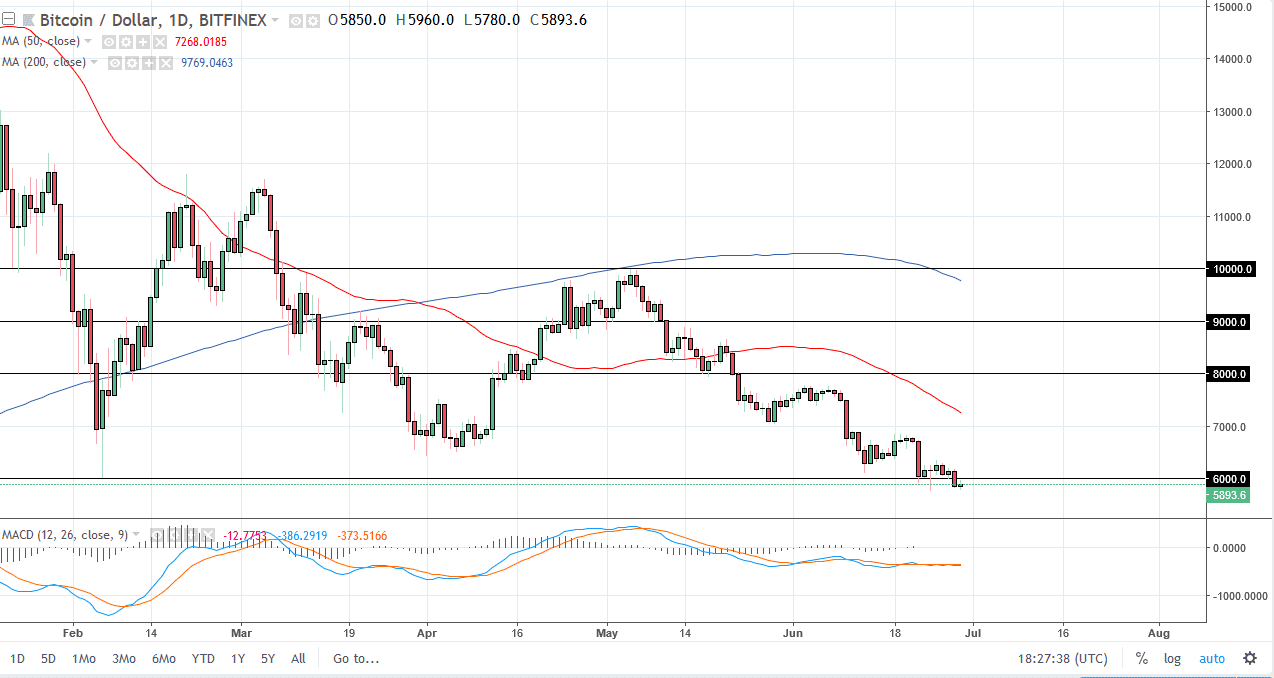

BTC/USD

Bitcoin has done very little during the trading session on Friday, as we continue to trade below the vital $6000 level. We are currently pressing the bottom of the hammer from the Sunday session of last week, and a break down below there would show yet another leg lower in Bitcoin. I think that the market will in fact break down below there, perhaps reaching towards the $5500 level next. I believe that longer-term we will go looking towards the $5000 level, and bitcoin will continue to be a “sell the rallies” type of situation. There is no reason to think that this market is going to be any different anytime soon, as there is no catalyst to turn things around. Bitcoin will continue to be sold over the longer-term, and now the longer-term movie averages are starting to turn lower as well.

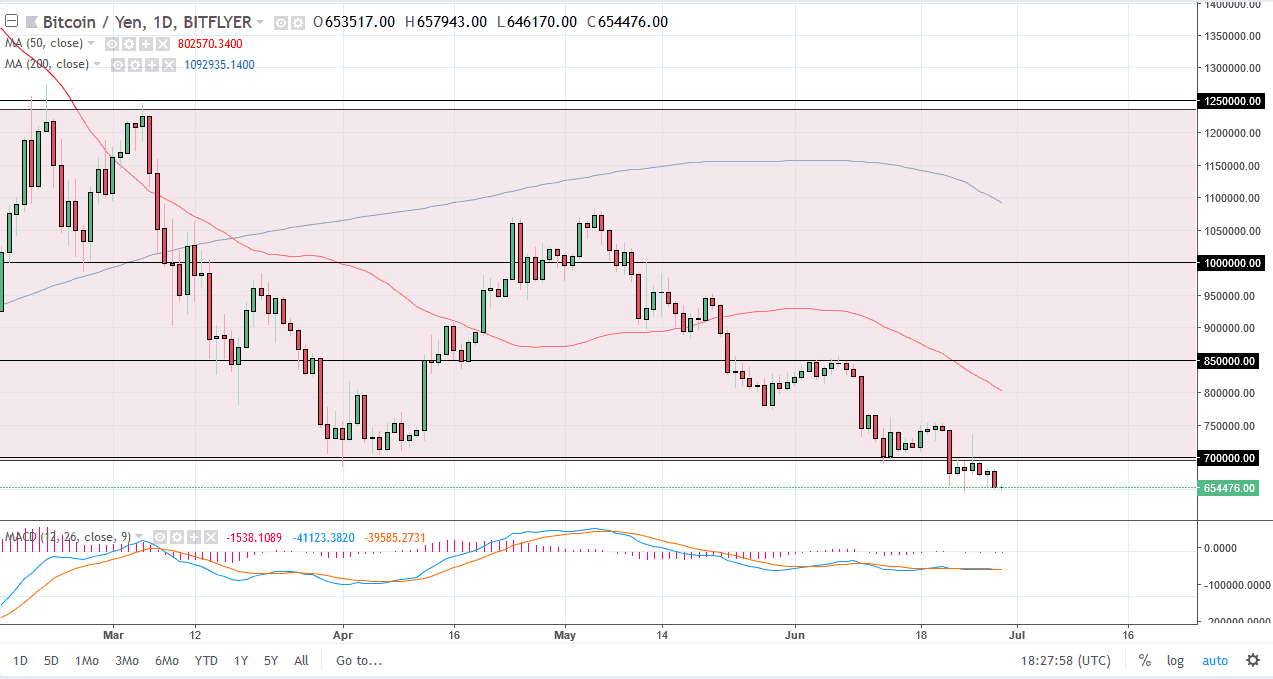

BTC/JPY

Bitcoin has also struggled against the Japanese yen as of late, essentially doing nothing during the day on Friday as we are hovering just above the Sunday hammer for last week. If we break down below the bottom of the hammer, and it certainly looks as if we are getting ready to do, the market is likely to go much lower, perhaps down to the ¥600,000 level, and then the ¥500,000 level. It is very difficult to imagine a scenario where this market rally significantly, and I believe that it will take a lot to break above the ¥750,000 level, as it has been resistance recently. Even if we break above there, the market would probably go to the ¥850,000 level where we find even more resistance. Bitcoin looks very weak currently, and I see nothing changing anytime soon. Sell rallies whenever you get a chance.