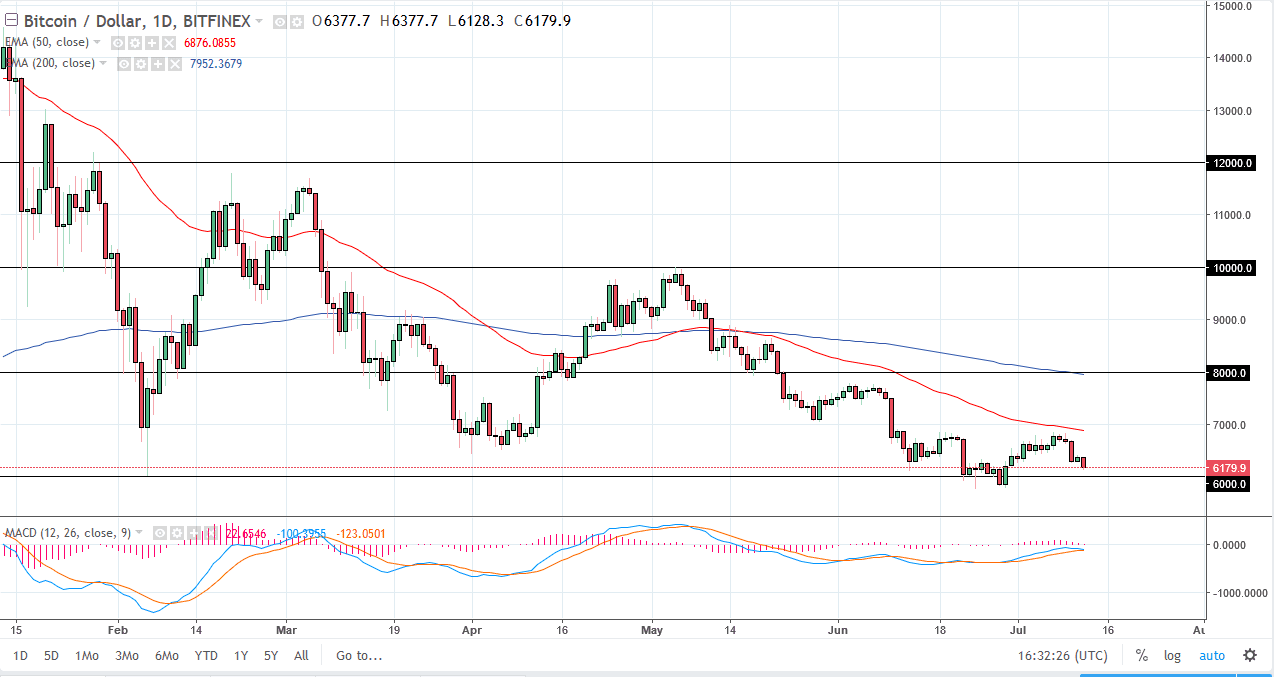

BTC/USD

Well, bitcoin has managed to fall again. We have lost over 3% during the trading session on Thursday, reaching towards the $6100 level again. The $6000 level is a demand area, but quite frankly we are starting to see this area get tested repeatedly. I feel it is only a matter time before it breaks down, so we make a fresh, new low, I would anticipate a move towards the $5500 level eventually. Rallies are to be sold, and it appears that the 50 day EMA continues offer dynamic resistance. At this point, I don’t have a scenario in which a willing to buy bitcoin, at least not the way it’s acting now. I suppose that if we were to break above the $8000 level, I would have to reconsider a lot of my thought process, but I believe that we simply must go lower at this point to fulfill the markets desire to get the bubble completely deflated.

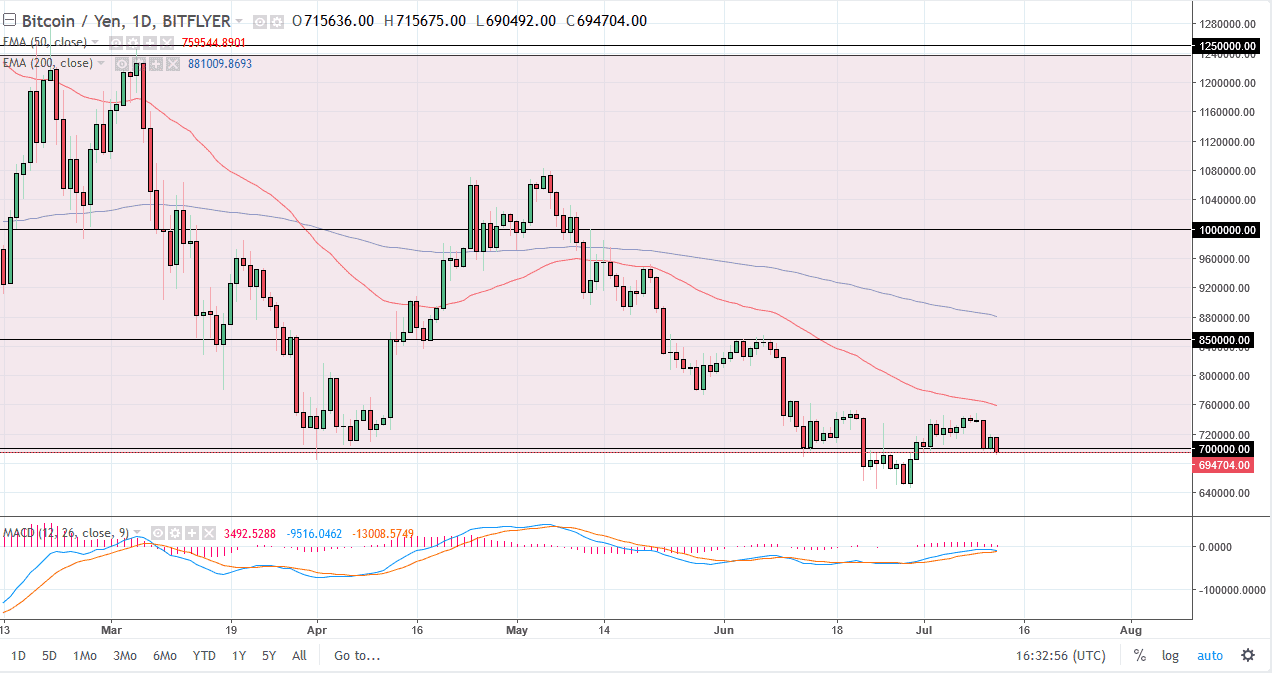

BTC/JPY

Bitcoin of course also fell against the Japanese yen, and it looks as if we will go looking towards the lows again, near the ¥650,000 level. If we break down below that level, the market probably goes down to the ¥600,000 level next, perhaps even lower than that. Given enough time, I believe that the ¥500,000 level will probably be a target, and I believe that the 50 day EMA is going to continue to be a resistive barrier. In fact, I don’t have any interest in buying right now, at least not until we break above the ¥850,000 level. That could change of course with the right impulsive move, but currently I don’t see enough demand to change my mind. I believe that ultimately we will break down.