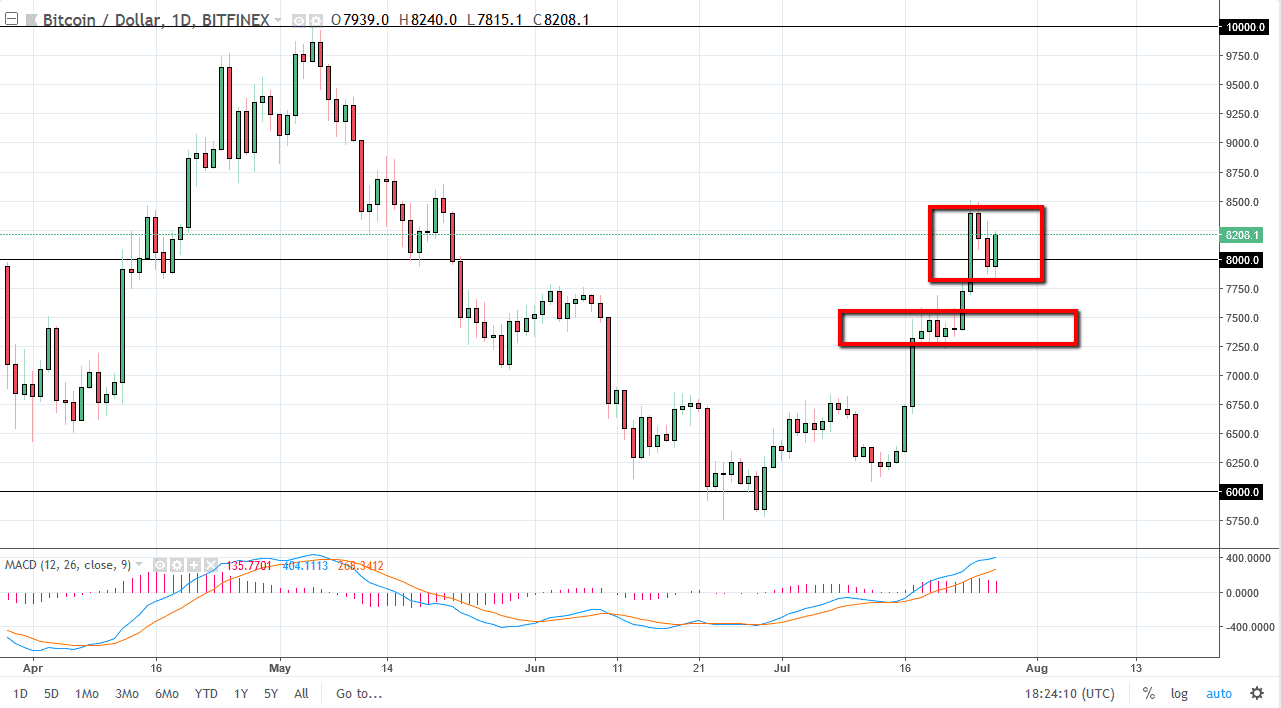

BTC/USD

Bitcoin markets initially fell during the trading session on Thursday but turned around to break above the $8000 level again. While I had hoped to see this market pull back a little bit further to find even more significant support near the $7500 level, it appears that we are simply consolidating. Going into the weekend, it would not surprise me at all to see this market drop a little bit, but I think there will be plenty of buyers underneath. The alternate scenario is that we can break above the $8500 level, which could open the door to the $9000 level, possibly even the $10,000 level. I believe that the market does still have an upward bias, but I would love to see some type of value be reintroduced into the market as we have been over bought.

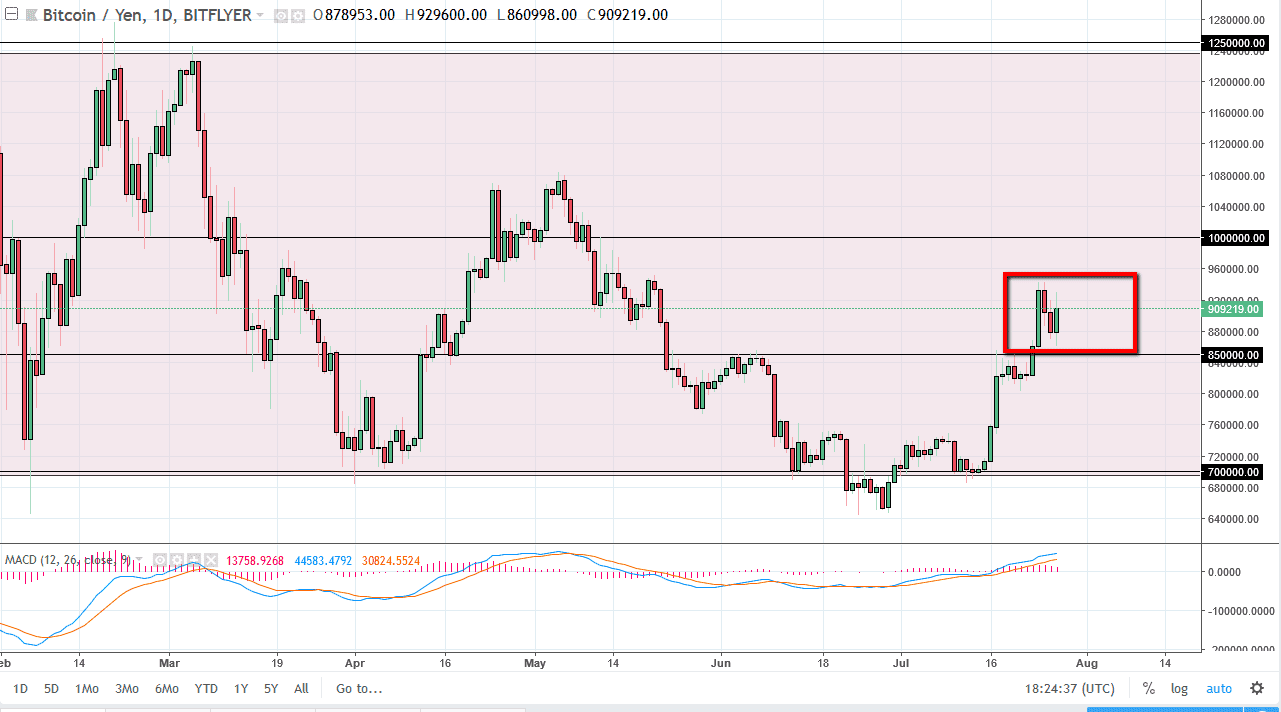

BTC/JPY

The Bitcoin markets also rose against the Japanese yen, using the ¥850,000 level as support. I think there is a significant support level in that region, and I think that it extends down to the ¥800,000 level. If we can break down below that level, then I think the market could drop towards the ¥700,000 level. Ultimately, I think that we do go a bit higher from here but we are starting to run into a little bit of resistance, so I would anticipate the next couple of days could be somewhat consolidated. I recognize that the ¥1 million level above is psychologically significant, so it may take several attempts to finally clear that level. In the meantime, I think that a lot of value hunters are coming back into the market on these dips taken advantage of “cheap” Bitcoin.