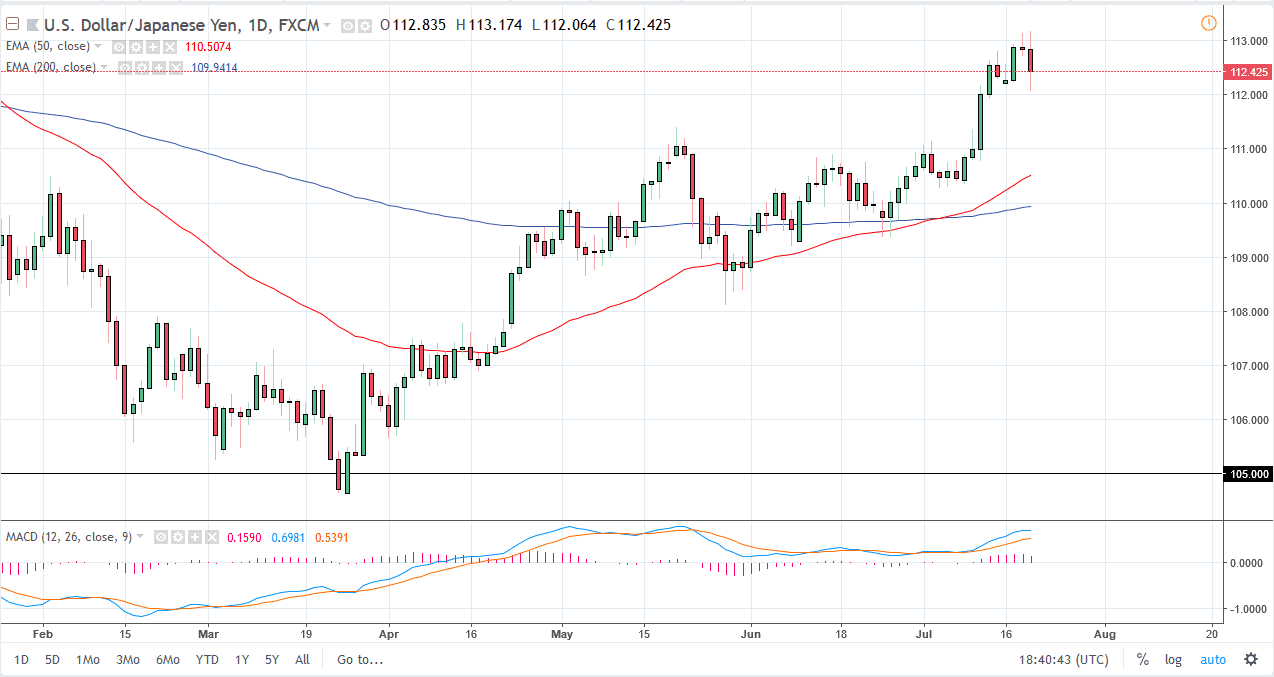

USD/JPY

The US dollar has initially tried to rally during the trading session on Thursday but found the ¥113 level to be a bit too much to hang onto and felt towards the ¥112 level. However, the ¥112 level has offered a bit of support, as there is a significant amount of demand. If we can break down below the ¥112 level, then I think the market probably goes looking towards the ¥111 level after that. I believe that the market will continue to be very noisy, and I do recognize that there is a lot of noise above to be dealt with as well. I think you need to look for short-term pullbacks and take advantage of, as it gives you an opportunity to pick up the US dollar “on the cheap.” The interest rate differential will continue to favor the US dollar, so longer-term I do believe that we go higher

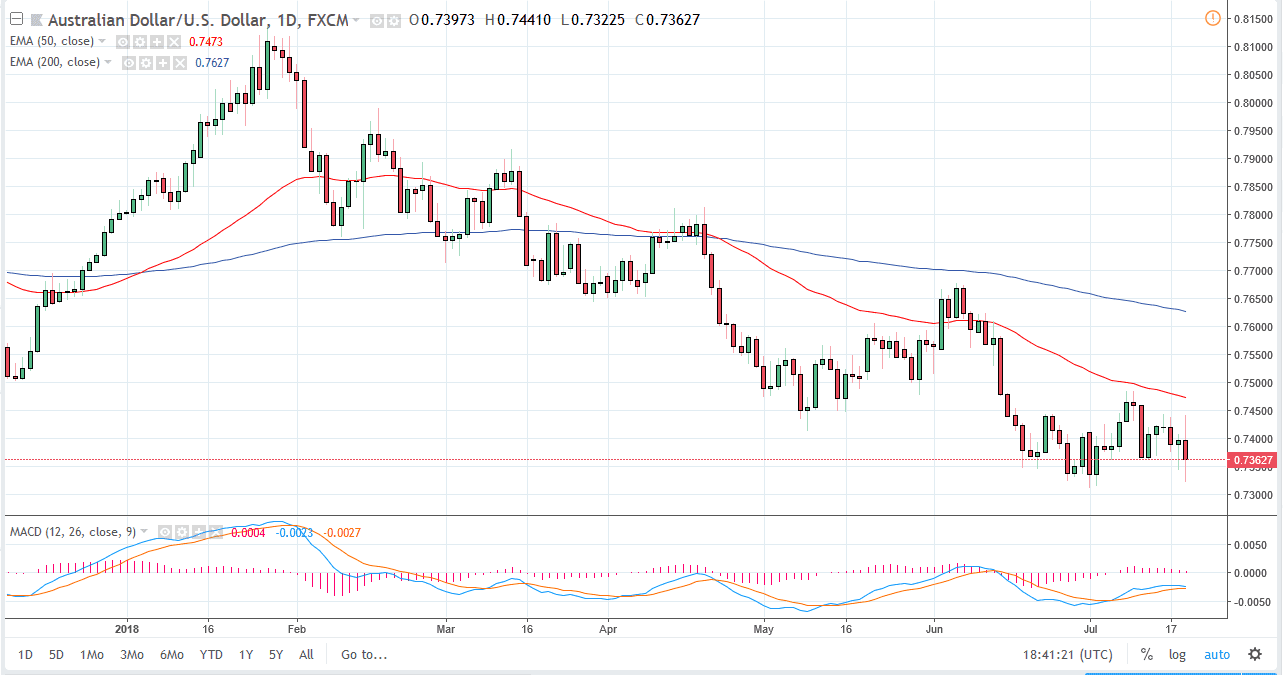

AUD/USD

The Australian dollar has had a wild session again on Thursday, reaching as high as the 0.7450 level, before dropping down towards the 0.7325 handle. There is a significant amount of support just below, so I think we will continue to go back and forth and try to build some type of base. When you look at the weekly charts, we have formed hammers over the last several weeks in this general vicinity, and I think that will continue to show an area of significant support. If we can break above the 0.75 level, the market will be free to go higher, but right now I think we are still in the process of trying to form a base more than anything else. If we were to break down below the 0.73 level, then I think the Australian dollar will unwind quite drastically.