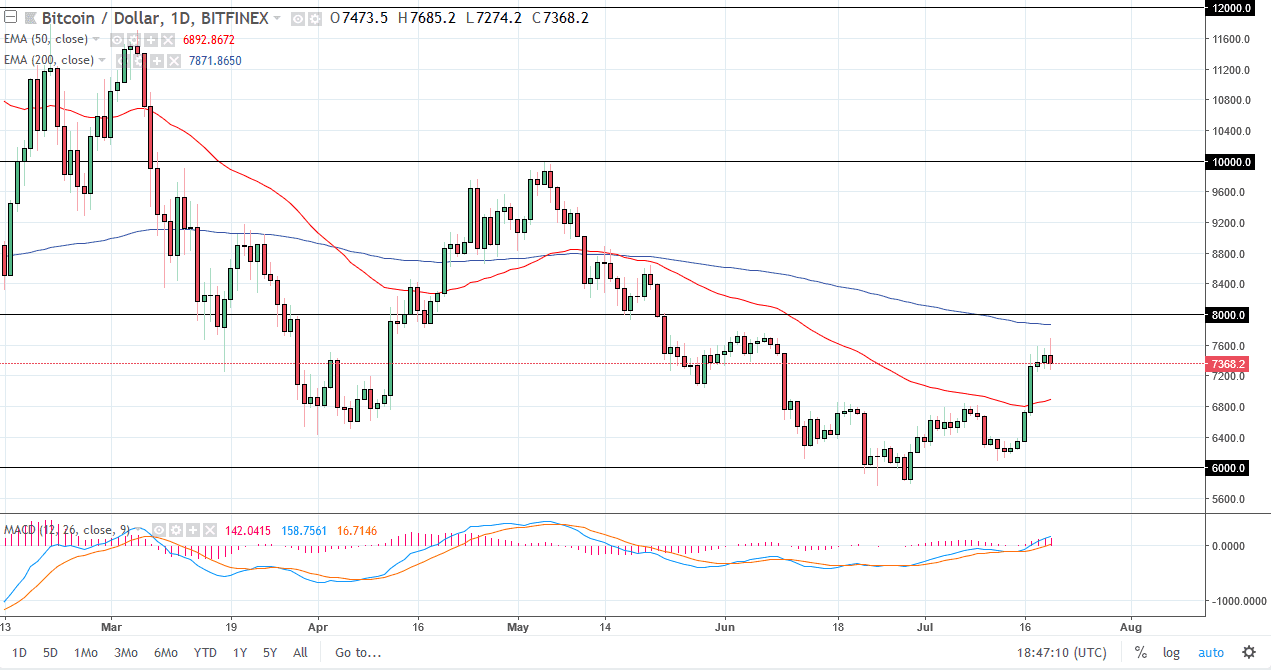

BTC/USD

Bitcoin initially rallied during the day on Friday but started to run into resistance at the $7600 level again. By the end of the day we ended up forming a shooting star, and it now looks as if the supply near the $7600 level is going to continue to offer a lot of bearish pressure. I think at this point, even if we do rally longer term, at the very least we need to pull back towards the $6800 level look for more demand. Ultimately, even under the best of scenarios we need to form some type of basing pattern to turn the negativity around. The 200 day exponential moving average is just above as well, so I think at this point it makes sense that we drift a little bit lower. We are most certainly closing out the week with a lot of softness.

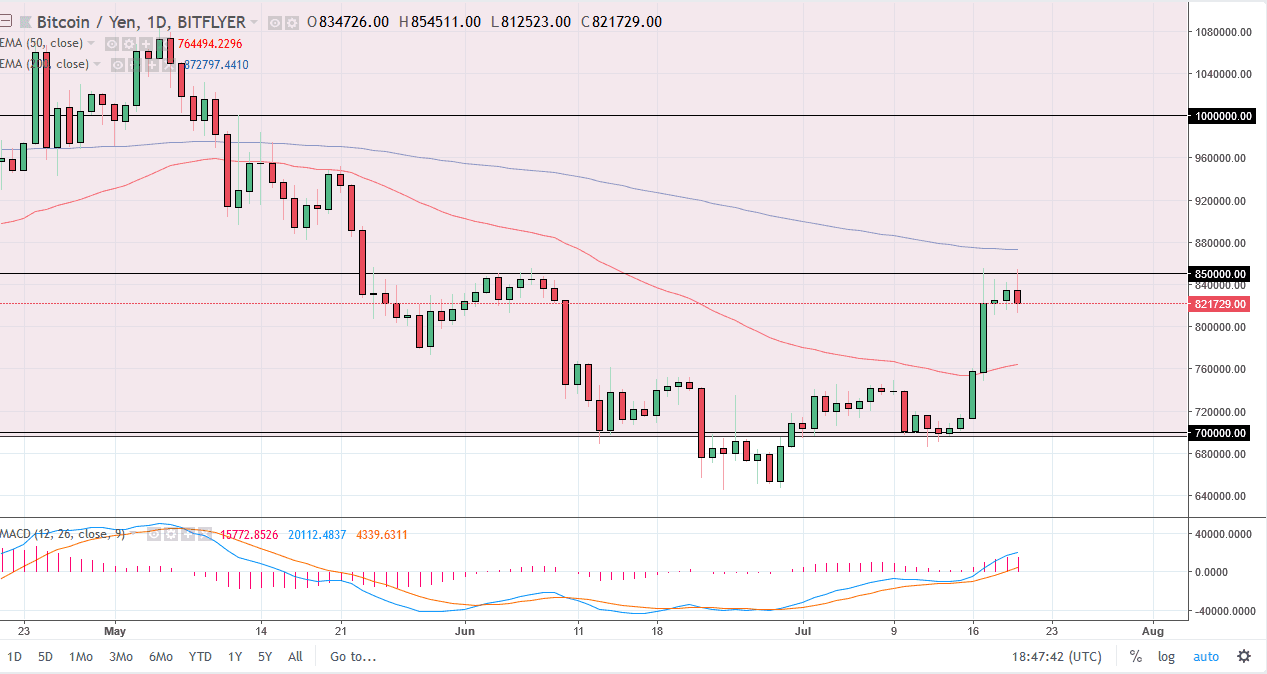

BTC/JPY

The bitcoin markets tried to break above the ¥850,000 level, but then turned around to fall in a very similar manner. At this point, we are at a major supply level and I think that demand is to be found at lower levels. I think that even if we are to go higher at this point, at the very least we need to pullback to find enough buyers. The 200 day moving average, pictured in blue on my chart, is just above as well, so I think at this point it will makes sense that certain algorithmic traders will come in and push the market lower. The question now is whether or not the ¥750,000 level can hold as support? It probably does, but over the next couple of sessions I would expect to see a little bit softness in this market.