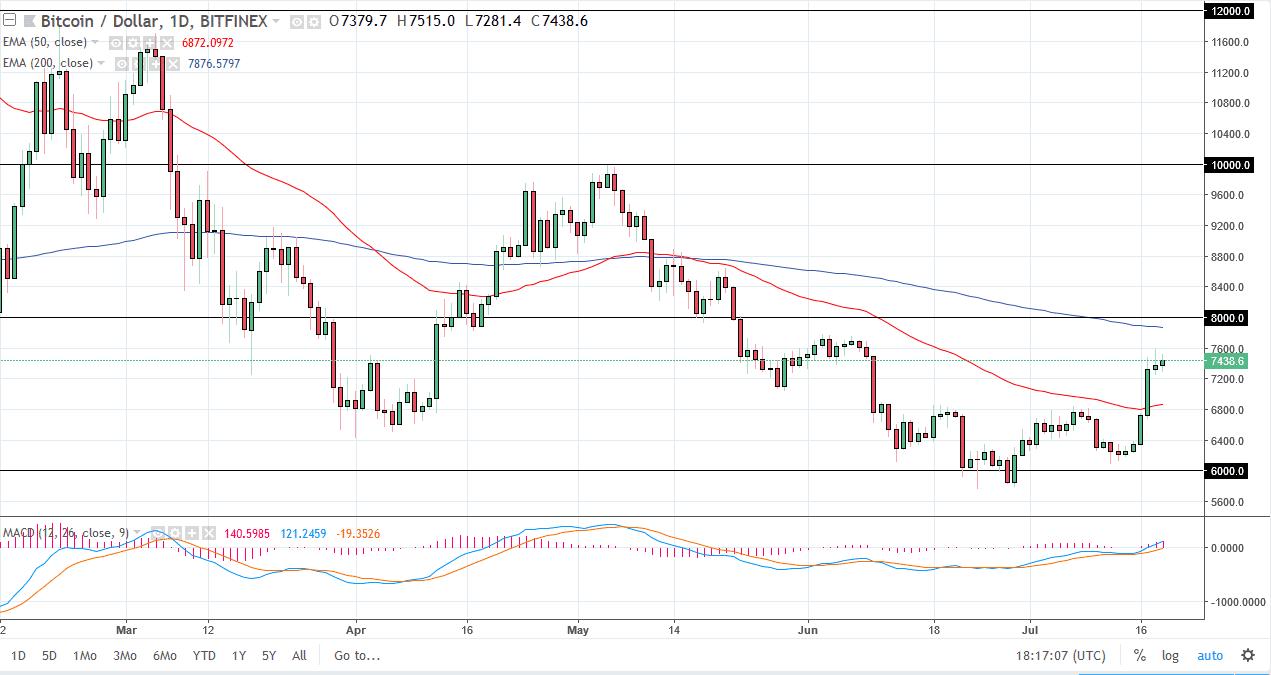

BTC/USD

Bitcoin has rallied slightly during the trading session on Thursday, but just barely so. The market is starting to slow down as I thought it might, as the $7600 level seems to have a lot of supply attached to it. It is because of this that I anticipate a pullback, it of course we have the 200 day exponential moving average just above this level. I believe that the $8000 level also offer a significant amount of resistance, so I believe that the very least going to get a little bit of a pullback. If $6800 can hold, then that would be a good sign that perhaps the buyers are coming back into the marketplace. Otherwise, this may have been a bit of a “dead cat bounce.” At this point, we are overbought in the short term, so I think you can expect some softness, or at least sluggish action.

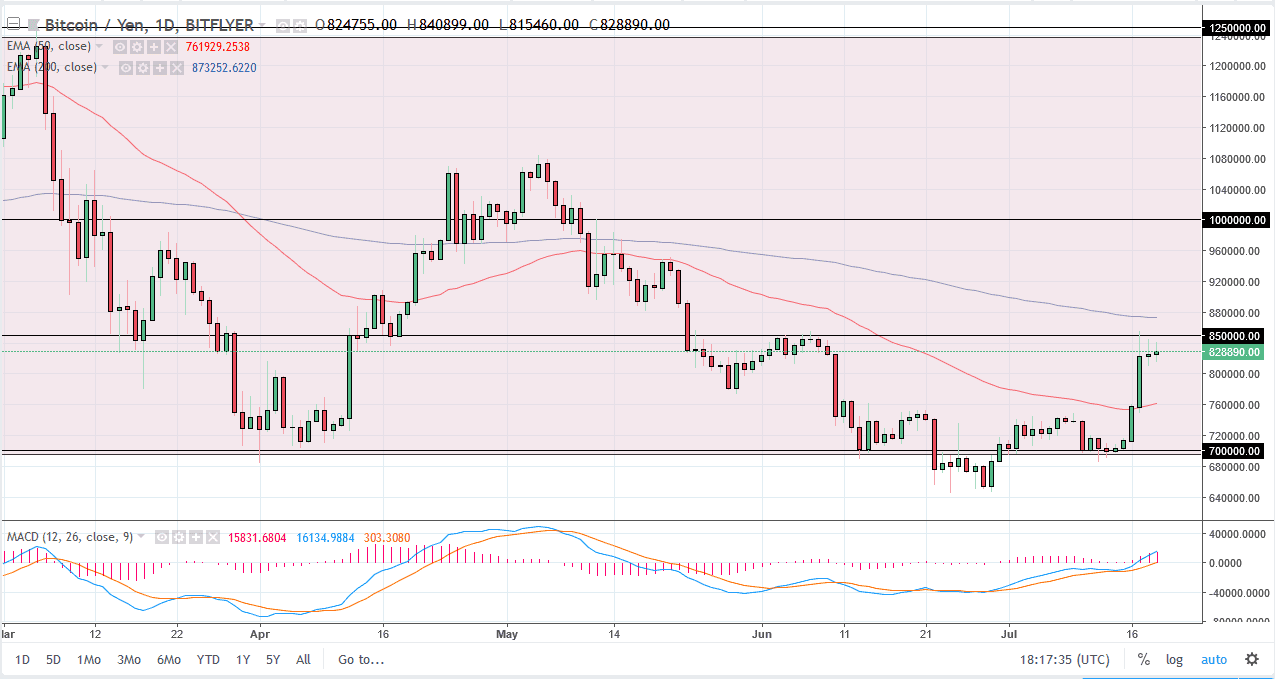

BTC/JPY

Bitcoin when sideways against the Japanese yen as we could not break above the ¥850,000 level. That’s an area that sees a lot of supply just as we see the $7600 level, and it looks as if we are starting to run out of steam. Because of this, if we turn around and break below the attorney thousand yen level, I think we will revisit the ¥700,000 level. Alternately, if we can break above the 200 day exponential moving average, pictured in blue on the chart, then we could rally a bit. In the meantime though, I think that we are more likely to see a pullback in this market than some type of explosion to the upside as we have gotten a bit ahead of ourselves over the last couple of sessions.