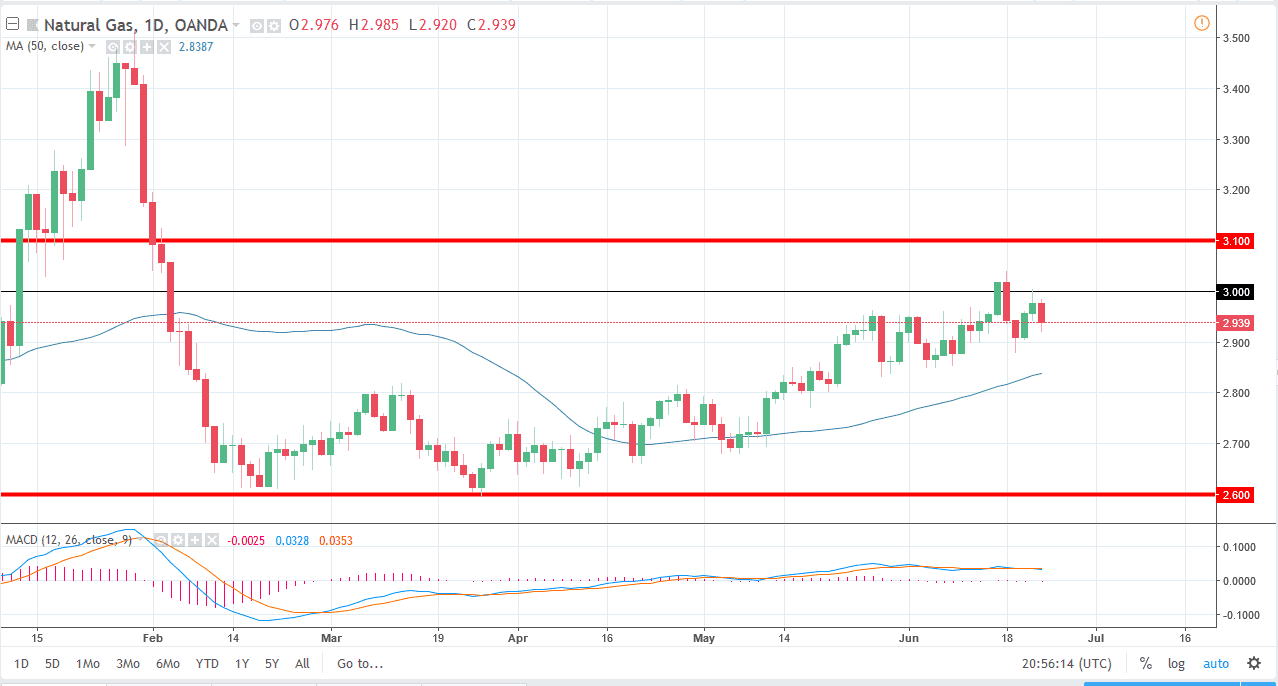

Natural Gas

Natural gas markets broke down during the trading session on Friday, breaking below the $2.95 level. The $3.00 level above has offered resistance, and I think that resistance extends to the $3.10 level. The market should continue to struggle in this area, and I think at this point it’s likely that we could go down to the $2.85 level if we can pick up a little bit of downward momentum. Of interest is that the Natural Gas Consortium meets in Washington DC next week, so that will obviously have an effect on the markets as well. We are closer to the top of the overall consolidation than the bottom, so I do look for selling opportunities. However, if we were to break above the $3.10 level, then the market probably continues to go much higher.