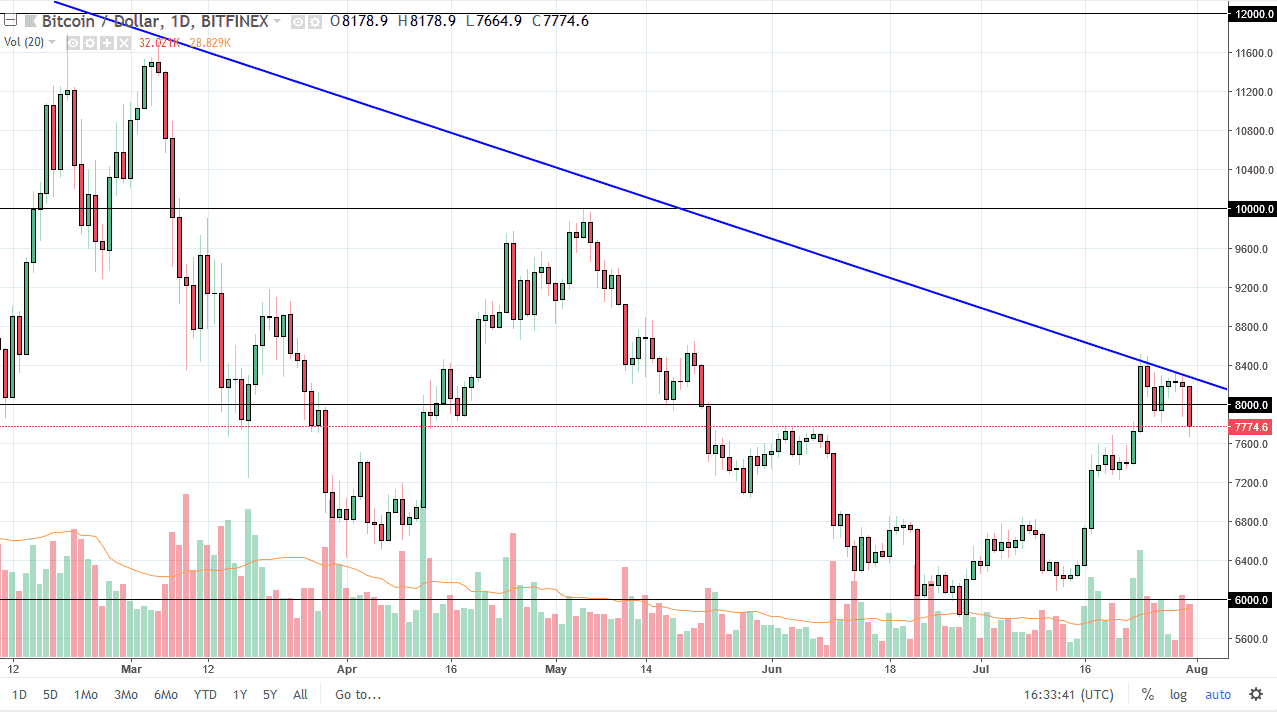

BTC/USD

The Bitcoin markets continued to see selling on Tuesday, as we have been seeing a bit of exhaustion. The market has recently tested a downtrend line and failed. This tells me there is still a lot of selling pressure above. I think that we are likely to go looking towards the $7500 level again, where there could be buyers to support it. However, the candle from Monday has been turned into a ‘hanging man.’ This is a very bad and ominous sign going forward. The alternate side is that we break above the downtrend line and go looking towards the $10,000 level. If we were to break down over here – the market then goes looking for the $6500 level that started all of the buying. Although this move has been good – its still a blip on the radar so far.

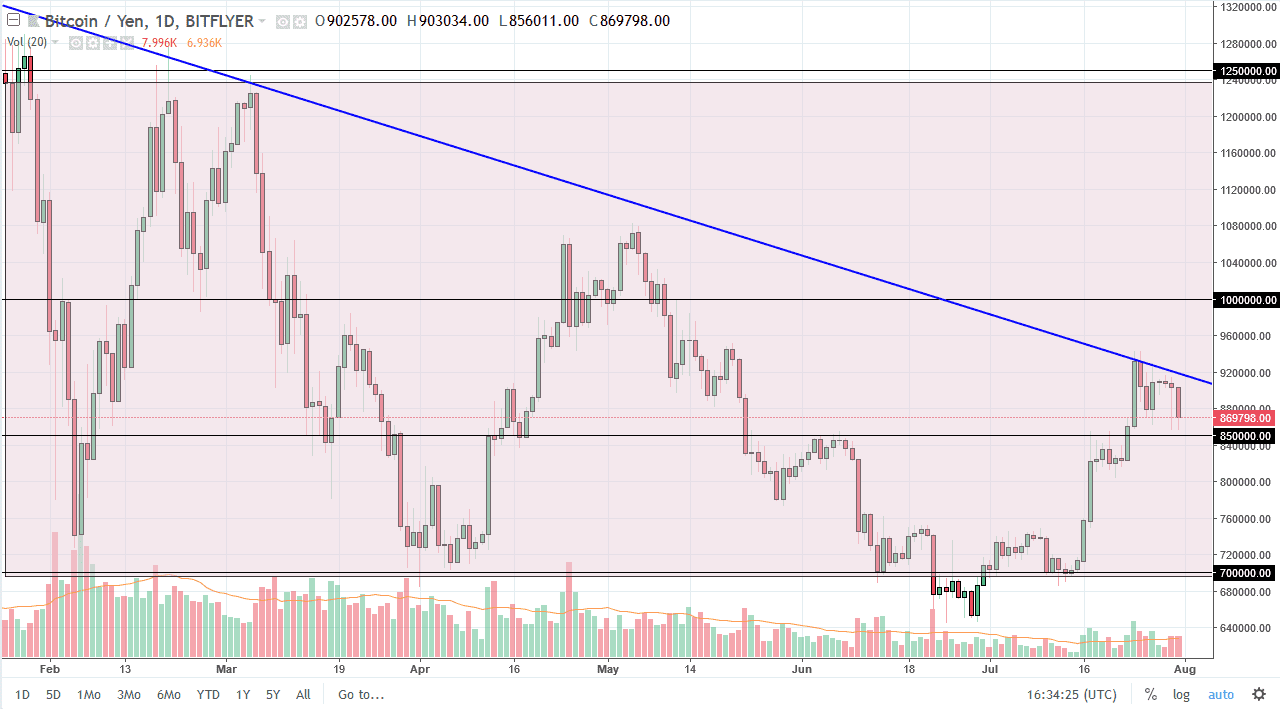

BTC/JPY

Bitcoin fell against the Yen as well, and as I said yesterday – if the Bank of Japan does something to weaken the Yen – and they did – and the BTC/JPY pair falls it would be a very bad sign. This is exactly what happened, and I think that if we break below the 825,000 level, this market will go towards the 700,000 level after that. Also, if we break above the downtrend line, the market will be looking at testing 1,000,000 next. A break above there would have this pair off to the races. I think at the very least we are looking at a pullback, but the weak BTC against the even weaker Yen has me thinking this pair is going to struggle in the near term, and this now looks as it is going to be a continuation of what we have seen over the last several months. The next few days will be crucial.