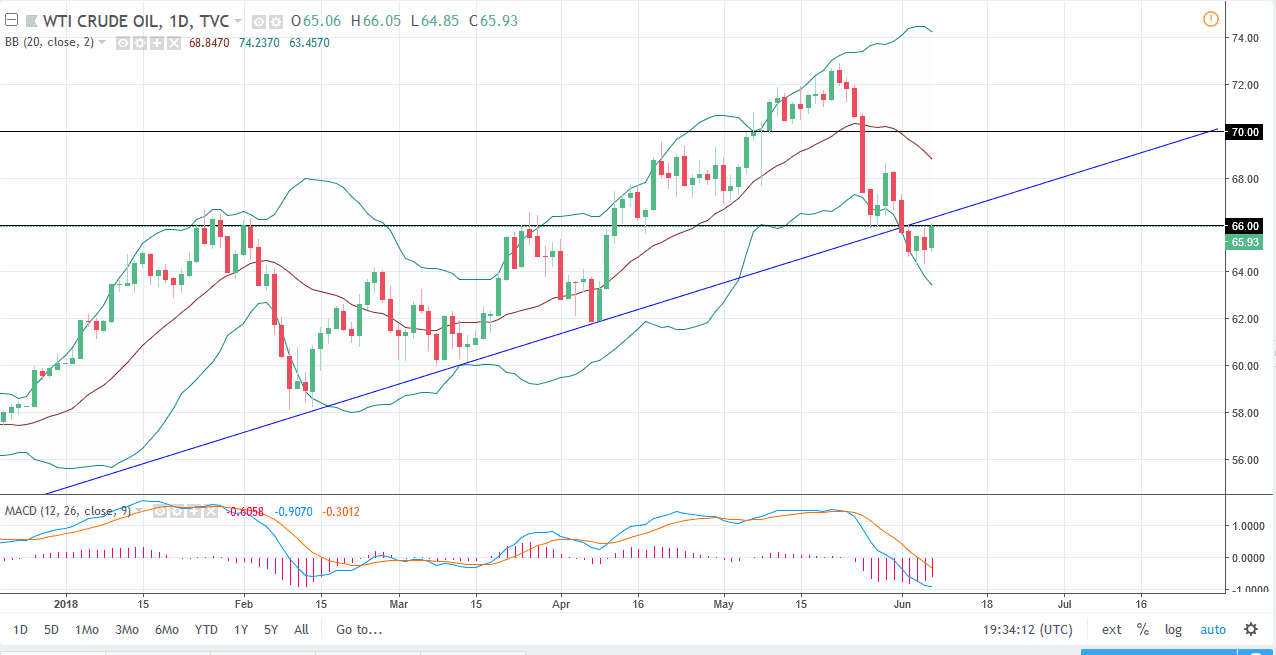

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Thursday, slamming into the $66 level. That is an area that has been supportive in the past, so it should now be resistance. However, we close to the very top of the candle, so that seems to be a sign that we are going to make a serious attempt at breaking back to the upside. The previous uptrend line should offer quite a bit of resistance, so if we can get a daily close above that level, then I think the market goes much higher. Otherwise, we could get a bit of a pullback. I think it is probably best to sit on the sidelines and wait for the daily candle to make a decision. I believe that the next 24 hours could be crucial as to where we go next.

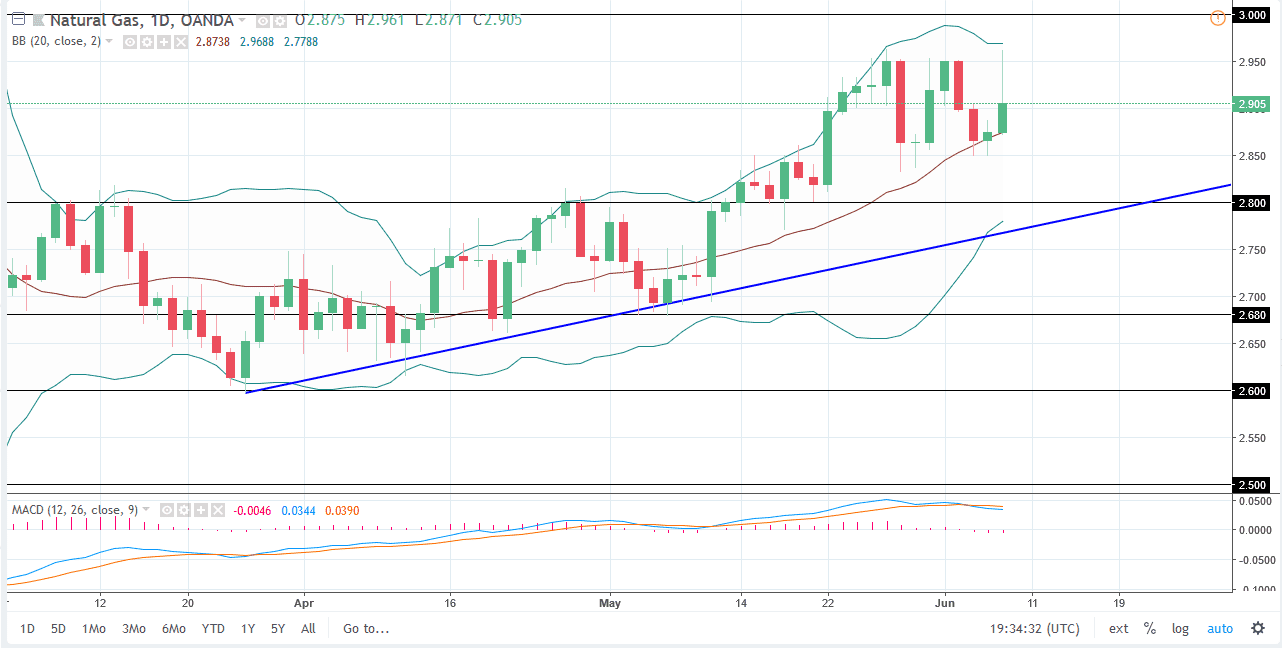

Natural Gas

Natural gas markets shot to the upside during the trading session on Thursday, reaching towards the $2.96 level. There is a lot of resistance extending to the $3.00 level, and I think that rolling over from here makes quite a bit of sense. There is an exhaustive shooting star for the day, and I think that shows that the sellers are starting to become a bit more aggressive. Ultimately, that should send this market looking to the $2.80 level, and then the uptrend line. I like selling short-term rallies again, as I think we are going to continue to struggle to go higher. Overall, this is a market that could rally, but until we can close above the $3.00 level on a daily candle, I think rallies are to be sold on signs of exhaustion going forward.