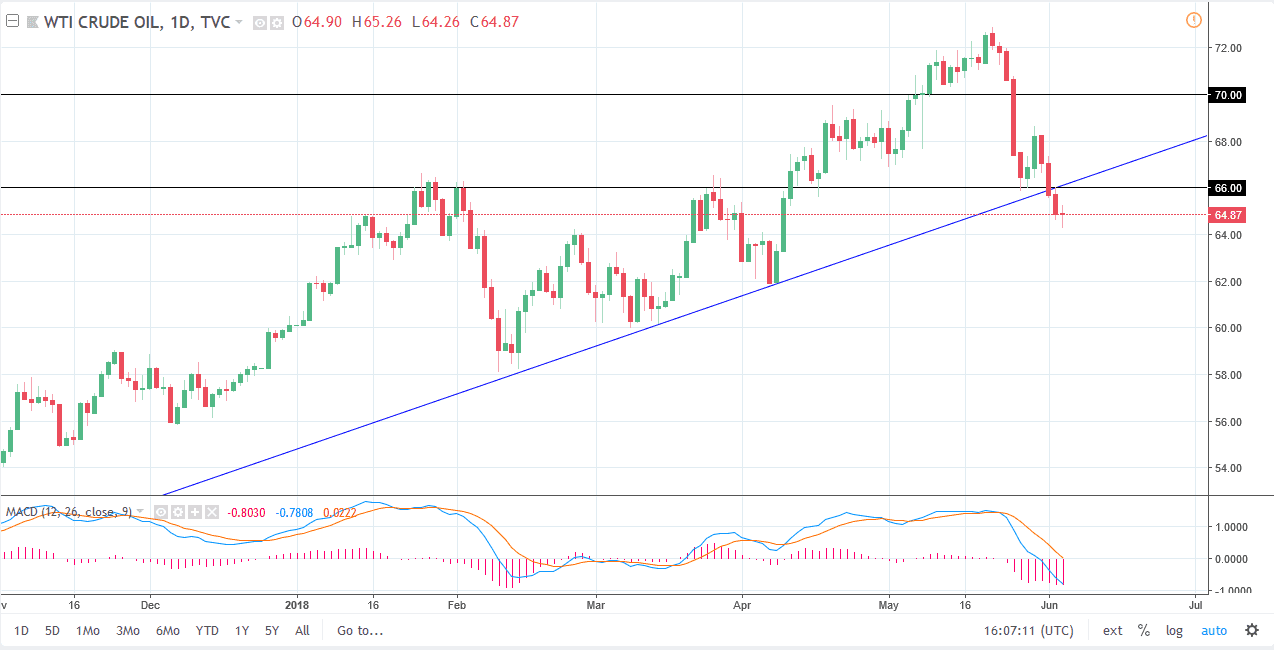

WTI Crude Oil

The WTI Crude Oil market went back and forth during trading on Tuesday, as we are testing the $65 region. We have broken through a major uptrend line, so I do expect the rallies will attract sellers. If we did break above the $66 level and the ensuing uptrend line that had been so supportive, it’s not until we get a daily close above those levels that I would be comfortable buying. I think that short-term rallies are to be sold, and I believe that we will probably break down through the $64 level next, perhaps reaching towards $62. I think that breaking this uptrend line was indeed a major turning point in the marketplace, at least for the next several weeks.

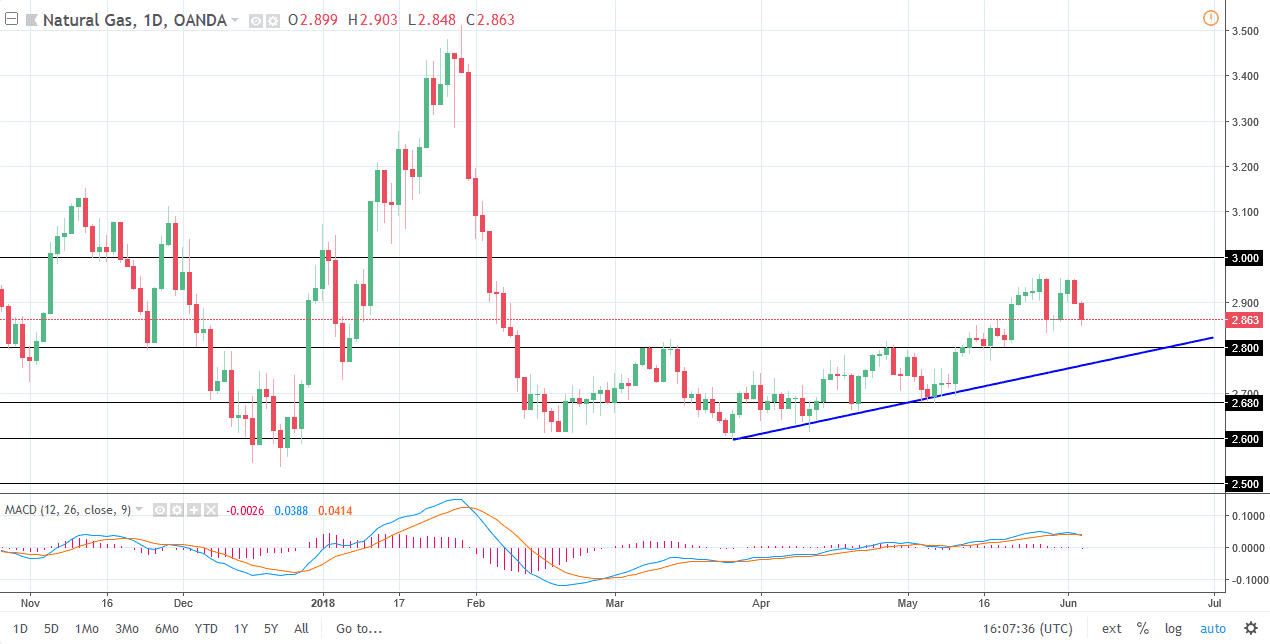

Natural Gas

Natural gas markets also fell during the day, losing 1.33% as I record this. The market looks likely to continue to go to the downside, perhaps reaching down towards the $2.80 level, and maybe even the uptrend line after that. I think that the market will eventually find buyers closer to that level, but it might take a bit of convincing. If we do break down below the uptrend line, then I think we run back towards the $2.60 level, which is the bottom of the longer-term consolidation. I think natural gas markets will continue to be very difficult to deal with, because quite frankly it’s a situation where the weather in America is driving the markets, and of course the weather is erratic in and of itself. I think that the three dollars level above is massive resistance, so if we were to break above there, it would be a strong sign that we are going to the $3.10 level. Otherwise, rallies are to be sold as you could make an argument for a double top-performing.