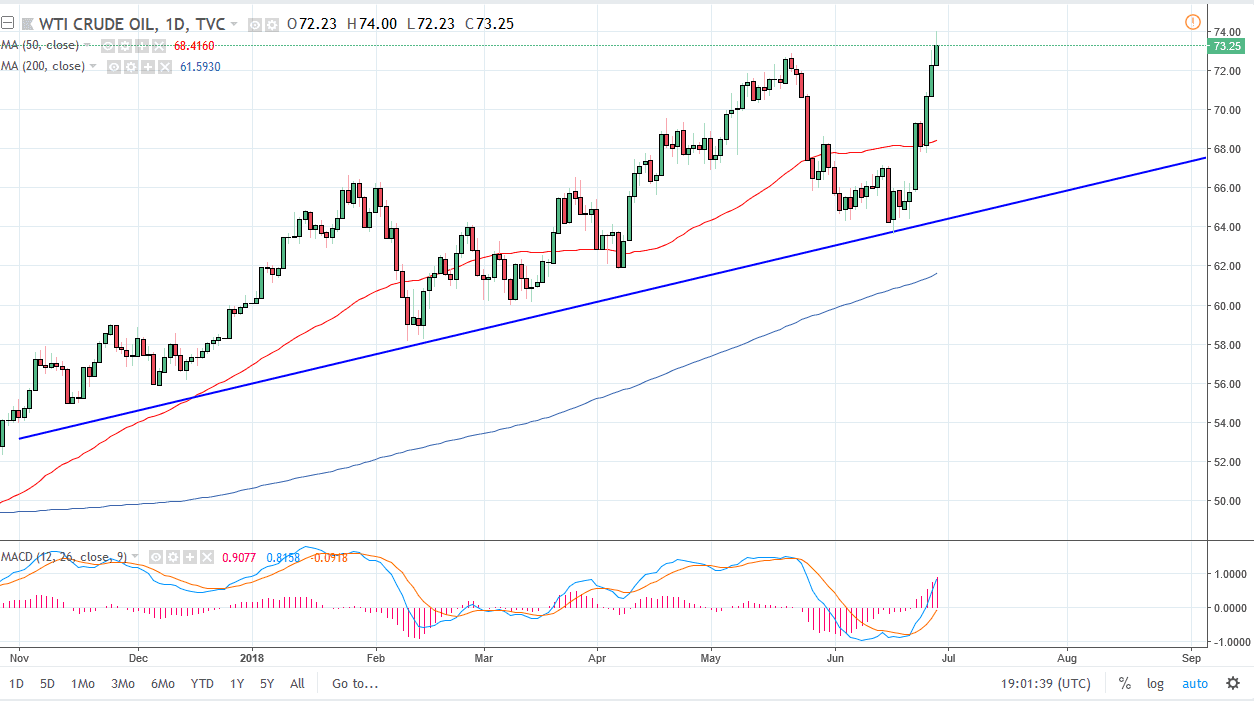

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the session again on Thursday, reaching towards the $74 level. We are extraordinarily bullish, and I think that will continue to be the case. However, we are most certainly overbought, so a short-term pullback makes sense and I think should be thought of as value. I’m using the 50 EMA as a potential support level, but I would also pay close attention to the $70 level as well. I certainly wouldn’t short this market, although I would anticipate some type of pullback. This is a very strong market currently, and therefore I don’t have any interest in trying to go against it. In fact, while the US dollar has been strengthening, oil seems to be ignoring that, showing just how bullish this market truly is.

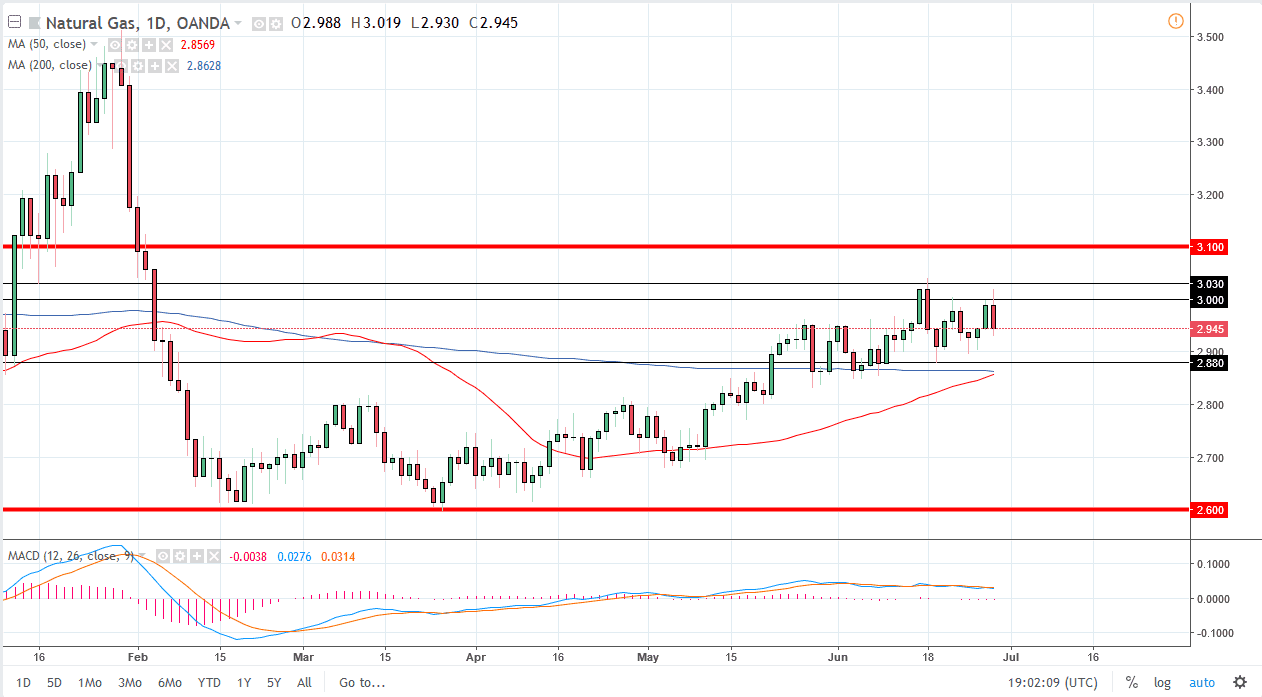

Natural Gas

Natural gas markets initially tried to rally during the day on Thursday but turned around once we got above the $3.00 level and got a significant reversal. Even though the natural gas storage numbers were at first glance bearish, the reality is that the market has gotten ahead of itself, and suppliers are more than willing to get rid of natural gas near the $3.00 level, as it is a profitable trade for them. Remember, natural gas markets have been under a lot of pressure for ages now, and a lot of natural gas producers are quick to dump it off as soon as they can make a decent profit. I believe there is a massive amount of resistance between the $3.00 level in the $3.10 level, so I’m looking for signs of exhaustion on short-term rallies to short this market again. The $2.88 level underneath is rather supportive, and makes a reasonable target.