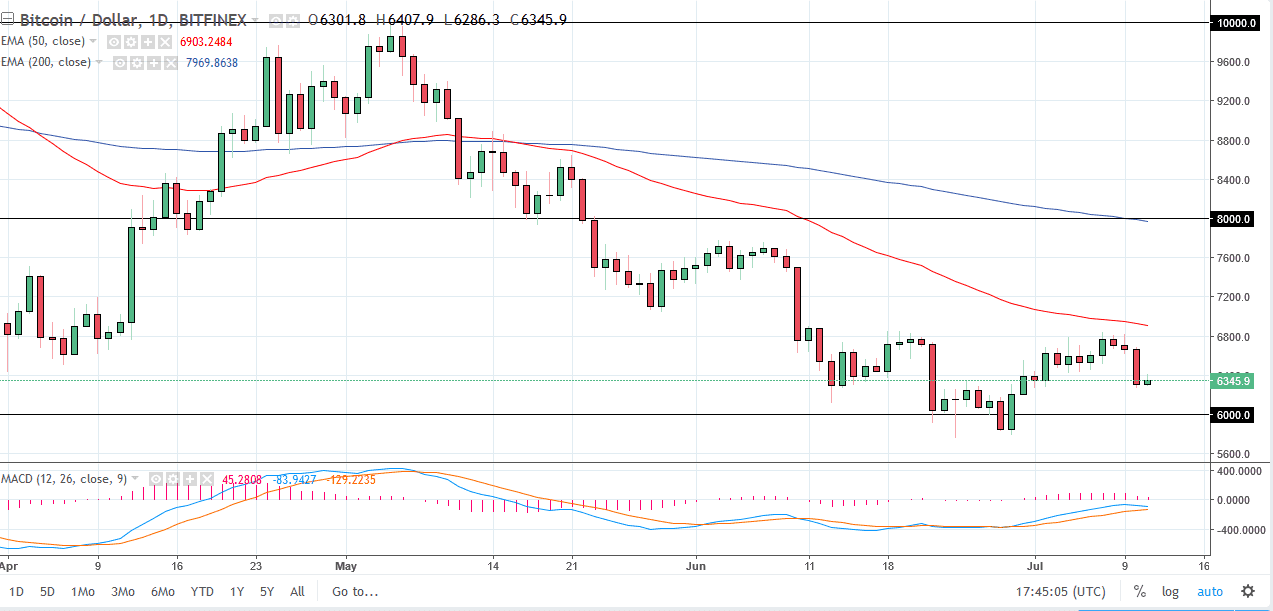

BTC/USD

Bitcoin continues to look lackluster at best, as we have bounced 0.75% during the day on Wednesday. Although that’s a reasonable gain in a mature market, you should keep in mind that the previous day was a loss of 5%. That continues to be what we see more than anything else, selling pressure outweighing buying pressure. There’s a reason why you should pay attention to impulsive candles. They tell you where most of the volume is. By volume, you can also assume that there is a certain amount of institutional money there. Currently, it looks as if Bitcoin is trying to break through a major support region in the realm of $6000, and there is nothing on this chart that tells me it won’t happen. I think we will have several attempts, but eventually we could break through there. The alternate scenario is that we somehow turn around and break above $7000, which would be very bullish. I wouldn’t hold my breath though.

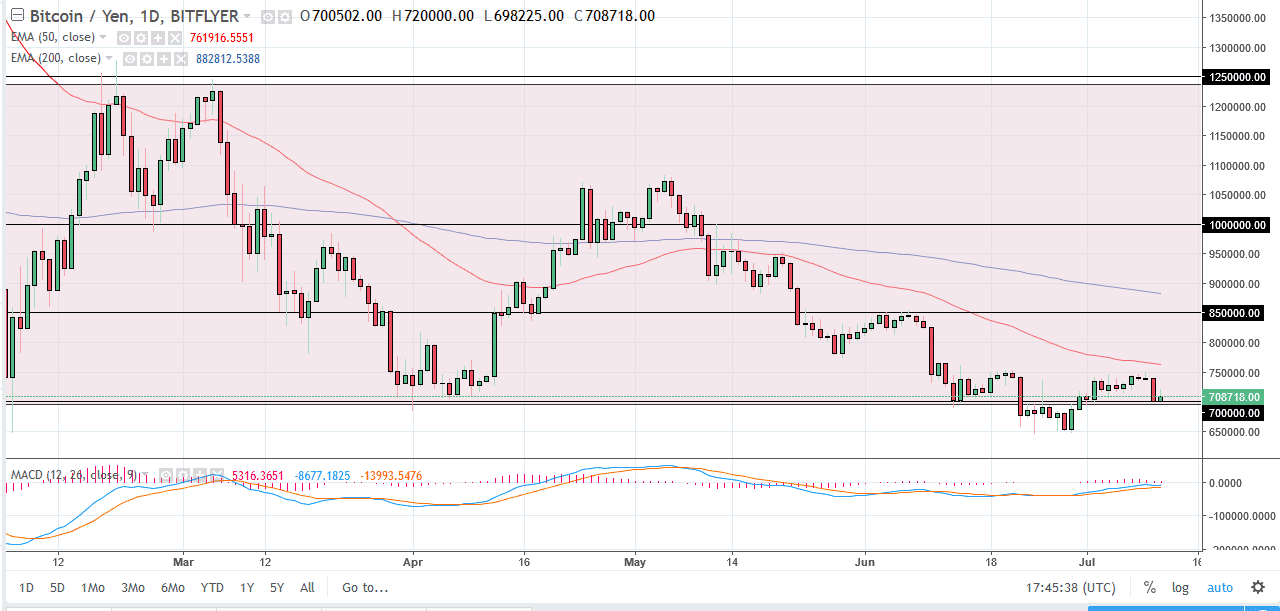

BTC/JPY

Bitcoin bounced slightly against the Japanese yen as well, using the ¥700,000 level as support. This is an area where we have seen some buying as of late, but again, just as in the BTC/USD pair, most of the impulsivity is to the downside. That tells me more than anything else on this chart. Buyers simply do not have the conviction to pick this market up, and I think it needs to break down even further before we get a complete capitulation, something that is needed for this market to finally turn around the overall trend. At this point, I don’t think we are close to it. However, I will of course monitor for changes in the overall attitude of the markets, but right now things look pretty gloomy to say the least.