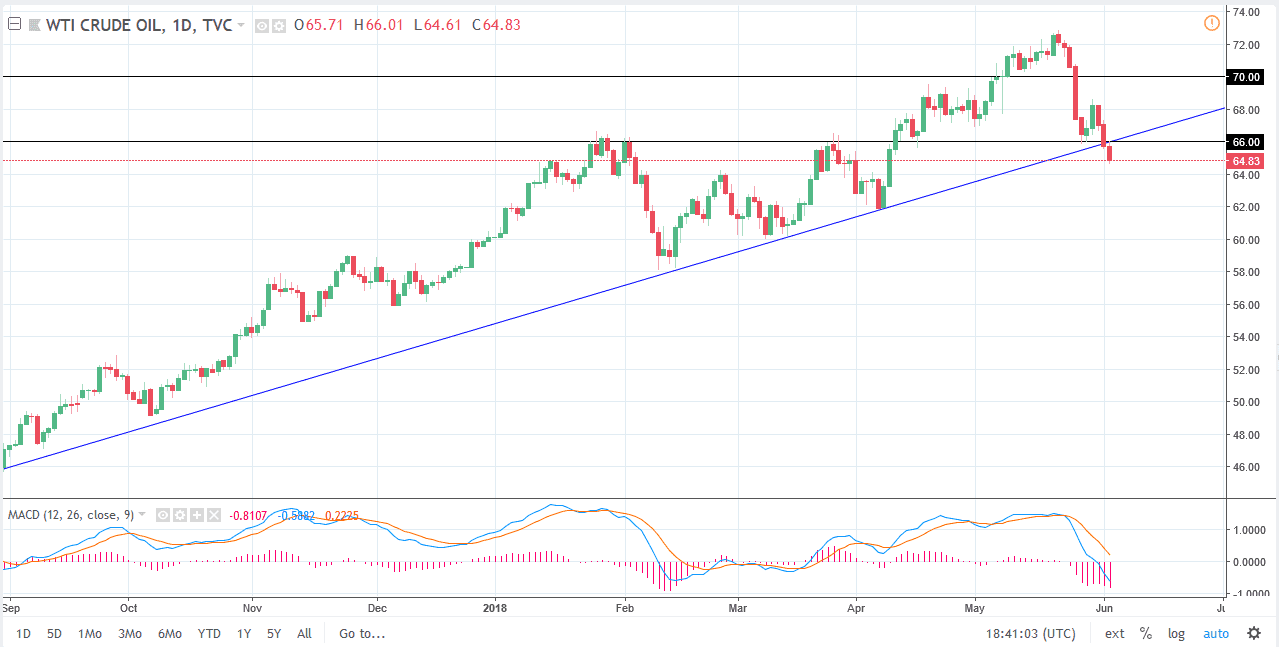

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the day, slicing through the previous uptrend line that has been so significant for months. Now that we have broken below there and have closed towards the bottom of the daily candle, I think this market could be heading for trouble. Unless we are able to turn around and close well above the $66 level, I think this market probably drops down to the $62 level, perhaps even the $60 level over the next couple of weeks. If we break down below there, then the market could break down rather significantly. If we did turn around and rally, I think that the market will probably go towards the $70 level above. It does look as if the oil market is going to continue to struggle in general, and I think that the market is ripe for a nice pullback.

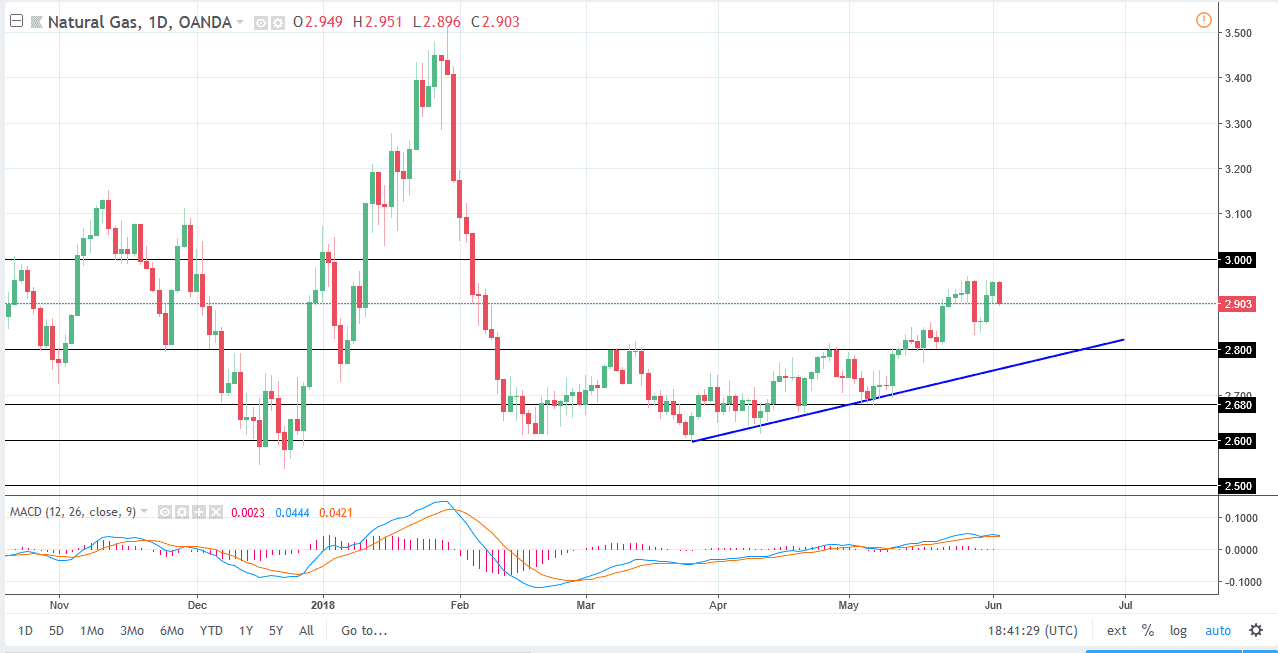

Natural Gas

Natural gas markets have fallen significantly during the trading session on Monday, and it now looks as if we may be trying to form a bit of a “double top.” The $2.95 level is an area that I think extends to at least the three dollars level for resistance. We could roll over and reach towards the $2.85 level today, and perhaps even break down to the $2.80 level. The uptrend line underneath still is intact, but when you look at the longer-term charts, there is a significant amount of resistance near the $3.00 level, and I think that the bottom of this market is probably closer to the $2.60 level. Ultimately, this market will continue to be noisy, but I think it’s only a matter of time before the sellers come back in.